Travel Insurance

What is Travel Insurance Plan?

Everybody makes a lot of planning to have a hassle-free and comfortable journey. But, if you

want to make your journey an enjoyable one, getting a travel insurance is a must. A travel

insurance policy helps you make your trip without the hassles and worries. Whether you lose

the passport, baggage, personal documents, or need any medical assistance, a travel

insurance will help you get out of worries. You may not need it all the time, but it would

be an imprudent choice to go without a travel insurance.

Why should I buy Travel Insurance?

There is an important need to buy a travel insurance plan for the following reasons:

Cover Medical Contingencies

Travelling to foreign soil involves risk, as there is no one to take care of you as your

family. If you have any medical emergency during your travel, then the expenses of

hospitalization and treatment might prove cumbersome in your pocket. Your travel

insurance policy will cover all hospitalization and medical expenses as per your policy

specifications.

Cover Unforeseen Contingencies

While travelling, there could be some unforeseen non medical contingencies which may

result in problems like loss of baggage, loss of passport, trip delay, trip

cancellation, etc. Such events cause emotional and financial displeasure. Travel

insurance policy will cover all such unforeseen contingencies and provide claims for the

same.

Feel safe in unfamiliar territory

While leaving your state or country one will always have some apprehensions in his/her

mind. As you feel safe at the place where you live, with travel insurance you will get

the same feeling of protection. The coverage under travel insurance will ensure your

travel is protected from startling exigencies.

Zero worries

Travelling for a vacation with family or for a corporate purpose or travelling as a

student, get some peace of mind and travel with zero worries for any loss or damage

during the travel period.Travel insurance eliminates all worries and cover contingencies

during the travel phase.

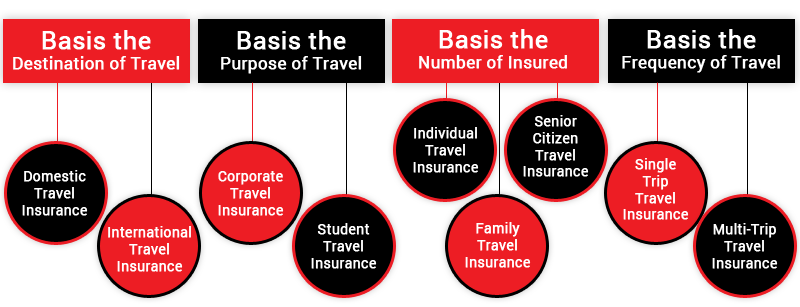

What kinds of Travel Insurance Plans can I opt from?

Travel insurance can be categorized on the basis of Destination, Frequency and Purpose of

Travel.

1. Basis the Destination of Travel

This travel insurance plan provides cover against checked-in lost/stolen baggage, emergency

cash and personal liability, medical emergencies, permanent disability & death, and travel

delay/cancellation. Any Indian resident or NRI want to travel in India can buy this

insurance. This travel insurance plan remains valid only when travelling in India.

This travel insurance plan is exclusively offered to customers travelling overseas.

International travel insurance provides a complete cover against medical expenses incurred

overseas, baggage & travel delays, loss of travel documents, hijack, and repatriation

expenses.

2. Basis the Purpose of Travel

Corporate Travel Insurance plan is available for employees of an organization and can avail

coverage for both domestic and international trips when going for business purposes.

Corporate Travel Insurance provides cover for personal belongings, illness/injury, cancelled

flights, and cancel/cut short your trip.

Student Travel Insurance covers expenses against loss of baggage, medical treatment, study

interruptions, and other incidental expenses.

3. Basis the Number of Insured

Individual Travel Insurance policy is for a single person protecting him/her against the

travel related medical and non medical emergencies like trip cancellation, loss of baggage

and passport, etc.

Family Travel Insurance plan covers the family of the insured during travel against the

travel related contingencies. A family travel insurance plan provides cover for flight

delay, baggage loss, accident, hospitalization, other incidental expenses, etc.

This travel insurance plan provides coverage against the cashless hospitalization and dental

treatments, in addition to the benefits available with a typical travel insurance plan. This

insurance plan is for people between the age group of 61 to 70 years.

4. Basis the Frequency of Travel

Single Trip travel insurance plan provides coverage against the standard risks covered in a

policy for a single trip. Single-trip insurance policy offers protection from travel-related

contingencies such as loss of baggage, loss of passport, flight delay, medical emergencies,

etc.

Multi Trip travel insurance plan offers coverage up to one year of time span. With the

multi-trip travel insurance, travelers don’t need to buy the insurance plan every time they

go on travelling abroad and thus can save considerable time and money.

What are the Benefits of Buying a Travel Insurance Plan?

Having a travel insurance is one of the key decisions when you have undertaken while planning

a travel. Following are the top benefits of buying a Travel Insurance:

Covers Medical Expenses

Getting medical treatment in a foreign country is quite expensive that could burn a hole in

your wallet. Anyone may have to face medical attention, so in order to avert from huge

medical expenses, it’s better to buy a right travel insurance plan that provides a

comprehensive medical cover.

Covers Trip Cancellation and Delay Expenses

Last minute personal/ medical emergency, or any mishap in the family could lead to trip

cancellation. This may cause losses in case your travel ticket bookings are non-refundable.

You may go for a travel insurance plan that provides cancellation coverage, as it pays you

against the financial losses that occur due to cancellation of the trip. Travel Insurance

Plans also provide reimbursement for additional hotel and/or meal expenses, when a trip is

delayed as covered under the policy.

Protection for Loss of Personal Belongings

If you lose your baggage in transit, your insurer will compensate you against the losses

incurred up to the maximum of the sum insured as provided under your insurance policy. Your

Insurance Company under this situation will also help you track and recover the baggage.

Losing your passport in a foreign country is quite stressful. In this situation, you only

need to call to an emergency number provided by your insurer and one of its representatives

will not help you get a duplicate passport, but they will also take care of the related

expenses incurred.

Provide Medical Cover

You never know what could happen to your health during travel. You may experience severe

health injuries that require an urgent medical attention. Moreover, Healthcare expenses may

put a setback to your finances and thus, you should get a right travel plan that provides

medical coverage against emergency medical assistance.

Facilitate Emergency Evacuation

A catastrophe such as Tsunamis, volcanic ash clouds, or terrorist attacks may strike at any

time during the travel. The emergency evacuation becomes a necessity at the occurrence of

these sorts of cataclysm. If you are fortunate enough to have a travel insurance cover, it

becomes the insurer’s responsibility to evacuate you back to the homeland and provide

medical assistance, if required.

24x7 Support

When stuck in a foreign country in an unknown location, having access round the clock support

will be quite helpful to get directions in such a tough time. When travelling abroad, it is

thus recommended to always carry a copy of the travel insurance document.

How is my Travel Insurance Premium Calculated?

Following are the key factors that are used in computing premiums for travel insurance

policy.

Sum Insured

When you want to buy a travel cover, you need to choose a Sum Insured amount. The higher

the sum assured you have chosen for your policy, the higher is the premium amount you

need to pay.

Location of your Travel

The destination of your travel makes an impact on the cost of your travel policy. The

rate of premium for travel insurance policy is higher when getting insurance for. The

medical services in regions such as US and Canada are quite expensive and, thereby, the

rate of premium for travel insurance policy is also costlier when travelling to these

regions.

Duration of Trip

The length of your trip also makes an impact on the premium charges. The longer you have

planned to stay in a foreign country during your travel, higher the premium amount will

be charged for your travel insurance plan.

Age & Health

Your age and health conditions also play a key role in determining the premium amount for

a travel policy. If you are having a previous medical history or any pre-existing

illness, your insurer may charge you the higher premium amount.

Type of Plan

The plan you chose also makes an impact on the premium amount. When choosing an insurance

policy for a single-trip is costlier than a multi-trip travel insurance plan. The

insurer may also charge the higher premium amount for a senior citizen travel insurance

plan considering the age and health factor.

Add-on Covers

Upon choosing special add-on covers such as cover for adventure sports under the travel

plan also tends to increase the premiums as the risk increases for the insurer.

What are some Smart Buyings Tips?

Following are the key tips that will help you choose a right travel insurance plan.

Plan in Advance: It is advisable to buy your travel policy just after you

have booked tickets for the trip. Nowadays, most travel policies are available with the

cancellation cover and so you can cancel the policy, if your trip is cancelled due to any

unavoidable reason. Also, you should not delay in buying a travel policy as you can get

enough time to choose the right coverage you actually need for your trip.

Look Around for Alternatives: It is recommended to search the travel

policies available with different insurers. It gives you the chance to choose a customized

travel insurance plan that fits your needs. By exploring plans, you can grab a policy with a

higher coverage at economical premium rates.

Study Reviews: Search customer reviews online and check what they are saying

about a particular travel policy, you are considering to buy. You may seek guidance from a

travel insurance expert or from your family or friends about the plan. It helps you get a

fair idea to assess whether a travel policy would be the right fit.

Take Appropriate Cover: Prior choosing a policy, it is quite essential to

assess the level of cover you need for your overseas trip. The coverage amount typically

depends on the length of the trip and the activities you have planned to do during the trip.

If you are planning for a leisurely trip, you may go with a lower coverage compared to an

adventurous trip. So, it is quite essential to choose the right cover for your overseas

travel.

Disclose Pre-existing Conditions: Before you buy a policy, it is recommended

to disclose your pre-existing medical conditions to the insurer. After providing all the

correct details regarding your pre-existing condition, you will not find any difficulty in

case of the claim concerning the pre-existing condition and the insurer will pay the

requested claim amount as per the policy terms.

Buy Online: It is advisable to first compare the different travel insurance

policies online, assess its benefits and check whether it fits to your needs. Buying policy

online also helps you grab the travel cover at discounted premium rates.

Read the Policy Wordings: Before you finalize to buy a particular travel

insurance plan, it would be a right move to read its policy terms and conditions. It helps

you know all about the policy benefits, inclusions, & exclusions, that enables you to assess

whether it is the right policy for your travel.

Is there any Add on Cover/Rider with Travel Insurance Plan?

Following are key add-on covers that you can attach with your Travel Insurance Plan.

Pre-existing Disease Cover

This add-on cover provides coverage against any eventuality arising due to a pre-existing

health condition.

Adventurous Sports Cover

With this add-on cover, the policy will cover you against injuries that sustained due to

participating in adventure sports such as mountaineering, scuba diving, Paragliding,

bungee jumping, and others.

Accidental Death & Dismemberment (AD&D) Cover

This add-on cover provides coverage to the insured against accidental death and

total/partial dismemberment, if sustained during the travel.

Terrorism Cover

This add-on cover provides coverage against damage caused by terrorists/attackers and

loss incurred due to counter-terror action.

(The add-on covers and its benefits may vary from insurer to insurer)

What is Not included in the Travel Insurance Plan?

Following are some of the general exclusions.

• Pre-existing diseases that lead to hospitalization

• Suicide and Insanity

• Expenses incurred from local protests/civil war

• Bodily injury sustained or expenses incurred due to participating in Hazardous Sports,

unless specified under the policy

(Note: The exclusions may vary from one insurer to the other)

Do’s and Dont’s for Travel Insurance

Read the Do’s and Don’ts related to your Travel Insurance Plan.

| Do’s |

Dont’s |

| Buy travel insurance timely |

Postpone your travel insurance buying decision |

| Fill the proposal form correctly and provide all the required important details |

Keep the material facts hidden. It may cause disputes during the claims settlement

|

| Evaluate your itinerary and buy the right cover for the entire travel duration |

Get the travel cover as suggested by your travel agent. Research at your end as

well

|

| Compare before choosing the final one |

Buy the plan without comparing online |

| Read the policy terms carefully before buying a travel insurance policy |

Forget to add the requisite add on covers to make your policy comprehensive |

Travel Insurance Glossary

Here are the basic terminologies used in a Travel Insurance Plan

Baggage: It means luggage and other personal belongings of the insured

during the travel.

Checked-In Baggage: It means the baggage provided by the insured to a carrier for

transportation. The baggage receipt is also issued for the same.

Air Travel: It means travel by an airline, licensed by the competent

authority for carrying passengers.

Disease: It refers to an illness of the body organs having a defined set of

symptoms that become noticeable with-in the policy period and that requires immediate

medical attention.

Medical Advice: It refers to any consultation from a medical practitioner

relating to any prescription.

Any One Illness: It refers to the continuous period of illness. It includes

its recurrence with-in 45 days of last consultation in the nursing home or hospital.

Accident: It refers to a sudden and unforeseen event caused by external and

visible means.

Condition Precedent: It means a policy term upon which the insurer’s

liability is conditional.

Cashless Facility: The insurer may accept the request of the insured for the

direct settlement of claim amount as agreed between the Network hospitals and the insurer.

Cancellation: It refers to the terms upon which the policy is liable to be

terminated either by the insured or the insurer by giving notice to the other for a period

not less than 15 days.

Civil War: It means armed opposition between two more parties belonging to

the same country. The opposing parties may be of different religious or ethnic groups.

Foreign War: It means armed opposition between two countries.

Hijack: It refers to unlawful control of common carrier in which the insured

is travelling by threat or violence with wrongful intent.

Terrorist Activity: It means activities against person, property or

organizations that involve the threat of force or violation with an aim to intimidate the

government or a section of the society.

Accumulation Limit: It refers to the maximum amount payable by the insurer

in case of rising claims towards any one accident to the insured.

Alternative Treatments: Any forms of treatments that include Ayurveda,

Homeopathy, Sidha, and Unani other that treatments such as allopathy or modern medicine.

Assistance Service Provider: It means the assistance company as appointed by

the insurer to assist the insured under the terms of the policy.

Trip Duration: It is the time period during which the insured goes out of

his country of residence for the trip and ending on the date of return, both days inclusive

and calculated on the basis of the local time of the insured’s country of residence.

Experimental Treatment: It relates to the treatment or therapy not based on

a well-known medical practice in India.

Travel Agent: It refers to a tour operator, an agent, or any other entity

from whom the insured buys his travel tickets, book a hotel room, and other travel-related

arrangements.

Beneficiary: In the event of death of the insured, the beneficiary refers to

the surviving spouse or the one as assigned by the insured.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing