Tata AIA Life Insurance InvestOne is a non-participating unit linked insurance product that provides you an opportunity to maximize returns on maturity through Guaranteed Maturity Addition along with Loyalty Additions. This plan helps fulfill financial obligations at key milestones of your life, you & your family’s dreams are realized.

Get QuotesThis policy offers following 8 investment funds, you can invest with that suit your investment objectives.

You have the option to invest in these 8 funds or opt for any one of the portfolio strategies namely,

Enhanced Automatic Asset Allocation Plus- It takes care of your portfolio and changes its allocation as per your age in a manner that you reap maximum returns with adjustment to risk exposure.

Protect Returns Of Funds Increased Over Time- It is automated way of transferring profits from the Profit Making Fund to the Profit Booking Fund. This strategy helps policyholders combat the risks of a volatile equity market.

In the event of death of the life assured during the policy term and the policy is in-force, the nominee will receive the higher of Basic Sum Assured less all Deductible Partial Withdrawals, 105% of the Single Premium paid, or the Single Premium Fund Value.

Additionally, the higher of Top-up Premium Fund Value, approved Top-up Sum Assured, or 105% of the total Top-up Premiums paid is also payable, provided the Policyholder has a Top-up Premium Fund Value.

On survival of the life assured till end of the policy term, Total fund value valued at applicable NAV is payable on the date of maturity.

Guaranteed Maturity Addition @5% in each of the funds under the Single Premium Account is credited to the respective funds on the date of maturity.

Loyalty Additions @1% in each of the funds under the Single Premium Account is credited to the respective funds. This benefit is payable in every 5th policy anniversary, starting from 10th policy anniversary till end of the policy term.

Additionally, 0.4% in each of the funds under the Single Premium Account is credited to the respective funds, payable every policy anniversary, starting from the 10th policy anniversary, till the end of the policy term excluding the last year.

Loyalty Additions are added into the fund and it is payable in the event of maturity, surrender, or death.

You may choose to receive the maturity amount either as a lump sum or installment over a period of time, termed as Settlement Period. The frequency and amount of the installments can be chosen by you at the time of maturity while exercising this option.

You can withdraw money after completion of 5th policy year. The minimum amount for partial withdrawal is Rs 5,000 and the total fund value after such withdrawal should be at least 50% of the single premium paid.

You have the option to pay additional premium as Top-up Premium and you can exercise this option up to 4 times during a policy year. The minimum Top-up amount is Rs 5,000.

Your Sum Assured will increase by Top-up Sum Assured. For entry age less than 45 years, Top-up Sum Assured is 1.25 times the Top-up Premium and for entry age 45 years or more, Top-up Sum Assured is 1.1 times the Top-up Premium.

You can switch among the available ULIP fund options. Switching option is not available, when you choose any one of the portfolio strategies.

The plan is not eligible for the bonuses as it is a non-participating life insurance plan.

No loan benefit can be availed under this plan.

Upon surrendering the policy with-in the lock-in period of 5 years, the fund value less applicable discontinuance charges is credited to the ‘Discontinued Policy Fund II’. The ‘Proceeds of the Discontinued Policy’ plus entire income earned after deduction of the fund management charges, subject to a minimum guarantee of interest @4% per annum is payable.

Upon surrendering the policy after the lock-in period of 5 years, the total fund value as on the date of surrender is payable.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 30 Days | 60 Years |

| Age at Maturity | 18 Years | 75 Years |

| Policy Tenure | 15 Years | 30 Years |

| Premium Paying Term | Single Pay | - |

| Premium Paying Mode | Single | - |

| Premium Amount | Rs 1 Lac | No Limit |

| Basic Sum Assured | 1.25 Times The Single Premium | Depending On Multiple Of Single Premium |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days | - |

| Plan Type | Offline | - |

Tata AIA Life Insurance Accidental Death and Dismemberment (Long Scale) (ADDL) Linked Rider can be opted, on payment of additional premium.

Premium Allocation Charges: Single Premium allocation charge is 2% of the single premium, during the first policy year. Top-up Premium Allocation Charge is 1.5% of Top-up premium. The single premium/top-up premium allocation charges are guaranteed through the entire policy term.

Policy Administration Charge: Monthly policy administration charge is 1% of single premium and it is deducted by cancelling Units from the Fund Value of the policy. This charge may be increased up to a maximum of 5% per annum compounded annually, subject to a maximum of Rs 6,000 per annum.

Mortality Charges: Mortality charge is equal to Sum at Risk (SAR) * applicable Mortality Rate for the month, based on the attained age of the Life Assured. Mortality charge is deducted on each Policy Month Anniversary.

Fund Management Charges: Fund management charge is 1.20% p.a for Multi Cap Fund, India Consumption Fund, Large Cap Equity Fund, Whole Life Mid-cap Equity Fund. 1.10% p.a for Whole Life Aggressive Growth Fund, 1% p.a for Whole Life Stable Growth Fund, 0.80% p.a for Whole Life Income Fund, 0.65% p.a for Whole Life Short Term Fixed Income Fund.

Fund Management Charges shall not exceed 1.35% p.a of the Fund value. A Fund Management Charge of 0.50% p.a. is charged on Discontinued Policy Fund II. The current cap on Fund Management Charge (FMC) for Discontinued Policy Fund - II is 0.50% p.a.

Discontinuance Charge: You have the option to discontinue the policy anytime during the policy term by intimating to the Company. This charge is levied as applicable under the policy terms & conditions. For more details, please refer the policy brochure.

Switching Charge: You can avail 12 free switches in a policy year and upon exercising more switches, Rs 100 per switch, subject to a maximum of Rs 250 may be levied.

Partial Withdrawal Charge: Four partial withdrawals are available during a policy year. Further, no partial withdrawal charges are levied under this plan.

Tax benefits under section 80C towards the premiums paid and the policy proceeds are eligible for tax benefits under section 10 (10D) of the Income Tax Act, subject to amendments from time to time.

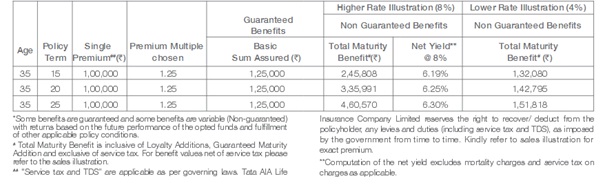

Mr. Raman aged 35 years, is leading a happy life with his wife ananya and a daughter sanya. He wants to build a corpus amount, so his family can achieve their dreams such as sanya’s education, her marriage, etc. He also wants to ensure financial security of the family, in case of a mishap. He thus opts for Tata AIA Life Insurance InvestOne, pays one-time premium with the policy term of 15 years, single premium of Rs 1 Lac, premium multiple chosen is 1.25, and the basic sum assured is Rs 1.25 Lacs.

Scenario A- Maturity Benefit: If Mr. Raman survives till maturity of the policy, he will receive the total fund value as applicable.

Scenario B- Death Benefit: In the event of death of Mr. Raman during any policy year, higher of Basic Sum Assured less all Deductible Partial Withdrawals, 105% of the Single Premium paid, or the Single Premium Fund Value is payable to the nominee.

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing