LIC’s New Endowment Plus is a unit linked non-participating assurance plan that offers investment plus insurance cover during the policy term. By investing in this plan, you can enjoy protection along with long term savings. You have the flexibility to invest in any one of the four fund options, so you can build a corpus and you or your family can easily realize their dreams.

Get QuotesThis policy offers following 4 investment funds, you can invest with that suit your investment objectives.

The Policyholder has the option to invest their money in any one of the available 4 funds.

In the event of death of the life assured prior the date of maturity and the policy is in-force, the following death benefit is payable.

On death before the Date of Commencement of Risk: An amount equal to the Policyholder’s Fund Value is payable.

On death after the Date of Commencement of Risk: An amount equal to the higher of Basic Sum Assured or Policyholder’s Fund Value is payable. Here, Basic Sum Assured is higher of (10 * Annualized Premium) or (105% of the total premiums paid).

Date of commencement of risk

In case the age at entry is less than 8 years, the risk will commence either one day prior to the completion of 2 years from the date of commencement of policy or one day before the policy anniversary coinciding with or immediately following the completion of 8 years of age, whichever is earlier.

For those aged 8 years or more, the risk will commence immediately.

The basic sum assured or paid-up sum assured is reduced to the extent of partial withdrawals made and it is applicable for the two years’ period from the date of withdrawal. After completion of the two years’ period from the date of withdrawal, the original sum assured is restored.

On survival of the life assured till end of the policy term and the policy is in-force, the policyholder’s fund value is payable. You can receive this benefit as a lump sum or as periodic installments by using ‘Settlement Option’.

On maturity, you can opt to receive your money in annual or semi annual installments over a maximum period of 5 years, after the date of maturity. You also have the option to completely withdraw the policyholder’s fund value at any time during the settlement period. No life cover is applicable during this period. No partial withdrawals and switching are allowed during the Settlement Period.

You can switch between 4 different fund options to capitalize market opportunities.

Partial Withdrawal is allowed from 6th policy year onwards (in case of minor lives, life assured attains 18 years or above).

From 6th to 10th policy year, partial withdrawal is allowed subject to the minimum balance of 3 annualized premiums or 50% of the policyholder’s fund value, whichever is higher as available on the date of withdrawal. From 11th to 20th policy year, partial withdrawal is allowed subject to the minimum balance of 3 annualized premiums or 25% of the policyholder’s fund value, whichever is higher as available on the date of withdrawal.

The plan is not eligible for the bonuses as it is a non-participating insurance plan.

No loan facility can be availed under this plan.

Upon surrendering the policy with-in the lock-in period of 5 years, the policyholder’s fund value less applicable discontinuance charges is credited to the ‘Discontinued Policy Fund’ and it is payable upon completion of the lock-in period. The proceeds of the Discontinued Policy Fund is higher of Discontinued Policy Fund Value or Guaranteed Monetary Amount.

Upon surrendering the policy after the lock-in period of 5 years, the policyholder’s fund value as on the date of surrender is payable.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 90 Days | 50 Years |

| Age at Maturity | 18 Years | 60 Years |

| Policy Tenure | 10 Years | 20 Years |

| Premium Paying Term (PPT) | Equal To Policy Tenure | - |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Premium Amount | Rs 20,000 (annually), Rs 13,000 (semi Annually), Rs 8,000 (quarterly), Rs 3,000 (monthly) | No Limit |

| Basic Sum Assured | Higher Of (10*Annualized Premium) Or (105% Of The Total Premiums Paid) | - |

| Freelook Period | 15 Days From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

LIC’s Linked Accidental Death Benefit Rider can be opted under this plan.

Premium Allocation Charges: This charge is deducted from the premium paid. The premium allocation charge is 7.5%/5%/3% during the 1st policy year/2nd to 5th policy year/6th policy year onwards, respectively.

Policy Administration Charge: Monthly policy administration charge is levied by the redemption of units under the policy. For 1st policy year, (0.35% * Instalment Premium* K) OR (Rs.100), whichever is lower. For 2nd policy year, (0.25% * Instalment Premium* K) OR (Rs.70), whichever is lower. For 3rd policy year, 2nd year charge * 1.03. For 4th policy year, 3rd policy year charge * 1.03. For 5th policy year, 4th policy year charge * 1.03. From 6th policy year onwards, Rs. 52.17 in 6th year and escalating at 3% p.a. thereafter. Where, K is 1/1.6/2.6/7 for annually, semi annually, quarterly & monthly mode of premium payment.

Mortality Charges: Mortality charge is applied on Sum at Risk (SAR) and it is deducted on each Policy Month Anniversary. It is the cost of life insurance cover, which is age specific.

Fund Management Charges: Fund management charge for all funds except Discontinued Policy Fund is 0.70% p.a, for Discontinued Policy Fund, it is 0.50% p.a.

Accident Benefit Charges: It is the cost of Accident Benefit cover (if opted). This charge is levied at the beginning of each month by canceling appropriate number of units from the Policyholder’s Fund Value. It is charged @Rs. 0.40 per thousand Accident Benefit Sum Assured per policy year.

Discontinuance Charge: This charge is levied, in case the policy is discontinued during the first 5 years. This charge is levied as applicable under the policy terms & conditions. For more details, please refer the policy brochure.

Switching Charge: You can avail 4 free switches in a policy year and upon exercising more switches, Rs 100 is charged per switch.

Partial Withdrawal Charge: A flat amount of Rs 100 is deducted by cancelling appropriate units from the Policyholder’s Fund Value.

Miscellaneous Charges: Alterations made in premium mode and Grant of Accident Benefit Rider after issuance of the policy attracts the charge of Rs 50 per alteration.

Service Tax Charge: The charges mentioned under this plan are subject to service tax as applicable from time to time.

Tax benefits can be availed as applicable under the Income Tax Act, subject to change in tax laws.

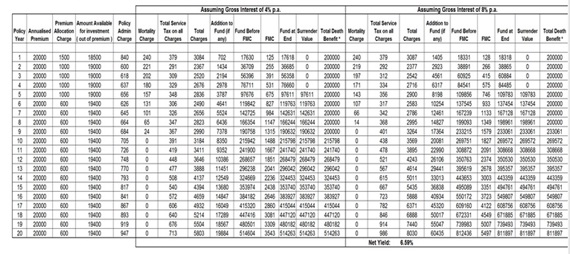

Mr. Raj aged 30 years, opts to buy LIC’s New Endowment Plus with the policy term of 20 years, annual premium of Rs 20,000 and basic sum assured of Rs 4,20,000. He has opted for Secured Fund.

Scenario A- Maturity Benefit: In case of his survival till maturity of the policy, the policyholder’s fund value is payable. You can receive this benefit as a lump sum or as periodic installments by using Settlement Option.

Scenario B- Death Benefit: In the event of his death during the policy term, the Death Benefit payable is higher of Basic Sum Assured or Policyholder’s Fund Value.

Benefit Illustration:

Note: This illustration is applicable to a non-smoker male/female standard life. The non-guaranteed benefits in above illustration are calculated so that they are consistent with the Projected Investment Rate of Return assumption of 4% p.a. (Scenario 1) and 8% p.a. (Scenario 2) respectively.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing