Kotak Platinum is a non-participating unit linked insurance plan that provides flexibility to customize as per your goals and objectives with low charges applicable. This plan provides a combination of 3 Investment Strategies and flexibilities, so you can gain absolute control over your investments.

Get QuotesThis policy offers following 7 investment funds, you can invest with that suit your investment objectives.

You have the option to choose from any of 3 investment strategies:

Self Managed Strategy: This strategy provides the flexibility to choose from a range of 7 fund options that enable you to maximize the earnings.

Age Based Strategy: With this investment strategy, the allocation of funds is done on the basis of Age & Risk Appetite. Under this strategy, allocation is done between Classic Opportunities Fund and Dynamic Bond Fund.

Systematic Switching Strategy: This investment strategy enables you to invest all or part of the investment in Money Market Fund and transfer a pre-specified amount every month into, either Classic Opportunities Fund or Frontline Equity Fund.

In the event of death of the life insured during the policy term, the higher of Basic Sum Assured less applicable partial withdrawal, Fund Value in the Main Account, or 105% of the Premiums paid. The death benefit also includes the highest of Top-Up Sum Assured, Top-Up Fund Value, or 105% of the Premiums paid, in case of top-up premium paid.

Up to the age of 60 years of life insured, Sum Assured payable on death is reduced to the extent of Partial Withdrawals made during the last two years prior the date of death. After 60 years of the life insured, Sum Assured payable on death is reduced to the extent of Partial Withdrawals made from 58 years onwards.

The minimum Death Benefit is at least equal to 105% of the total premiums paid.

On survival of the life insured till the end of the policy term, Fund Value including all Survival Units is payable. You have the option to receive the fund value as a lump sum or choose the settlement option for maturity benefit payout.

Survival Units are added every 5 years, starting from the end of the 10th policy year. Survival Units are equal to 2% of the average Fund Value in the previous three years.

The total top-up premium paid does not exceed the sum of all the regular premiums paid. Top-up premium has a lock-in period of 5 years from the date of Top-Up payment. Each top-up has a top-up sum assured of 125% or 110% of top-up amount depending on the age of the Life Insured at the time of payment of the top-up premium. The minimum Top-up premium allowed is Rs 10,000. You can exercise this option any time, except the last 5 years of the policy.

Settlement Option is available at maturity and it provides you the flexibility to receive the maturity benefits either 50% as lump sum and balance 50% as periodic installments or whole amount through periodic installments. The installment period cannot exceed the maximum period of 5 years.

This option has to be intimated to the company with-in 3 months before the date of maturity. The life insured also has to specify the mode of the periodic installments as annually, semi annually, or quarterly at the point of pre-settlement notification.

You can switch between fund options to capitalize market opportunities.

Premium Re-direction facility is available to alter future premium allocation based on investment strategies.

Partial Withdrawal is allowed after completion of five policy years. The minimum partial withdrawal amount is Rs 10,000. The minimum fund value required after such withdrawal is 50% of the total premiums paid.

The plan is not eligible for the bonuses as it is a non-participating life insurance plan.

No loan benefit can be availed under this plan.

Upon surrendering the policy with-in the lock-in period of 5 years, the fund value less applicable discontinuance charges is credited to the ‘Discontinued Policy Fund’ and it is refunded upon completion of lock-in period. The proceeds after addition of interest subject to a minimum of 4% per annum is payable after the end of the lock-in period.

Upon surrendering the policy after the lock-in period of 5 years, the Fund Value as on the date of surrender is payable.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 0 Year | 65 Years, 60 Years (limited Pay) |

| Age at Maturity | 18 Years | 75 Years |

| Policy Tenure | 10 Years | 30 Years (For Minors, It Is Higher Of 18 Or 10 Minus Age At Entry) |

| Premium Paying Term (PPT) | Regular/Limited Pay (5 Years For 10 Years Policy Term, 10 Years For 15 To 30 Years Policy Term) | - |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Premium Amount | Annually- Rs 99,000, Semi Annually- Rs 49,500, Quarterly- 24,750 & Monthly- Rs 8,250 | No Limit |

| Basic Sum Assured | For Regular Pay: >45 Years- Higher Of 10 Times Annualized Premium Or 0.5* Policy Term * Annualized Premium At 45 Years- Higher Of 7 Times Annualized Premium Or 0.25* Policy Term* Annualized Premium 46 Years To 55 Years- Higher Of 7 Times Annualized Premium Or 0.25* Policy Term* Annualized Premium 56 Years To 60 Years- Higher Of 7 Times Annualized Premium Or 0.25* Policy Term* Annualized Premium =&<61 Years- 7 Times AP For Limited Pay: >45 Years- Higher Of 10 Times AP Or 0.5* Policy Term * AP At 45 Years- Higher Of Higher Of 7 Times AP Or 0.25*Policy Term* AP 46 Years To 50 Years- Higher Of 7 Times AP Or 0.25* Policy Term* AP 51 Years To 60 Years- Higher Of 7 Times AP Or 0.25* Policy Term* AP | For Regular Pay: >45 Years- 25 Times Annualized Premium At 45 Years- 25 Times Annualized Premium 46 Years To 55 Years = 15 Times Annualized Premium 56 Years To 60 Years = 10 Times Annualized Premium For Limited Pay: >45 Years- 15 Times AP At 45 Years = 15 Times AP 46 Years To 50 Years- 15 Times AP Except For 5 PPT Which Is 10 Times AP 51 Years To 60 Years- 10 Times AP Except For 5 PPT Which Is 7 Times AP |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

Following riders can be opted, on payment of additional rider premium:

Premium Allocation Charges (PAC): This charge is deducted from the premium paid and the net premium is then allocated at the Net Asset Value. PAC is 5%/4%/2% for year 1, 3%/3%/2% for year 2 to 5, 1.5%/1.5%/1.5% for year 6 onwards under annualized premium bands of Rs 99,000 to Rs 4,99,999/Rs 5,00,000 to Rs 24,99,999/Rs 25,00,000 and above, respectively.

Policy Administration Charge: Monthly policy administration charge is levied by the redemption of units under the policy. It is 0.20%/0.10% per month as a percentage of the first year’s annualized premium for annualized premium bands of Rs 99,000 to Rs 4,99,999/Rs 5,00,000 to Rs 9,99,999, respectively. No policy administration charge is levied for annualized premium band of Rs 10,00,000 and above. This charge shall not exceed Rs 500 per month.

Mortality Charges: Mortality charge is applied on Sum at Risk (SAR) and it is deducted on each Policy Month Anniversary. It is 0.999/1.445/2.328/5.244 for age 20 years/30 years/40 years/50 years, respectively.

Fund Management Charges: Fund management charge levied is a percentage of the Fund Value. It is 1.35% p.a for Classic Opportunities Fund, Frontline Equity Fund & Balanced Fund, 1.20% p.a for Dynamic Bond Fund & Dynamic Floating Rate Fund, 1% p.a for Dynamic Gilt Fund, 0.60% p.a for Money Market Fund, 0.50% p.a for Discontinued Policy Fund.

Discontinuance Charge: This charge is levied, in case the policy is discontinued during the first 4 policy years. This charge is levied as applicable under the policy terms & conditions. For more details, please refer the policy brochure.

Switching Charge: You can avail 12 free switches in a policy year and upon exercising more switches, Rs 250 is applicable on each additional switch.

Partial Withdrawal: Rs 250 per partial withdrawal is levied.

Miscellaneous Charges: The charge for replacement of policy document is Rs 250, Rs 100 for premium re-direction, change in basic sum assured is Rs 500 and Rs 250 for cheque dishonor.

Tax benefits can be availed under section 80C & 10(10D) under the Income Tax Act, subject to change in tax laws.

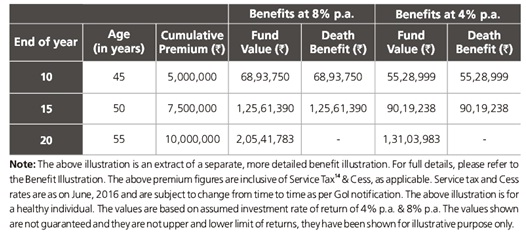

Amit at 35 years of age opts to buy Kotak Platinum to ensure accumulation of wealth plus life cover. He chooses Kotak Platinum plan with the policy term of 20 years with regular annual premium payment of Rs 5,00,000 and sum assured of Rs 50,00,000 under Age Based Strategy with Aggressive Risk Appetite.

Scenario A- Maturity Benefit: In case of his survival till maturity of the policy, Fund Value including all Survival Units is payable.

Scenario B- Death Benefit: In the event of his death during the policy term, the higher of Basic Sum Assured less applicable partial withdrawal, Fund Value in the Main Account, or 105% of the Premiums paid. The death benefit also includes the higher of Top-Up Sum Assured, Top-Up Fund Value, or 105% of the Premiums paid, in case of top-up premium paid.

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing