HDFC Life Capital shield is an investment cum protection plan which offers you potential returns by investing portion of your investment into equity and rest in debt fund. This amalgamation offers great returns along with offering life cover for the policy term.Allocation of money towards debt will systematically enhance the corpus to protect your fund value.

Get QuotesThe plan works as per Capital Shield Management Strategy where 2 funds are available:

As a part of the strategy,a portion of your money is invested in both the funds. The allocation percent will depend upon the age at which the policy is purchased and the chosen sum assured.

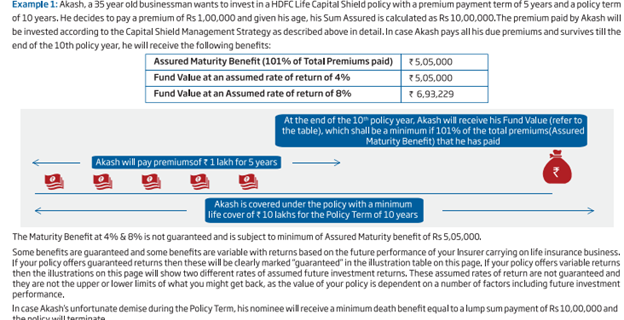

In the event of death of the life assured while the policy is in-force, the nominee will receive the higher of Sum Assured, Fund Value or 105% of all the premiums paid. The policy terminates, after payment of Death Benefit.

On survival of the life insured till the end of the policy term, the higher of fund value or Assured maturity benefit(101% * “Total Premiums” paid till date) less the Total Partial Withdrawals made till date (if any) is payable on the maturity date.

Additional units will be added to the fund value from the end of 6th policy year in the following manner:

End of 6th policy year: Loyalty Additions = 0.5% of average fund value

End of 7th policy year: Loyalty Additions = 0.5% of average fund value

End of 8th policy year: Loyalty Additions = 0.75% of average fund value

End of 9th policy year: Loyalty Additions = 0.75% of average fund value

End of 10th policy year: Loyalty Additions = 1.50% of average fund value

No switching is applicable under this plan.

No Premium redirection is applicable.

Partial Withdrawal is allowed from 6th policy year onwards wen the policy holder attains 18 years.Minimum Partial Withdrawal amount is Rs 10,000.

This plan is not eligible for the bonuses.

No loan benefit can be availed under this plan.

You have an option to revive a discontinued policy within 2 consecutive years from the date of discontinuance of the policy. For the policy revival, you need to pay all due and unpaid premiums, as per underwriting policy.

Upon surrendering the policy with-in the lock-in period of 5 years, the Fund Value less applicable discontinuance charges is credited to the ‘Discontinued Policy Fund’ and it is refunded upon completion of the lock-in period. The applicable fund management charge of the Discontinued Policy Fund is levied. The proceeds after addition of minimum guaranteed interest rate as stipulated by IRDAI is payable after the end of the lock-in period.

Upon surrendering the policy after the lock-in period of 5 years, the Fund Value as on the date of surrender is payable immediately and the policy then terminates.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 8 Years | 60 Years |

| Age at Maturity | 18 Years | 70 Years |

| Policy Tenure | 10 Years | 10 Years |

| Premium Paying Term (PPT) | Single, Limited- 5 Years | - |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Premium Amount | Single Pay- Rs 48,000 Limited Pay- Rs 48,000 (annually), Rs 24,000 (semi Annually), Rs 12,000 (quarterly), Rs 4,000 (monthly) | No Limit (subject To Underwriting) |

| Sum Assured | < 45 Years Single Premium Policies: 125% Of Single Premium Limited Pay Policies: 10 Times The Annualized Premium >=45 Years Single Premium Policies: 110% Of Single Premium Limited Pay Policies: 7 Times The Annualized Premium | < 45 Years Single Premium Policies: 125% Of Single Premium Limited Pay Policies: 10 Times The Annualized Premium >=45 Years Single Premium Policies: 110% Of Single Premium Limited Pay Policies: 10 Times The Annualized Premium |

| Freelook Period | 30 Days From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Online | - |

No rider can be opted under this plan.

Premium Allocation Charges: For single pay policies, it is 3% of a single premium amount.For limited pay (Annual Mode policies) it is 9% (1st year),7%(2nd & 3rd year) and 6% (4th & 5th year). For limited pay (Non-Annual Mode policies) it is 7% (1st year),6%(2nd & 3rd year) and 5% (4th & 5th year).

Policy Administration Charge: For single pay policies it is 0.12% of single premium (1st to 5th policy year), 0.07% increasing at 5% per annum (6th policy year onwards).For Limited pay plans, it is 0.39% per month of the annualized premium increasing at 5% per annum.

Investment Guarantee Charge: 0.50% of the fund value charged daily.

Mortality Charges: Mortality charge depends on age and level of cover. This charge is applicable for providing you with the risk cover.

Fund Management Charges: Fund management charge levied is a percentage of the Fund Value. It is 1.35% p.a. for all funds. This charge is subject to a maximum amount as allowed by IRDAI.

Partial Withdrawal Charge: 4 free partial withdrawals are allowed during a policy year. The subsequent partial withdrawal in the same policy year is charged with Rs 250 or Rs 25 when executed through the company’s portal.

All the charges mentioned above expect mortality charge may be revised, upon prior approval from IRDAI.

Tax benefits can be availed under section 80C & 10 (10D) under the Income Tax Act, subject to change in tax laws.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing