Future Generali Flexi Online Term Plan is a non-linked and non-participating pure term insurance plan. Securing your family with financial protection is quite essential and that’s the reason, why you should opt for this term plan. This plan provides you the option to customize the plan depending on your needs.

Provides longer protection till 75 years

Affordable life cover

Secure your family’s financial future

Lump-sum or monthly death benefit option

Monthly or Annual Mode of premium payment available

Option to create your own customized plan

Hassle-free policy buying

Discounted premium rates for non-smokers and women

High sum assured discounts

Following are the death benefit options available under this plan.

1. Death Benefit – Option 1- Basic Life Cover:

The sum assured under the plan is paid as Lump Sum to the nominee as death benefit. The Death benefit shall be the higher of:

Here sum assured is equal to sum assured chosen while buying the plan or discounted value of fixed income as on date of death (6.5% p.a. compounded yearly) or discounted value of increasing Income as on date of death (6.5% p.a. compounded yearly).

2. Death Benefit – Option 2 - Fixed Income Protection:

A fixed income on a monthly basis is paid to the family. This death benefit option offers a monthly income on your death till such time you would have either turned 60 or for 10 years whichever is higher.

3. Death Benefit – Option 3- Increasing Income Protection:

It provides a monthly payout increasing at the rate of 10% per annum to the family in order to provide protection against inflation.

| Feature | Specification |

| Age (as on last birthday) |

Minimum: 18 Years Maximum:55 Years |

| Age at Maturity | 75 Years |

| Policy Tenure |

Minimum: 10 Years Maximum: 57 Years |

| Sum Assured | Minimum: 50 Lacs Maximum: No limit (subject to underwriting) |

| Premium Paying Term | Same as policy term Years |

| Premium Paying Mode | Monthly/Annually |

| Maturity Proceeds | Nil |

| Plan Type | Online |

| Grace Period | 30 days – for Annual mode |

Future Generali Accidental Benefit Rider can be opted to enhance the protection cover.

Rider offers 2 Options:

Option 1 “Accidental Death Protection”: Provides cover in case of an accidental death

Option 2 “Accidental Death and Accidental Total and Permanent Disability Protection”: Provides

i) Cover in case of an accidental death; or

ii) Cover in case of a total and permanent disability arising out of an accident.

Note: Only one rider option can be opted in the policy. Refer the Rider brochure for more details.

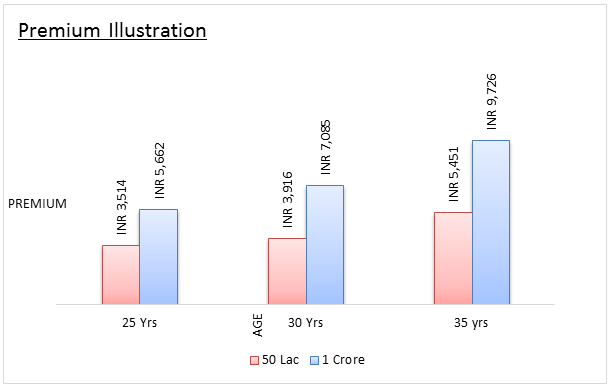

Sample illustration of the Premium Amount for an individual of age 25, 30 and 35 years, opting for a Life Cover of Rs. 50 lacs or Rs. 1 crore as Sum Assured and 25 years as Policy Tenure.

|

|

25 years |

30 years |

35 years |

|

Sum assured = Rs. 1 crore |

Rs. 5,662 |

Rs. 7,085 |

Rs. 9,726 |

|

Sum assured = Rs. 50 lacs |

Rs. 3,514 |

Rs. 3,916 |

Rs. 5,451 |

(Note: Premium amount is for a non smoker individual keeping good health conditions at the time of buying this insurance plan)

Future Generali Flexi Online Term Plan is eligible for Tax benefits as stated:

(Subject to the provision stated therein.)

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing