Aegon Life was formed with the coming together of Aegon N. V., an international provider of Life insurance, pensions and asset management, and Bennett Coleman & Company, India's largest media conglomerate popularly known as Times Group. This union brings together a local approach, with global expertise of launching products that cater to different sets of customers to meet their long-term financial goals. Aegon was the first company to introduce online term life insurance product and currently has a presence in more than 20 countries worldwide.

1. Comprehensive cost effective online term plan

2. Offers extensive coverage till the age of 100 years

3. Flexibility to choose the death benefit payout

4. Inbuilt Terminal Illness Benefit available

5. Option to enhance your life coverage

6. Enhance your coverage with available riders in the plan

7. Lower premium rates for Females & Nonsmokers

8. Avail Tax Benefits under IT Act

Death Benefit

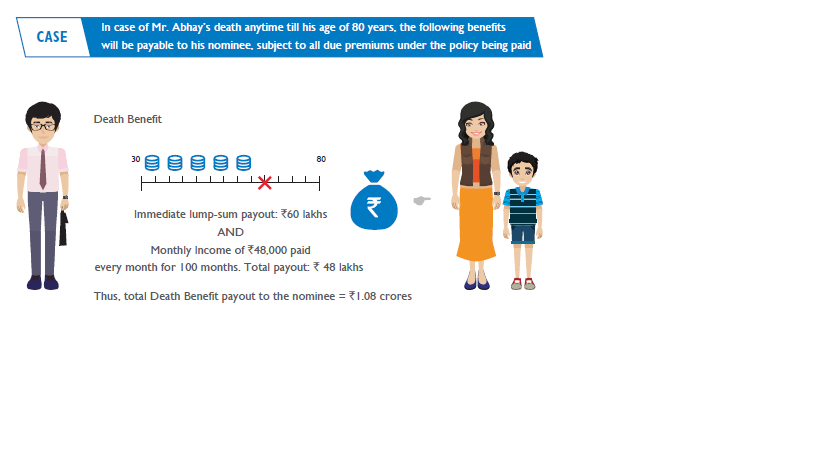

In the event of the untimely death of the life insured during the policy term, the total death sum assured is payable to the nominee provided all due premiums have been paid. The total death sum assured is calculated as the sum of Lump-sum Sum Assured and Income Benefit Sum Assured. The nominee will receive the Total Sum Assured which shall be payable as Lump-sum Sum Assured (paid immediately) or 1.2% of the Income Benefit Sum Assured (which will be paid monthly for 100 months) or as a combination of Lump-sum and Income benefit. The Policy will terminate on payment of the above benefits.

Terminal Illness Benefit

A payout equal to 25% of the base sum assured is paid on diagnosis of any terminal illness. The death benefit under this scenario, is then reduced by the amount paid as the terminal illness benefit. The company will not charge the premiums after accepting the terminal illness claim.

Life Stage Benefit

The life insured has an option to increase the Total Sum Assured under the policy on happening of any one or all of the following events:

The Lump-sum Sum Assured and the Income Benefit Sum Assured will accordingly increase by the above mentioned percentages, upon exercise of the option. The Policy Premium payable shall be increased by the premium corresponding to the Additional Sum Assured.

Maturity Benefit

It is a pure protection plan and no maturity benefits are payable if the life insured survives the policy term.

Surrender Benefit

There is no surrender value for regular premium policies. However, the company will pay the surrender benefit for the Single Premium.

Surrender Value for single premium policy = 70% * Single Premium (excluding any extra premium loading and service tax) *(outstanding Policy Term in complete months / Policy Term in months)

| Feature | Specification |

| Age (as on last birthday) |

Minimum: 18 Years Maximum:65 Years |

| Age at Maturity | 70 Years |

| Policy Tenure |

Minimum: 5 Years Maximum: 82 Years |

| Sum Assured | Minimum: 25 Lacs Maximum: No Limit (subject to underwriting) |

| Premium Paying Term | Single or Same as policy term Years Years |

| Premium Paying Mode | Single,Annually,Half-Yearly & Monthly |

| Maturity Proceeds | Nil |

| Plan Type | Online |

| Grace Period | 30 days/15 days (for monthly mode) |

Following riders are available under this plan with regular pay premium payment mode:

(Riders are optional and are available at an extra cost.)

How the Plan works?

Let’s understand this plan with an example:

Mr. Abhay (Age 30 years, Non-smoker) opts for Aegon Life iTerm Insurance Plan. His plan details are:

Note: Premiums excluding taxes and cess

Premiums paid may qualify.

*The tax benefits are subject to change as per change in tax laws from time to time. Please consult your tax advisor for details.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing