Future Generali Insurance Company Limited came into existence with a joint venture between the Future Group (owns popular retail chains in India) and Generali Group (established in Italy in 1831, a leader in the global insurance and financial markets). Future Generali Insurance Company has got the capital infusion of Rs. 710 crore since its inception. Its Assets under Management (AUM) is more than Rs. 1,900 crore (on March 31, 2015).

The company has gained a wide presence with 137 locations across India, over 2,200 corporate clients, and 6,100 agents. Future Generali has served over 11 lakh customers and settles more than 1,80,000 claims every year. We are awarded an ISO 9001:2008 certification (quality excellence) and ISO/IEC 27001:2013 (information security management system standard). Future Generali offers insurance products for personal, commercial, social, and rural insurance. This general insurance company is a leading player in segments like jewelry, events, and film insurance. The latest Incurred Claims Ratio (ICR) of Future Generali for FY 2018-19 is 69%.

Future Generali Health Total Plan

Future Generali Future Health Suraksha - Individual Plan

Future Generali Future Health Suraksha - Family Floater Plan

Future Generali Future Hospicash Plan

Future Generali Future Health Surplus Plan

COMPARE

Mr. K.G. Krishnamoorthy Rao

Managing Director & Chief Executive Officer

Mr. K.G. Krishnamoorthy Rao

Managing Director & Chief Executive Officer  Mr. Easwara Narayanan

Chief Operating Officer

Mr. Easwara Narayanan

Chief Operating Officer  Mr. Neel Chheda

Head Actuary

Mr. Neel Chheda

Head Actuary

Thursday, Jun 08, 2017 10:00 AM

Future Enterprises plans to sell 50% stake in insurance company Future Generali, sources privy to the development told CNBC-TV18.

Sunday, May 07, 2017 10:00 AM

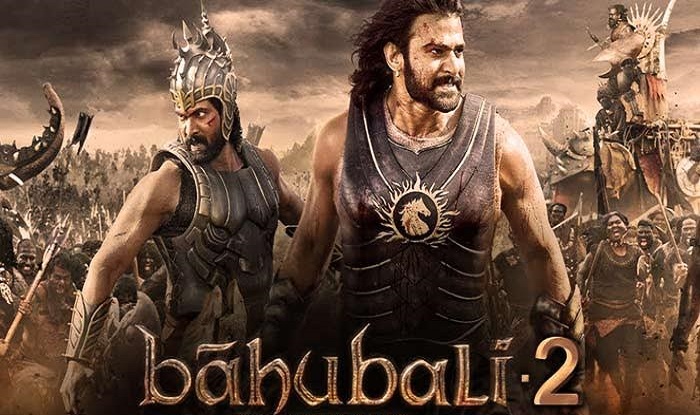

The movie Bahubali 2 The Conclusion, which has set cash registers ringing at the box office, has been good for insurers as well.

Tuesday, Jan 31, 2017 10:00 AM

Future Generali India Insurance Company Ltd (FGIL) has entered into a corporate agency tie-up for its products with Bank of Maharashtra (BOM), a public sector bank.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing