Dream Smart Plan is a unit linked insurance plan that helps achieve your family’s dreams such as child’ education, buying a perfect house for your family, planning post-retirement life, etc. This plan provides flexibility to pay premiums for a limited duration along with life cover for 20 years. This plan helps invest your money in unit linked funds that take care of your long term financial goals.

Get QuotesThis policy offers following 5 investment funds and you have the option to invest in any one or combination of fund options.

In the event of death of the life insured during the policy term,

Before age 60 years, the Death Benefit payable is higher of Sum assured less partial withdrawals (in preceding two years), 105% of all premiums paid or Fund value. On attaining 60 years or above, the Death Benefit payable is higher of Sum assured less partial withdrawals (after attaining 58 years of age), 105% of all premiums paid or Fund value.

If the policy is in discontinuance state, the Death Benefit is equivalent to the Proceeds of Discontinuance Policy Fund.

On survival of the life insured till the end of the policy term, the Fund Value is payable.

Loyalty Additions as 1% of your fund value is made in form of extra allocation of units at the end of the 15th policy year.

You have the option to Increase/Decrease the Sum Assured from 6th policy year onwards. This option is available once in a policy year, subject to a maximum of three times during the entire policy term. Increase/Decrease in Sum Assured does not result in any change in annual premium.

You can switch among 5 available fund options to suit your changing investment needs. The minimum switch amount allowed is Rs 10,000.

Premium Re-direction facility is available to alter future premium allocation.

Partial Withdrawal is allowed after completion of five policy years (in case of minor lives, life assured attains 18 years). The minimum partial withdrawal amount is Rs 10,000. The minimum fund value required after such withdrawal does not fall below 120% of the first year premium.

The plan is not eligible for the bonuses.

No loan benefit can be availed under this plan.

Upon surrendering the policy with-in the lock-in period of 5 years, the fund value less applicable discontinuance charges is credited to the ‘Discontinued Policy Fund’ and it is refunded upon completion of the lock-in period. The proceeds after addition of interest subject to a minimum guaranteed interest rate of 4% per annum or as stipulated by IRDAI is payable after the end of the lock-in period.

Upon surrendering the policy after the lock-in period of 5 years, the Fund Value as on the date of surrender is payable immediately.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 7 Years | 60 Years |

| Age at Maturity | - | 80 Years |

| Policy Tenure | 20 Years (fixed) | - |

| Premium Paying Term (PPT) | 10 Years | 20 Years |

| Premium Paying Mode | Annually Only | - |

| Annual Premium Amount | Rs 25,000 | No Limit |

| Sum Assured | < 45 Years- 10 Times The Annual Premium >= 45 Years - 7 Times The Annual Premium | No Limit (subject To Underwriting) |

| Freelook Period | 15 Days From The Receipt Of The Policy | - |

| Grace Period | 30 Days | - |

| Plan Type | Offline | - |

No rider is available under this plan.

Premium Allocation Charges: This charge is deducted from the premium paid. The Premium Allocation Charge is 8.4%/6.4%/5.4% during the 1st policy year, 2nd & 3rd policy year, 4th to 10th policy year, respectively. No Premium Allocation Charge is levied from 11th policy year onwards.

Policy Administration Charge: Policy administration charge is 0.05% per month on the annual premium during 1st to 5th policy years. This charge increases by 20% every five years, subject to a maximum of Rs 416.67 per month.

Mortality Charges: Mortality charge is based on the age of the life insured and Sum at Risk (SAR) at the time of deduction of charge.

Fund Management Charges: Fund management charge levied is a percentage of the Fund Value. It is 1.35% p.a for Equity II Fund, Growth Plus Fund, Balanced Plus Fund & Debt Plus Fund, 0.80% p.a for Liquid Fund, 0.50% p.a for Discontinued Policy Fund. Fund management charge for Liquid Fund may be revised up to 1.35% p.a on prior approval from IRDAI.

Discontinuance Charge: This charge is levied, in case the policy is discontinued during the first 4 policy years. This charge is levied as applicable under the policy terms & conditions. For more details, please refer the policy brochure.

Switching Charge: You can avail 6 free switches during a policy year. A charge of Rs 250 is levied per switch when opted for subsequent switches in the same policy year. This charge can be revised to Rs 500, with prior approval from IRDAI.

Premium Re-direction: Premium re-direction once in a policy year is available.

Partial Withdrawal: 4 free partial withdrawals are allowed during a policy year. A charge of Rs 250 is levied when opted for subsequent withdrawal in the same policy year. This charge can be revised to Rs 500, with prior approval from IRDAI.

Miscellaneous Charges: Medical examination expenses in case of increase in sum assured, subject to a maximum of Rs 3000. This charge can be revised to a maximum of Rs 5000, upon prior approval from IRDAI.

Tax benefits can be availed under section 80C & 10(10D) under the Income Tax Act, subject to change in tax laws.

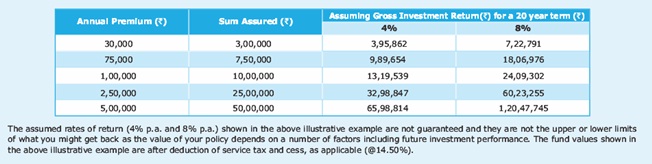

Mr. Raman aged 40 years, is leading a happy life with his wife ananya and a daughter sanya. He wants to build a corpus amount, so his family can achieve their dreams such as sanya’s education, her marriage, etc. He also wants to ensure financial security of the family, in case of a mishap. He thus opts for Dream Smart Plan with the premium paying term of 10 years, annual premium of Rs 1,00,000 and the sum assured of Rs 10,00,000.

Scenario A- Maturity Benefit: In case of his survival till maturity of the policy, the Fund Value is payable. Loyalty Additions as 1% of your fund value is made in form of extra allocation of units at the end of the 15th policy year.

Scenario B- Death Benefit: In the event of his death during the policy term, Before age 60 years, the Death Benefit payable is higher of Sum assured less partial withdrawals (in preceding two years), 105% of all premiums paid or Fund value. On attaining 60 years or above, the Death Benefit payable is higher of Sum assured less partial withdrawals (after attaining 58 years of age), 105% of all premiums paid or Fund value.

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing