Bharti AXA Life Elite Advantage plan is a non-linked & non-participating savings and protection oriented life insurance plan, which offers benefits of savings cum protection for your loved ones in case of an unfortunate event. This Bharti AXA elite advantage plan offers guaranteed regular returns after completion of the policy term, so that the proceeds continue even after the completion of the policy term. Bharti AXA Life Elite Advantage helps your family to lead the same lifestyle that you have worked so hard for.

Get QuoteDeath Benefit

In case of an unfortunate event of death of the Life Insured during the Policy Term, the sum of benefits will be payable to the nominee is higher of Sum Assured on Maturity, or 11 times Annualised Premium, or 105% of all premiums paid (excluding any additional charges as levied by the company over and above the standard premium rates).

Maturity Benefit

If the Life Insured survives the policy term and all the premiums are duly paid, the following benefits are payable.

1. Guaranteed Payout: It is a percentage of the Sum Assured on Maturity and is paid during the Maturity Payout Period starting from the end of the policy term till the end of the 19th year. The frequency of the guaranteed payout will be Annual/Semi-Annual/Quarterly as chosen by the insured.

Maturity Payout Period: The Maturity Payout Period is a period post the Policy Term when the guaranteed payouts as shown in the table above and the Sum Assured at Maturity are paid. This is dependent on the Policy Term.For a Policy Term of 10 years, the Maturity Payout Period is from the end of 10th year till the end of 20th year. For a Policy Term of 12 years, the Maturity Payout Period is from the end of 12th year till the end of 20th year.

2. Sum Assured: 100% of Sum Assured on Maturity is paid at the end of the 20th year from the Policy Date. The percentage of Guaranteed Payout depends upon the Policy Term, Premium Payment Term and the Premium Amount as mentioned below:

(The Policyholder has an option to take the above mentioned maturity benefit as a lump sum. The lump sum shall be calculated as a Net Present Value of future payouts at a guaranteed rate of 5% p.a)

Bonus

This plan is a non participating plan and is not eligible for any bonus.

Loan Benefit

This plan offers loan benefit to the policyholder.The maximum loan amount will not exceed 70% of the surrender value.

Surrender Value

The policy acquires a surrender value after the payment of two annualised premiums for premium payment term of 5 and 7 years and after payment of three annualised premiums for the premium payment term of 12 years. The surrender value is dependent on the year of surrender and premium payment term.

Tax Benefit

The plan offers tax benefits under section 80C and section 10 (10D) of the Income Tax Act,1961.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 8 Years (for 10 Year Policy Term) 6 Years( For 12 Year Policy Term) | 65 Years |

| Age at Maturity | - | 75 Years (for 10 Year Policy Term) 77 Years (for 12 Year Policy Term) |

| Policy Tenure | 10 Years | 12 Years |

| Premium Paying Term | Limited Pay & Regulay Pay 5 Years ( For 10 Year Policy Term) 7/12 Years(for 12 Year Policy Term) | - |

| Premium Paying Mode | Annually,Semi Annually, Quarterly And Monthly | - |

| Premium Amount | Rs 24,000 (for 5 Year Policy Term) Rs 15,000 (for 7 Year Policy Term) Rs 12,000 (for 12 Year Policy Term) | - |

| Sum Assured | Depends On The Minimum Premium | - |

| Freelook Period | 15 Days/ 30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days & 15 Days (for Monthly Mode) | - |

| Plan Type | Offline | - |

Following riders are available with this plan

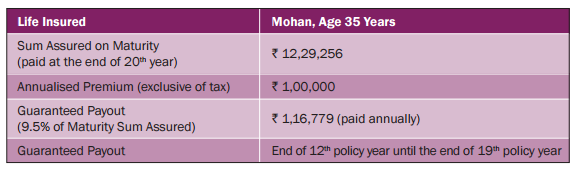

Let us understand the plan with the example of Mohan.

Mohan purchases Bharti AXA Life Elite Advantage Plan and invests Rs 1,00,000 as Annualised Premium. He chooses a Policy Term of 12 years and a Premium Paying Term of 12 years. Assuming that Mohan is in good health, his Sum Assured as per his age is Rs 12,29,256.

He will receive the maturity benefit in regular installments from the end of the policy term until the end of the 19th year. These payouts could serve as a second income and also help in paying his child’s school expenses.The lump sum amount that he will receive at the end of the 20th year could be used for his daughter’s higher education expenses.In case of the unfortunate event of his death before the maturity of the policy, his family will get higher of 100% of Sum Assured or 105% of the Premiums paid or 11 times the Annualised Base Premium.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing