Bajaj Allianz Future Wealth Gain is an individual, non-participating & unit-linked insurance plan that offers the dual benefit of protection and growth that helps you to fulfill the dreams of the loved ones. It also provides flexibility to invest in a range of fund options that helps you to create wealth and meet future financial goals.

2 variants can be opted this plan:

Under this policy, you can choose from two unique portfolio strategies:

1. Investor Selectable Portfolio Strategy: It enables you to allocate premiums on the basis of your choice. You can opt for this strategy and choose from following 8 investment funds that suit your investment objectives.

2. Wheel of Life Portfolio Strategy: It provides you ‘Years to Maturity’ based portfolio management and investments would be allocated to funds namely Equity Growth Fund II, Accelerator Mid-Cap Fund II, Bluechip Equity Fund, Bond Fund & Liquid Fund in the proportions as specified under the policy, depending on outstanding years to maturity.

You have the option to switch from Investor Selectable Portfolio Strategy to Wheel of Life Portfolio Strategy and vice versa by giving a written notice 30-days before making such a switch.

For Wealth Plus

In the event of unfortunate death of the life assured within the policy term while all due premiums are paid, the death benefit payable is higher of Sum Assured plus Top up Sum Assured OR Fund Value as on the date of receipt of intimation of death.

The minimum death benefit is 105% of the total premiums paid, till the date of death.

For Wealth Plus Care

In addition to the benefits applicable for ‘wealth plus’ variant, Income Benefit is also payable.

Income Benefit: Total of all the regular premiums due under the policy, after the date of death or diagnosis of cancer when occurs during the premium payment term is payable.

In case, death occurs after claim has been paid for cancer and income benefit being triggered, no additional benefit will be payable on death and outstanding income benefits (if any) will be payable to the nominee.

Note:

In case the death of the life assured occurs prior attaining age 60 years, the sum assured will be reduced to the extent of the partial withdrawals made during the two year period immediately before the death of the life assured.

If the death occurs on or after 60 years of age, the sum assured will be reduced to the extent of the partial withdrawals made after completion of 58 years and onwards.

On survival of the life assured till end of the policy term, regular premium fund value plus top-up premium fund value is payable.

On maturity, you can opt to receive your money in annually, semi annually, quarterly or monthly installments over a maximum period of 5 years, post the date of maturity. You also have the option to completely withdraw the fund value at any time during the settlement period. No life cover is applicable during this settlement period. Only fund management charge is levied during the settlement period.

Loyalty Additions are made to the Regular Premium Fund Value at the end of every 5th policy year commencing from the 10th policy year, provided all due regular premiums have been paid in full. It is expressed as a percentage of an annualized premium.

Loyalty Addition is 15%/20%/25%/30% added at the end of 10th/15th/20th/25th policy year, respectively.

Fund booster will be added to the Regular Premium Fund Value at maturity, provided all due regular premiums have been paid up to the date of the allocation of Fund Booster. It is expressed as a percentage of an annualized premium.

For 10 year policy term- it is 5%/7%/10% for premium payment term of 5/7/10 years, respectively. For 15 years policy term & above, fund booster is 30%/42%/60%/90% for premium payment term of 5/7/10/15 years, respectively.

No fund booster is added for top-up premium paid.

Non-zero positive claw back additions are added to the regular premium fund value to ensure maximum reduction in yield criteria, as specified in regulations 37 of IRDA (Linked Insurance Products) Regulations, 2013. It is added each year from the end of 5th policy year.

You have the option to pay additional premium as Top-up Premium and you can exercise this option any time, except the last 5 years of the policy. The minimum Top-up premium allowed is Rs 5,000. For age less than 45 years, Top-up Sum Assured is 1.25 times the Top-up Premium paid. For other ages, Top-up Sum Assured is 1.1 times the Top-up Premium paid

For ‘wealth plus care’ variant, top-up premiums are allowed to an extent that base sum assured plus top-up sum assured does not exceed Rs 1 Crore.

You can switch between fund options to capitalize market opportunities. The minimum switching amount is the lower of Rs 5,000 or value of units in the fund to be switched from.

Premium apportionment is used to modify the allocation proportion of future premiums to various funds. The minimum premium apportionment to any fund is at least 5%. This benefit is applicable only under ‘Investor Selectable Portfolio Strategy’.

Partial Withdrawal is allowed up to 2 times during a policy year and time interval between two withdrawals cannot be less than 3 months.

The minimum partial withdrawal amount at any one time is Rs 5,000, subject to a maximum of 10% of the total premiums paid. The total amount withdrawn through the entire policy term cannot be more than 50% of the total premiums paid. The regular premium fund value shall not fall below 3 times the annualized premium after making such withdrawal.

The plan is not eligible for the bonuses as it is a non-participating life insurance plan.

No loan benefit can be availed under this plan.

Upon surrendering the policy with-in the lock-in period of 5 years and on complete withdrawal from the policy, the fund value less applicable discontinuance charges is credited to the ‘Discontinued Life Policy Fund’ and it is refunded upon completion of lock-in period. The risk cover ceases after surrendering the policy. The discontinuance charge is applicable only to the Regular Premium Fund Value.

Upon surrendering the policy after the lock-in period of 5 years, the total fund value as on the date of surrender is payable.

Under ‘Wealth Plus’ variant, if waiver of premium is opted and has already been activated under the policy, then, the present value of future waiver of premium installments, discounted at 4% p.a., shall be paid on termination of policy.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 0 Years (wealth Plus), 18 Years (wealth Plus Care) | 60 Years |

| Age at Maturity | 18 Years (wealth Plus), 28 Years (wealth Plus Care) | 75 Years (wealth Plus), 70 Years (wealth Plus Care) |

| Policy Tenure | 10 Years | 15 To 25 Years |

| Premium Paying Term (PPT) | 5/7/10 Years | 5/7/10/15 Years |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Premium Amount | Rs 50,000 (annually) | As Per Maximum Sum Assured Allowed |

| Sum Assured | For Age <=45 Years: Higher Of 10 * Annualized Premum Or 0.5 * Annualized Premum * Policy Term For Age >45 Years: Higher Of 10 * Annualized Premium Or 0.25 * Annualized Premum * Policy Term | For Age <=45 Years: Sum Assured Multiple Of 15/20/30/40 Is Applicable For Age >45 Years: Higher Of 10 * Annualized Premum Or 0.25 * Annualized Premum * Policy Term (for Entry Age 45 Years Or More) For Wealth Plus Care For Age <=45 Years: Higher Of 10 * Annualized Premum Or 0.5 * Annualized Premum * Policy Term For Age >45 Years: Higher Of 10 * Annualized Premum Or 0.25 * Annualized Premum * Policy Term |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

Following are the riders available, upon payment of additional rider premium.

For ‘Wealth Plus’ variant,

For ‘Wealth Plus Care’ variant,

Premium Allocation Charge: This charge is deducted from the premium paid. It is 2% for top-up premium and for regular premium- yearly mode, it is 8.5%/5%/2% during 1st policy year for the annualized premium of Rs 50,000 to 99,999/Rs 1,00,000 to Rs 1,99,999/Rs 2,00,000 to Rs 2,99,999 respectively.

For 2nd policy year, it is 8%/3.5%/1.5% for the annualized premium of Rs 50,000 to 99,999/Rs 1,00,000 to Rs 1,99,999/Rs 2,00,000 to Rs 2,99,999 respectively. For 3rd to 5th policy year, it is 6%/3.5%/1.5% for the annualized premium of Rs 50,000 to 99,999/Rs 1,00,000 to Rs 1,99,999/Rs 2,00,000 to Rs 2,99,999 respectively.

From 6th policy year onwards, no premium allocation charge is levied.

Policy Administration Charge: No policy administration charge is levied during the first five policy years. From 6th policy year & onwards, it is 2% p.a of the annualized premium to a maximum of Rs 6,000 p.a. Monthly policy administration charge is levied through the entire policy term by the redemption of units under the policy.

Mortality Charge: Mortality charge is applied on Sum at Risk (SAR) and it is deducted on each Policy Month Anniversary.

Fund Management Charges: Fund management charge for Equity Growth Fund II, Accelerator Mid-Cap Fund II & Pure Stock Fund is 1.35% p.a, Pure Stock Fund II is levied with 1.30% p.a, Asset Allocation Fund II & Bluechip Equity Fund is levied with 1.25% p.a, Bond Fund & Liquid Fund is levied with 0.95% p.a and for Discontinued Policy Fund, it is 0.50% p.a.

Discontinuance Charge: This charge is levied, in case the policy is discontinued during the first 4 years. This charge is levied as applicable under the policy terms & conditions. For more details, please refer the policy brochure. No discontinuance charge is levied on top-up premium fund value.

Switching Charge: Unlimited free switches are available during the policy term.

Miscellaneous Charge: Rs 100 per transaction is levied towards alteration of premium payment term, premium payment frequency & change of premium apportionment. This charge is capped to Rs 200 per transaction.

Service Tax: The charges mentioned under this plan are subject to applicable tax and cess, as applicable.

Rider Charge: Applicable charge is levied, upon opting rider/s.

Tax benefits can be availed as applicable under the Income Tax Act, subject to change in tax laws.

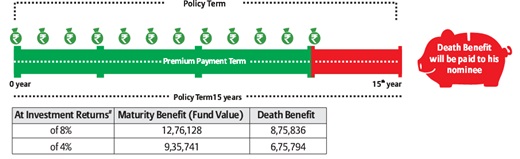

Mr. Aryan aged 30 years wants to build a corpus amount, so his family can achieve their dreams such as children’s higher education, marriage, etc. He also wants to ensure financial security of the family, in case of a mishap. He thus decides to buy Bajaj Allianz Future Wealth Gain- wealth plus variant with the policy term of 15 years, premium payment term of 15 years, annual premium of Rs 50,000 and sum assured is Rs 5 Lacs.

Scenario A- Maturity Benefit: If Mr. Aryan survives till maturity of the policy, regular premium fund value is payable.

Scenario B- Death Benefit: In the event of death of Mr. Aryan during 12th policy year, the death benefit payable is higher of Sum Assured plus Top up Sum Assured OR Fund Value as on the date of intimation of death.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing