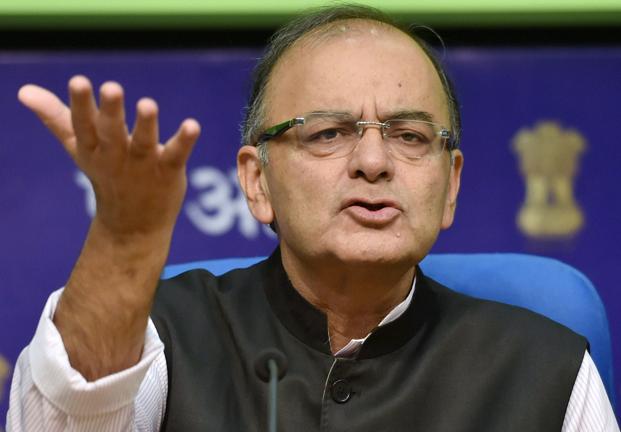

The government's plan to list public sector general insurers is gaining momentum with additional details such as business numbers and financial projections being sought from these insurers. A note is currently being prepared for the listing proposal to be presented before the Cabinet. In his Budget speech, Finance Minister Arun Jaitley said the general insurance companies owned by the government would be listed on stock exchanges. He had said public share-holding in government-owned firms was a means of ensuring higher levels of transparency and accountability.

Apart from the sole domestic reinsurer General Insurance Corporation of India (GIC Re), the four public-sector insurers are New India Assurance, United India Insurance, Oriental India Insurance, and National Insurance. "Details on our financial performances, business growth as well as future expectations from business have been sought by the ministry officials. They have also asked for information on any future areas of growth," said a senior public-sector generalinsurance official. Sources said the listing process and timeline would be finalised over the next few weeks. It is expected that the process will reach its advanced stages by the end of this financial year. New India Assurance could become one of the first candidates for listing, based on financial performance.

There have been discussions in the past between the finance ministry and these insurers on their possible listing. It is anticipated that New India, which is among the largest in the public sector, could be the first to be taken to the listing path.

For the first quarter ended June 30, 2016, New India collected global premium of Rs. 5,263 crore, with a growth rate of 14.7%. Its profit after tax stood at Rs. 218 crore and net worth including fair value at Rs. 31,232 crore. Once the Cabinet nod is given, these insurers will internally begin to finalise all the processes and also appoint external consultants to ensure a smooth transition.

However, underwriting losses remain an area of concern for these insurers especially in segments such as health and motor third-party insurance. Once they get closer to listing, the focus would be to reduce these losses significantly, said public-sector insurance executives. Listing will not only involve overhaul of existing processes. Experts say in the run-up to the initial public offering (IPO), the way these insurers function would have to undergo a change. While corporate governance practices are already in place, there will be more pressure on top management to refine it, say experts.

According to data from the Insurance Regulatory and Development Authority of India (IRDAI), underwriting losses increased 23% year-on- year from FY14 to FY15. Insurers said that on an average, there is a 20-30% rise every year in underwriting losses. Public-sector insurers have seen a bigger impact of this due to the large volumes of business they underwrite every year. Among the segments, fire and property are seeing a rise in losses, especially with large claims as well as undercutting to retain clients. Similarly, the group health segment has also seen losses pile up because of heavy discounts to existing corporate customers.