With an aim to expand its presence in the financial markets, Asia's oldest bourse BSE has sought approval from markets regulator Sebi to float two entities for web aggregator and brokerage in insurance space.

The bourse also runs the mutual fund trading platform BSEStar MF.The exchange, in July, submitted an application with Sebi"for approval for activities undertaken by BSE Investments and BSE CSR as an insurance web aggregator andinsurance broker by setting up two subsidiaries underBSE Investments." BSE Investments, which is a direct subsidiary, was incorporated as a public limited company in February 2014.

The main objects of the firm include carrying on the business of a holding and investment company in India or abroad and buy, subscribe, underwrite, invest in shares, stocks, warrants and other money market instruments, BSE said in its draft papers filed with Sebi.

The move is aimed at expanding the presence of BSE in the financial markets space.

Earlier this month, BSE had filed draft papers with Sebi to launch its initial public offering for the public issue of shares worth up to Rs 1,500 crore.

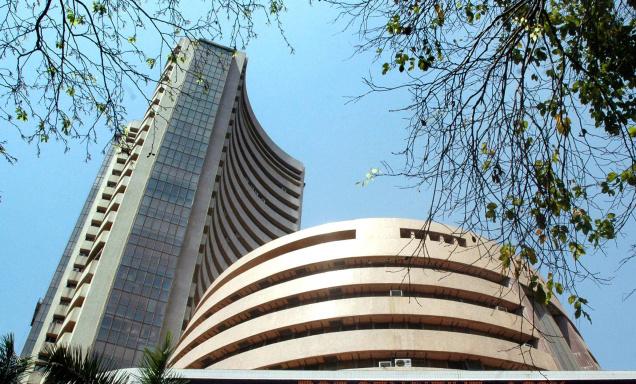

Shares of nearly 3,000 companies trade on BSE, earlier known as the Bombay Stock Exchange.