SUD Life's Elite Assure Plan is a Non-Linked Non-Participating Life Insurance plan which offers death and survival benefits and also allows you to choose how much to receive as supplementary income and for how long.

The plan offers 2 plan variants:

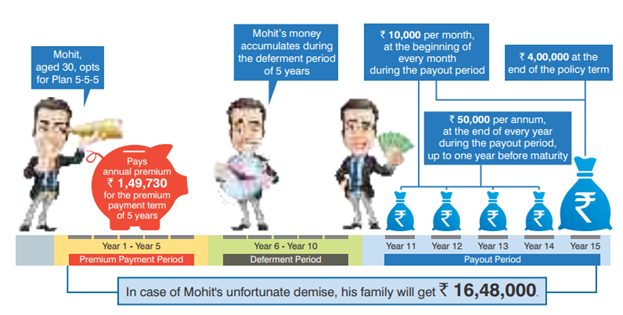

1. 5-5-5 Plan - Pay premiums for 5 years (Your money accumulates for another 5 years Receive payouts in the next 5 years)

2. 7-7-7 Plan - Pay premiums for 7 years (Your money accumulates for another 7 years Receive payouts in the next 7 years)

Get QuoteDeath Benefit

In the event of death of the life insured during the policy term, nominees will receive Death Sum Assured immediately under the policy, without deducting the monthly or annual income already paid, if any. The policy will be terminated and no further benefits will be paid.

Death Sum Assured is highest of 10 times of Annual Premium OR 105% of all the premium (excluding taxes and extra premiums, if any) paid as on date of death, OR Minimum Guaranteed Maturity Benefit, OR absolute amount assured to be paid on death (11 times the Annual Premium rounded up to the next ` 1000), where, Annual Premium refers to premium payable in a year excluding any extra premium, service tax and loading for modal factors, if any.

Survival Benefit

You will receive three types of payouts, during the payout period (last 5 policy years for Plan Option '5-5-5' and last 7 policy years for Plan Option '7-7-7') on survival:

Bonus

This plan is a non participating endowment plan which does not get any bonus.

Loan Benefit

The Policy loan is not available against this plan.

Surrender Value

The Surrender Value payable will be higher of “Guaranteed Surrender Value (GSV)” and “Special Surrender Value (SSV)”. If you have paid all premiums for at least 2 consecutive full years, then only the policy will acquire a surrender value.

Tax Benefit

The plan offers tax benefits under section 80C and section 10 (10D) of the Income Tax Act,1961.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 20 Years | 50 Years |

| Age at Maturity | 35 Years | 71 Years |

| Policy Tenure | 15 Years | 21 Years |

| Premium Paying Term | 5 Pay And 7 Pay | - |

| Premium Paying Mode | Annually,Semi Annually,Quarterly And Monthly | - |

| Premium Amount | - | - |

| Sum Assured | 11 X Annual Premium | - |

| Freelook Period | 15 Days/ 30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days & 15 Days (for Monthly Mode) | - |

| Plan Type | Offline | - |

The following riders are available with this product:

Mohit, aged 30, has opted for Plan 5-5-5 and has chosen a monthly income of ` 10,000 per month. He has to pay annual premium of ` 1,49,730 for the premium payment term of 5 years. His money accumulates during the deferment period of 5 years, and he starts receiving the income benefits after the deferment period. He will receive income benefits of ` 12,00,000 during the payout period of 5 years, as below:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing