SUD Life AAYUSHMAAN is a Non Linked Deferred Participating Plan that pays lump sum benefits and enduring financial safety net to ensure that nothing comes in the way of your family's happiness. The guaranteed additions and bonuses,in the plan enhance your benefits under the plan with time.

Get QuoteDeath Benefit

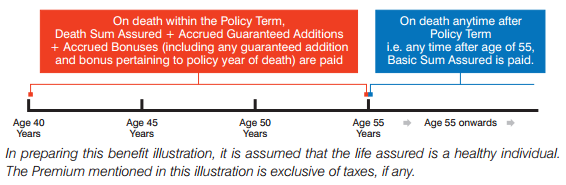

In the event of death of the life insured during the policy term, nominees will receive Death Sum Assured along with the accrued Guaranteed Additions, accrued Reversionary Bonuses (including any guaranteed addition and bonus till death and Terminal Bonus, if any. The policy ceases thereafter. Death Sum Assured = Highest of, a) 10 times of Annualized premium Or b) Guaranteed Sum assured at the time of Maturity(i.e. Basic Sum assured) Or c) Absolute amount assured to be paid on death (150% of the Basic Sum Assured)

Maturity Benefit

On survival of the Life Assured till the end of the Policy Term, life insured will get Basic Sum Assured along with the accrued Guaranteed Additions, accrued Reversionary Bonuses and terminal bonus.

Guaranteed Benefits

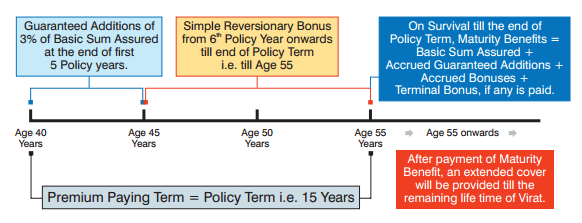

Guaranteed Additions of 3% p.a. of Basic Sum Assured will be attached to the policy at the end of each policy year for the first 5 policy years, provided the policy is in-force.

Extended Life Cover

On survival of the Life Assured till the end of the Policy Term, Maturity Benefit is paid and an extended life cover equal to the Basic Sum Assured will be provided for the remaining lifetime of the Life Assured. On death of the Life Assured during the extended life cover period, Basic Sum Assured will be paid and the contract terminates immediately.

Bonus

Simple Reversionary and Terminal bonus will be payable. Simple Reversionary Bonus will start getting declared and attached to all in-force Policies from sixth policy year onwards.

Loan Benefit

The loan can be availed for up to 70% of the Surrender Value at the applicable interest rate levied.

Surrender Value

The Surrender Value payable will be higher of “Guaranteed Surrender Value (GSV)” and “Special Surrender Value (SSV)”. If you have paid all premiums for at least first three consecutive full years, then only the policy will acquire a surrender value.

Tax Benefit

Plan offers tax benefits under section 80C and section 10 (10D) of the Income Tax Act,1961.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 50 Years |

| Age at Maturity | - | 70 Years |

| Policy Tenure | 15/20/25 Years | 30 Years |

| Premium Paying Term | Equal To The Policy Pay Term | - |

| Premium Paying Mode | Annually,Semi Annually,Quarterly And Monthly | - |

| Premium Amount | - | - |

| Sum Assured | Rs 1.5 Lacs | Rs 100 Crores |

| Freelook Period | 15 Days/ 30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days & 15 Days (for Monthly Mode) | - |

| Plan Type | Offline | - |

Following riders are available under this product:

Virat, aged 40 is looking for a plan which will cover him for lifetime and provide a lump sum amount at an intermediate stage of his life to take care of his family needs. He decides to pay premiums for 15 years for Basic Sum Assured of ` 3,00,000. He pays Annual Premium of ` 28,497/- throughout the Policy Term.

Scenario 1: If Virat survives the policy term:

At the end of Policy Term (i.e. at the end of 15 Policy year):

(a) Basic Sum Assured: ` 3,00,000

(b) Accrued Guaranteed Additions: ` 45,000 (3% p.a. of 3,00,000 for first 5 years)

(c) Accrued Bonuses

Returns at 4% p.a. 15,000

Returns at 8% p.a. 1,35,000

Thus, total Maturity Benefit received by Virat is

Returns at 4% p.a. ` 3,60,000 (3,00,000+45,000+15,000)

Returns at 8% p.a. ` 4,80,000 (3,00,000+45,000+1,35,000)

Scenario 2: If Virat dies during the policy term:

In case of Virat's unfortunate demise in the 10 Policy year (i.e. within the Policy Term), his nominee will receive the following benefits and the policy terminates immediately.

(a) Death Sum Assured: 4,50,000 (Higher of 10 times Annualised Premium or Basic Sum Assured or 150% of Basic Sum Assured )

(b) Accrued Guaranteed Additions: ` 45,000 (3% p.a. of 3,00,000 for first 5 years)

(c) Accrued Bonuses Returns at 4% p.a.= Rs 7,500 and Returns at 8% p.a = Rs 67,500

Total Death Benefit received by Virat is:

If Returns at 4% p.a. = Rs 5,02,500 (4,50,000+45,000+7,500)

If Returns at 8% p.a.= Rs 5,62,500 (4,50,000+45,000+67,500)

Scenario 3: Virat dies after the completion of policy term

On death at any time after the Policy Term In case of unfortunate demise of Virat at age 75, his nominee will receive Basic Sum Assured of ` 3,00,000 and the policy terminates immediately.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing