Sahara Shubh Nivesh-Jeevan Bima is a without-profit single premium endowment assurance plan that helps you to fulfill various financial obligations such as buying a house, dream vacation with your family, providing the best education to the children, etc. This plan also provides life cover that ensures financial protection for your family.

Invest today in this plan helps you to create wealth for the future.

Get QuoteDeath Benefit

On the death of the life insured during the term of the policy, the sum assured is payable immediately. Sum Assured is not less than 125% of the single premium when age at entry is less than 45 years and it is 110% of the single premium when age at entry is equal to or more than 45 years.

Maturity Benefit

On survival till completion of the policy term, the sum assured chosen is payable to the life insured.

Bonus

No bonuses are payable, as it is a without-profit endowment insurance plan.

Loan Benefit

You can avail loan amount up to 90% of the surrender value.

Surrender Value

Surrender Value can be acquired anytime during the term of the policy. Surrender Value payable is higher of Guaranteed Surrender Value or Special Surrender Value.

Tax Benefit

The premiums paid and benefits payable are eligible for tax benefit as applicable under the Income Tax Act, 1961. The income tax laws are subject to change from time to time.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 9 Years | 60 Years |

| Age at Maturity | - | 70 Years |

| Policy Tenure | 10 Years (fixed) | - |

| Premium Paying Term | Single Pay | - |

| Premium Paying Mode | Single | - |

| Premium Amount | - | - |

| Sum Assured | Rs 50,000 | No Limit (subject To Underwriting) |

| Freelook Period | 15 Days From The Receipt Of The Policy | - |

| Grace Period | Nil | - |

| Plan Type | Offline | - |

No rider can be attached under this plan.

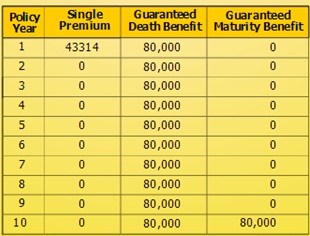

Devansh is looking for a plan that can help him accumulate wealth to meet future financial goals along with financial protection for the family. He at 35 years of age buys Sahara Shubh Nivesh-Jeevan Bima with the policy term of 10 years, pays single premium of Rs 43,314 and the sum assured is Rs 80,000.

Scenario A: Devansh Survives the Policy Term

On survival of Devansh till end of the policy term, an amount equal to the sum assured i.e., Rs 80,000 is payable.

Scenario B: Devansh dies during the Term of the Policy

In the event of the demise of Devansh during the policy term, the death benefit payable equal to sum assured i.e., Rs 80,000 is payable.

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing