PNB Metlife Mera Heart and Cancer care plan offers financial protection against two critical illnesses which are cancer ,heart disease or both. The plan offers comprehensive cover against all stages of cancer and heart diseases. It is a custom made plan which offers flexibility to choose the plan features as per your need and requirement along with a bundle of other benefits.

The plan Offers 2 Plan Variants:

The lump sum payout is made to the insured as per the stage of illness diagnosed.

The benefits payable at each stage will be less any claims paid in the earlier stages.The payout pattern is similar for both plan variants gold & platinum.

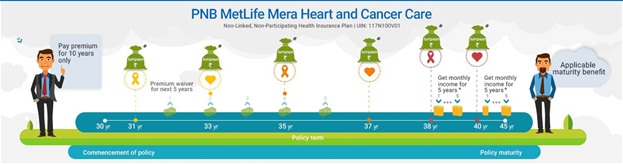

For a premium paying policy, claim payable under Mild or Moderate stage diagnosed illness allows a premium waiver for the next 5 policy years. This benefit will only be available on the first instance of a valid Mild or Moderate claim.

Maturity benefit is payable at the end of the chosen policy term,if the policyholder chooses “the Return of Balance Premium option”. The benefit is the sum of all premiums, less critical illness claims already paid. No maturity benefit will be paid if the policyholder has not opted for “return of balance premium option”.

The death benefit is payable on the earlier occurrence of either Death or diagnosis of Terminal Illness. Death benefit payout will be the sum insured on death less any critical illness claims paid earlier dug the policy term.

This benefit is available with platinum plan variant only.Under this benefit, an additional monthly income benefit of 1.5% of the sum insured is paid, on severe stage claim for a fixed period of five years, from the date of claim.The monthly income benefit is in addition to all the benefits described under the plan.

After paying regular premiums for at least three full years from the date of commencement of the policy, Surrender Value, which is higher of Guaranteed Surrender Value (GSV) and Special Surrender Value (SSV), shall be payable, less any critical illness claims paid, if any.The GSV and SSV rates are expressed as a percentage of total premiums paid under the Policy.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 65 Years |

| Age at Maturity | 28 Years | 75 Years |

| Policy Tenure | 10/15 Years | 20 Years |

| Premium Paying Term | Equal To Policy Term | - |

| Premium Paying Mode | Monthly,Semi Annually & Annually | - |

| Sum Assured | Gold Variant :Rs 5 Lakh Platinum Variant: Rs 10 Lakh | Gold Variant : Rs 40 Lakh Platinum Variant:Rs 80 Lakh |

| Grace Period | 30 Days | - |

| Plan Type | Online/Offline | - |

“The Return of Balance Premium option” can be opted as an add-on benefit with both plan benefits.

Tax benefits under this plan are available as per the provisions and conditions of the Income Tax Act, 1961 and are subject to any changes made in the tax laws in future.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing