LIC’s New Jeevan Nidhi is a traditional with-profits pension plan providing a combination of protection and saving features. This plan provides death cover during the deferment period and offers annuity on vesting.

Get QuotesFollowing is the death benefit payable under this plan.

On death during the first five policy years, the Basic Sum Assured plus accrued Guaranteed Addition is paid. On death after the first five policy years, the Basic Sum Assured along with accrued Guaranteed Addition, Simple Reversionary and Final Additional Bonus is paid.

In any case, the death benefit shall not be less than 105% of the total premiums paid.

The nominee can take the death benefit in any one of the following ways:

At maturity, an amount equal to the Basic Sum Assured along plus accrued Guaranteed Additions, vested Simple Reversionary bonuses and Final Additional bonus is payable to the Life Insured.

Amount received as a maturity benefit can be used in one of the following ways:

A policyholder can take up to 1/3rd of the benefit as tax-free lump sum as per the prevailing income tax regulations. The rest of the amount can be utilized to purchase an annuity at the then prevailing annuity rate.

Guaranteed Additions is Rs 50 per thousand of Basic Sum Assured for each completed year. It is added during the first five policy years.

Simple Reversionary Bonus: You can avail Simple Reversionary Bonus from 6th policy year onwards at a rate, as declared by the Corporation.

Final Bonus: Final (Additional) Bonus may also be declared under the policy in the year when the policy resulting a death claim or on vesting.

No loan facility is available under this policy.

Single Premium policies can be surrendered at any time during the deferment period. The Guaranteed Surrender Value within the first three policy years is 70% of the Single premium and thereafter, it is 90% of the Single premium.

Under Regular Premium policies, for deferment period less than 10 years, the policy can be surrendered, if the premiums have been paid for at least two consecutive years and for deferment period of 10 years or more, the policy can be surrendered, if the premiums have been paid for at least three consecutive years.

Moreover, the surrender value of accrued Guaranteed Additions and vested simple reversionary bonuses, is also payable.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 20 Years | 58 Years (regular Premium), 60 Years (single Premium) |

| Vesting Age | 55 Years | 65 Years |

| Deferment Period | 7 To 35 Years (regular Premium), 5 To 35 (single Premium) | - |

| Premium Payment Term | Single & Regular Pay | - |

| Premium Paying Mode | Single, Annually, Semi Annually, Quarterly & Monthly | - |

| Basic Sum Assured | Rs 1,00,000 (regular Premium Policies, Rs 1,50,000 (single Premium Policies) | No Limit |

| Freelook Period | 15 Days From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

LIC’s Accidental Death and Disability Benefit Rider can be opted under this plan.

This policy provides tax benefits towards the premiums paid under Section 80CCC of the Income Tax Act. The commutation benefit on vesting (1/3rd of the benefit) can be taken as tax-free lump sum under section 10(10A) of the Income Tax Act, 1961.

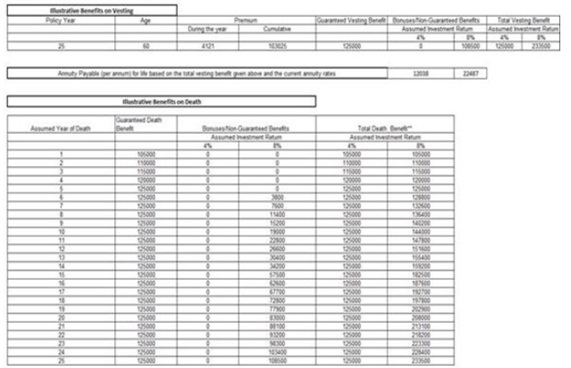

Mr. Raj Agnihotri aged at 35 years wants to get annuity benefit on vesting along with the life cover during the deferment period. He decides to buy LIC’s New Jeevan Nidhi with the policy term and premium payment term of 25 years, basic sum assured is Rs 1 Lac with the annual premium of Rs 4121.

Scenario A: On survival of Mr. Raj

In case of survival of the life insured till the vesting date, an amount equal to the Basic Sum Assured along with accrued Guaranteed Additions, vested Simple Reversionary bonuses and Final Additional bonus is payable.

Scenario B: On demise of Mr. Rai

On the unfortunate death of Mr. Raj at the age of 50 years, Basic Sum Assured along with accrued Guaranteed Addition, Simple Reversionary and Final Additional Bonus is paid.

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing