LIC New Money Back Plan - 20 Years is a non-linked, participating plan that provides the combination of periodic payment on survival at regular intervals along with protection against death through the entire policy term. This combination of benefits provides financial security for the family before maturity and maturity benefit for the surviving policyholders.

Get QuotesIn the event of death of the life insured before the date of maturity, Sum Assured on Death plus Vested Simple Reversionary Bonuses & Final Additional Bonus is payable to the nominee, provided the policy is in-force. Sum Assured on Death is higher of 10 times of annualized premium or 125% of basic sum assured. The total death benefit payable cannot be less than 105% of all the premiums paid.

On survival of the life insured till maturity of the policy, 40% of the Basic Sum Assured plus Simple Reversionary Bonuses & Final Additional Bonus is payable.

20% of the basic sum assured is payable at the end of each of 5th, 10th, & 15th policy year. This benefit is payable on survival of the life insured to the end of the specific durations during the policy term.

Simple Reversionary Bonus is declared annually at the end of each financial year. When declared, it becomes guaranteed benefit under the plan. This bonus amount is added from the date of commencement of the policy till death or completion of the policy term, whichever is earlier. Final additional bonus may also be payable, in case the claim is arising due to maturity or death.

Loan facility can be availed under this policy, after payment of three full policy years’ premiums.

This policy acquires Surrender Value after paying at least three full policy years’ premium. The Guaranteed Surrender Value is a percentage of total premiums paid and it depends on the year of surrender. The Surrender Value of Vested Simple Reversionary Bonuses is also payable. The Special Surrender Value is payable, when it is more favorable to the policyholder.

Under this policy, you can avail tax benefits under section 80C & 10 (10D) of the Income Tax Act, subject to change in tax laws.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 13 Years | 50 Years |

| Age at Maturity | - | 70 Years |

| Policy Tenure | 20 Years | - |

| Premium Paying Term | 15 Years | - |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Basic Sum Assured | Rs 1 Lac | No Limit (subject To Underwriting) |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

LIC’s Accidental Death and Disability Benefit Rider can be opted, on payment of additional rider premium.

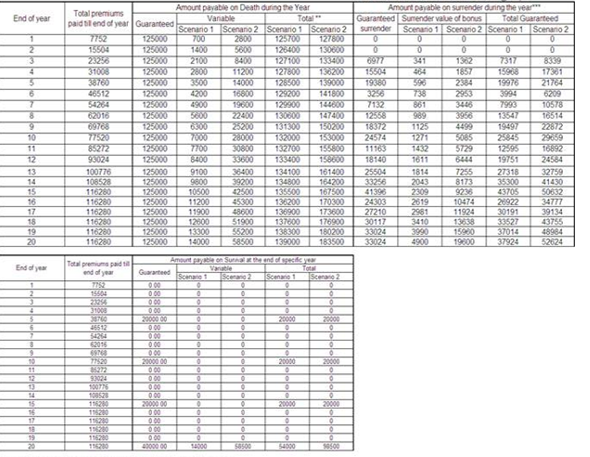

Raman at 30 years, wants to buy LIC’s New Money Back Plan - 20 Years to get regular money backs along with life protection. He opts the plan with the policy term of 20 years, premium paying term of 15 years, sum assured is Rs 1,00,000 with annual premium of Rs 7,752.

Scenario A: Raman Survives the Policy Term

If Mr. Raman survives till the maturity of the policy term, he receives Rs 20,000 at the end of each of 5th, 10th, & 15th policy year, as the survival benefit. Rs 40,000 plus Simple Reversionary Bonuses & Final Additional Bonus is payable as the maturity benefit.

Scenario B: Raman dies during the Term of the Policy

In the event of demise of Mr. Raman during the policy term, Rs 1,00,000 plus Vested Simple Reversionary Bonuses & Final Additional Bonus is payable to the nominee.

Benefit Illustration:

Please Note: The benefits illustrated above are calculated at Projected Non-Guaranteed Investment Rate of Return assumption of 4% p.a. (Scenario 1) and 8% p.a. (Scenario 2) respectively. It is assumed that the rate of return will be able to earn throughout the term of the policy

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing