IndiaFirst Life Cash Back Plan is a non participating, non linked, money back insurance plan. The plan ensures that you have always ample amount of funds to take care of your special moments of life. The IndiaFirst Life Cash Back Plan guarantees regular payouts at regular intervals to meet your specific needs. The plan also offers maturity payout which is assured. The policy will also safeguard your family's financial security in case of the life assured's untimely death by paying the death benefit along with accumulated guaranteed additions.

Get QuotesThe death benefit payable to the nominee in the event of death of the life insured is an aggregate of Sum Assured on death plus guaranteed addition, till date of death. The sum assured on death is higher of10 times of the annualized premium or 105% of all premiums paid, excluding service tax and extra premium / rider premium, if any, as on date of death or guaranteed sum assured on maturity.

Once the death benefit proceeds are paid to the nominee, the policy gets terminated and no Survival Benefit or Maturity benefit is payable in that scenario.

The life insured will receive the payout during the policy term, as per the premium payment term opted.

The survival benefits payable are as follows:

For a 9 year policy term: 20% of the sum insured on maturity is payable in the 3rd policy year and 20% of the sum insured on maturity is payable in the 6th policy year.

For a 12 year policy term: 20% of the sum insured on maturity is payable in the 4th policy year and 20% of the sum insured on maturity is payable in the 8th policy year.

For a 15 year policy term: 20% of the sum insured on maturity is payable in the 5th policy year and 20% of the sum insured on maturity is payable in the 10th policy year.

Maturity benefit is payable on the survival of the Life Assured till the end of the policy term. Maturity benefit is payable to the Policyholder which is the base Sum Assured plus accrued bonus and Terminal Bonus, (if any) and the policy terminates.

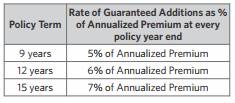

The guaranteed additions will depend on the policy term as mentioned below:

The plan is not eligible for any bonus as it is a non participating plan.

No loan benefit is available under this policy.

The plan can be surrendered after payment of 2 and 3 full years's premium provided the premium paying term is 5 or 7 years and 10 years respectively. The surrender value will be higher of the Guaranteed Surrender Value (GSV) and Special Surrender Value (SSV).

The plan helps in getting tax benefits under section 80C and section 10 (10D) of the Income Tax Act,1961.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 15 Years | 45 Years (for 9 Year Policy Term) 50 Years (for 12 Year Policy Term) 45 Years (for 15 Year Policy Term) |

| Age at Maturity | - | 70 Years |

| Policy Tenure | 9/12 Years | 15 Years |

| Premium Paying Term | 5 Pay (for 9 Year Policy Term) 7 Pay (for 12 Year Policy Term) 10 Pay (for 15 Year Policy Term) | - |

| Premium Paying Mode | Annually,Semi Annually,Quarterly And Monthly | - |

| Premium Amount | Rs 522 (for Monthly Mode) Rs 1,554 (for Quarterly Mode) Rs 3,071 (for Semi Annually Mode) Rs 6,000 (for Annual Mode) | Depends On Max Sum Assured |

| Sum Assured | Rs 50,000 | No Limit Subject To Underwriting |

| Freelook Period | 15 Days/ 30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days & 15 Days (for Monthly Mode) | - |

| Plan Type | Offline | - |

No Riders are available under this plan.

Let us understand the plan with the example of Rahul:

Life Insured: Rahul

Policy Term: 9 years

Sum Assured: Rs 1 Lakh

Survival Benefit: Rahul will receive 40% of the sum assured during the policy term, i.e Rs 20,000 in the 3rd policy year (20 % of the sum assured) and another Rs 20,000 in the 6th policy year (20% of the sum assured).

Guaranteed Additions: 5% of the annualized premium at every policy year end.

Maturity Benefit: The remaining 60% of the sum assured i.e Rs 60,000 is paid at the end of the policy term along with accrued guaranteed additions.

Death Benefit: The death benefit payable to Rahul’s nominee in the event of death is an aggregate of Sum Assured on death plus guaranteed addition, till date of death.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing