ICICI Pru Easy Retirement is a Unit Linked Pension Plan, which offers equity linked growth on your savings along with the assurance of capital guarantee. This plan helps you build a retirement corpus that will enable you to receive a sizeable regular income, after your retirement.

Get QuotesThis policy offers following investment fund options.

In the event of death of the life insured within the policy term, the nominee will receive the higher of the Guaranteed Death Benefit or Fund Value. The Guaranteed Death Benefit is 105% of all the premiums paid.

In case of death of the life insured when the money is in Pension Discontinued Policy Fund, the PDP Fund Value is payable to the nominee.

The nominee has the option to utilize the death benefit in following 3 ways:

On your vesting date, you will receive the higher of the Assured Benefit or Fund Value. The Assured Benefit is equal to 101% of all the premiums paid.

You have 4 following options to receive the vesting benefit.

You have the option to take up to 1/3rd of the benefit as tax-free accumulated value as per the current income tax regulations. The balance amount is then utilized to purchase an immediate annuity, which ensures you a regular income.

There is an option to extend the vesting date, provided the life insured is aged below 55 years and maximum vesting age is 80 years. You can postpone your vesting date any number of times.

You have the flexibility to choose any of the annuity options as available at the time of your vesting.

You have the option to invest the available money through Topups and it can be exercised anytime up to 5 years before the vesting date of your policy. The minimum amount of topup is Rs 2,000.

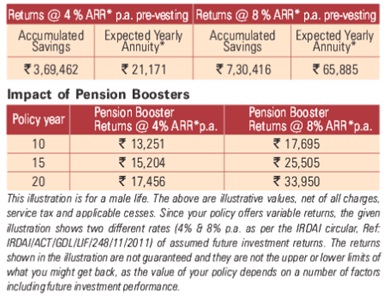

On completion of 10th policy year and on completion of 15th policy year thereafter, a Guaranteed Pension Booster is available, if at least five years’ premiums have been paid. Pension Booster is equal to 5% of the average daily total Fund Value over the preceding 12 months. This benefit is available through allocation of extra units.

In order to comply with the reduction in yield, the non-negative claw-back additions are added to the fund value after first 5 policy years.

You have the flexibility to switch units between the fund options, depend on your financial goals and investment outlook. The minimum switch amount is Rs 2,000.

At the time of payment of subsequent premiums, you can avail premium redirection without any charge.

You have the option to increase the premium payment term by notifying the company. You can decrease the premium payment term by notifying the company after payment of all premiums for at least 5 policy years. Increase/decrease in premium payment term is available in multiples of one year.

No bonus is applicable under this plan.

No policy loan can be availed under this plan.

Upon surrendering the policy with-in the lock-in period of 5 years, the fund value after deducting Policy Discontinuance Charges is transferred to the Pension Discontinued Policy (PDP) Fund. A fund management charge of 0.50% p.a is levied. The proceeds from PDP Fund are subject to a minimum guaranteed return of 4% p.a or any other rate as prescribed by IRDAI. It is payable on the expiry of the lock-in period.

Upon surrendering the policy after the completion of the lock-in period of 5 years, you are entitled to receive the fund value.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 35 Years | 70 Years |

| Age at Vesting | 45 Years | 80 Years |

| Policy Term | 10, 15, 20, 25, 30 Years | - |

| Premium Paying Term (PPT) | Limited Pay (5/10 Years), Equal To Policy Term | - |

| Premium Paying Mode | Annually, Semi Annually & Monthly | - |

| Premium Amount | Rs 48,000 | No Limit |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Online/Offline | - |

No rider can be opted under this plan.

Premium Allocation Charge: Premium allocation charge is deducted from the premium amount and then the units are allocated. For annual mode, it is 3%/2% from year 1 to premium payment term for annual premium less than Rs 5,00,000/Rs 5,00,000 to Rs 9,99,999 respectively.

For semi-annual & monthly mode, the Premium Allocation Charge is 3%/3%/2% for year 1 & year 2 when annual premium is less than Rs 5,00,000/Rs 5,00,000 to Rs 9,99,999/equal to or more than Rs 10,00,000, respectively. It is 2%/3%/1.5% from year 3 to premium payment term when annual premium is less than Rs 5,00,000/Rs 5,00,000 to Rs 9,99,999/ equal to or more than Rs 10,00,000, respectively.

For Topups, the Premium Allocation Charge is 2%.

Policy Administration Charge: This policy administration charge is a percentage of the annual premium and it is levied every month for the first 10 policy years. The policy administration charge is subject to a maximum of Rs 6,000 per annum.

For annual mode, the policy administration charge is 0.25%/0.10%/0.05% per month for year 1 to year 5 when annual premium is less than Rs 5,00,000/Rs 5,00,000 to Rs 9,99,999/equal to or more than Rs 10,00,000, respectively. From year 6 to year 10, it is 0.05% per month irrespective of the annual premium.

For semi-annual & monthly mode, the policy administration charge is 0.25%/0.10%/0.05% per month for year 1 to year 10 when annual premium is less than Rs 5,00,000/Rs 5,00,000 to Rs 9,99,999/equal to or more than Rs 10,00,000, respectively.

Total Policy Administration Charge may be increased up to a maximum of 1.50% of annual premium per month.

Fund Management Charges: The fund management charge is 1.35% p.a for Easy Retirement Balanced Fund & Easy Retirement Secure Fund. There will be additional charges of 0.50% p.a. and 0.10% p.a. towards investment guarantees for Easy Retirement Balanced Fund and Easy Retirement Secure Fund, respectively.

Switching Charge: Four free switches are available during every policy year. Subsequent switches will be charged at Rs 100 per switch. Any unutilized switch cannot be carried forward to the next policy year. Switching charge may be increased to a maximum of Rs 200 per switch.

Discontinuance Charge: This charge is levied, in case the policy is discontinued during the first 4 policy years. This charge is levied as applicable under the policy terms & conditions. For more details, please refer the policy brochure.

The premiums paid are eligible for tax benefits under Section 80CCC of the Income Tax Act, 1961. Up to 1/3rd of the benefit can be taken as tax-free lump sum, as prescribed under section 10(10A) of the Income Tax Act, 1961.

Akhilesh at 40 years of age, wants to accumulate corpus that can ensure a regular income after his retirement. He buys ICICI Pru Easy Retirement with the policy term of 20 years, premium payment term of 5 years with the annual premium of Rs 50,000 and assured benefit of Rs 2,52,500. He chooses to invest his money with Easy Retirement Balanced Fund.

Scenario A: Akhilesh Survives till Vesting

On the vesting date, Akhilesh will receive the higher of the Assured Benefit or Fund Value. Guaranteed Pension Booster also adds up to the Fund Value. He has the option to Purchase an immediate annuity, take advantage of commutation benefit, postponment of vesting date, or utilize the entire vesting benefit to purchase a single premium deferred pension product.

Scenario B: Akhilesh dies within the Policy Term

In the event of death of Akhilesh within the policy term, the nominee will receive the higher of the Guaranteed Death Benefit or Fund Value. The nominee has the option to withdraw the death benefit proceeds, Utilize this benefit to purchase an immediate annuity plan, or withdraw a part of the death benefit amount and utilize the remaining amount to purchase an immediate annuity plan.

Premium Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing