HDFC Life YoungStar Udaan is a traditional participating insurance plan that helps you empower your child’s dreams. You can now dream big for your child and this plan helps you to attain systematic savings for your child’s goals, so they can realize their glorious career without any obstacles, even when you are not around.

Get QuotesIn the event of death of the life insured during the term of the policy, the death benefit is payable depending on the option chosen.

Classic Option- The death benefit is higher of sum assured on death or 105% of the premiums paid. Here, sum assured on death is higher of sum assured on maturity or 10/7 times of annualized premium for entry age up to 50 years/ entry age above 50 years.

Classic Waiver Option- The death benefit is higher of sum assured on death or 105% of the premiums paid. Here, sum assured on death is higher of sum assured on maturity or 10/7 times of annualized premium for entry age up to 50 years/ entry age above 50 years.

All future premiums are waived off and paid by the company.

On the demise of the life insured after commencement of survival benefits (in academia and career maturity benefit options), the death benefit payable is not reduced by the survival benefits already paid.

Maturity benefit is the aggregate of last guaranteed payouts (moneyback options) or sum assured on maturity (endowment option), accrued guaranteed additions, reversionary bonus, interim bonus and terminal bonus.

The maturity benefit is payable, depending on the option chosen.

Option 1 Aspiration (Endowment Option)- Lump sum as 100% of sum assured plus Guaranteed Additions as 25% of sum assured. In total, it is 125% of sum assured.

Option 2 Academia (Moneyback Option)- 30% of sum assured at 5th year before maturity. 15% of sum assured at 4th/3rd/2nd/1st year before maturity. At maturity, 15% of sum assured plus Guaranteed Additions as 25% of sum assured. In total, it is 130% of sum assured.

Option 3 Career (Moneyback Option)- 15% of sum assured at 5th/4th/3rd/2nd/1st year before maturity. At maturity, 40% of sum assured plus Guaranteed Additions as 25% of sum assured. In total, it is 140% of sum assured.

The survival benefit in monthly installments is 8.5% of the annual survival payout. It is payable over a period of 12 years.

Additional boosters as guaranteed additions are available when the premium pay term is 10 years or more. Guaranteed Additions is 3%/5% per annum for the first 5 policy years, when the policy term is less than or equal to 19 years/equal to or greater than 20 years. It is payable at maturity.

Simple Reversionary Bonus: Simple Reversionary Bonus is declared at the end of each financial year and is expressed as a percentage of sum assured on maturity. Once added, it becomes guaranteed and is payable on maturity or death, whichever occurs earlier under classic death benefit option and it is only payable on maturity for classic waiver death benefit option.

Terminal Bonus: Terminal bonus is added to a policy, depending on the surplus at the end. It is a non-guaranteed benefit.

The maximum loan that can be availed under this policy is 80% of the surrender value.

Surrender Value is higher of Special Surrender Value or Guaranteed Surrender Value. The policy will acquire a guaranteed surrender value on payment of at least 2 full policy year’s premium, when premium payment term is less than 10 years and it can be acquired on payment of at least 3 full policy year’s premium, when premium payment term is 10 years or above.

You can avail tax benefits under section 80C & 10 (10D) of the Income Tax Act. Tax benefits are applicable, as per the prevailing tax laws.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 30 Days (aspiration), 8 Years (academia And Career), 18 Years (classic Waiver) | 60 Years (classic Option), 55 Years (classic Waiver Option) |

| Age at Maturity | 18 Years (aspiration), 23 Years (academia And Career), 33 Years (classic Waiver) | 75 Years |

| Policy Tenure | 15 Years | 25 Years |

| Premium Paying Term (PPT) | 7 Years/10 Years/policy Term Minus 5 Years | - |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Premium Amount | Rs 24,000 (annually), Rs 12,000 (semi Annually), Rs 6,000 (quarterly), Rs 2,000 (monthly) | No Limit |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Online | - |

No rider can be opted under this plan.

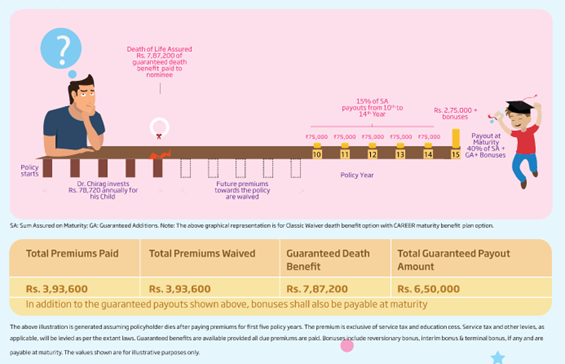

Mr. Chirag at 35 years of age, opts to buy HDFC Life YoungStar Udaan (career maturity benefit option with classic waiver death benefit option) with the policy term of 15 years, premium payment term of 10 years, annual premium amount of Rs 50,000, and sum assured on maturity of Rs 5,00,000.

Scenario A: Chirag Survives the Policy Term

15% of sum assured at 5th/4th/3rd/2nd/1st year before maturity. At maturity, 40% of sum assured plus Guaranteed Additions as 25% of sum assured. These payouts help Chirag pay his children’s education cost such as coaching and college fees.

Scenario B: Chirag dies during the Term of the Policy

In the event of death of Chirag at 40 years of age, the death benefit payable is Rs 5,25,000 as a lump sum to the family.

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing