Future Generali New Saral Anand plan is a non linked, participating endowment plan. The plan offers a comprehensive plan benefits under single policy to achieve the milestones in your life like buying a house, child education, funds for retirement, etc.The plan offers extended life cover which exists even after the policy matures.

Get QuoteDeath Benefit

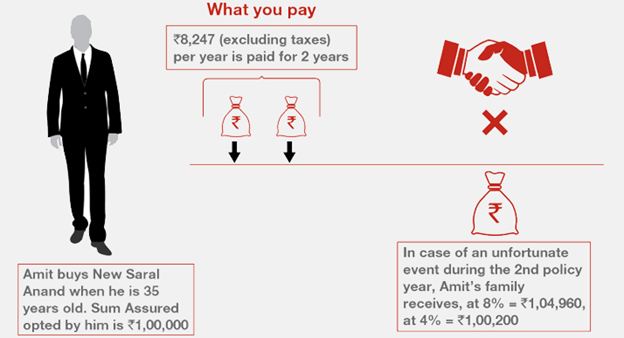

The death benefit payable to the nominee In the event of death of the life insured is higher of:

(where Death Sum Assured is higher of Sum Assured10 times Annualised Premium or Maturity Sum Assured, which is equal to sum assured or Absolute amount payable on death (which is equal to Sum Assured)

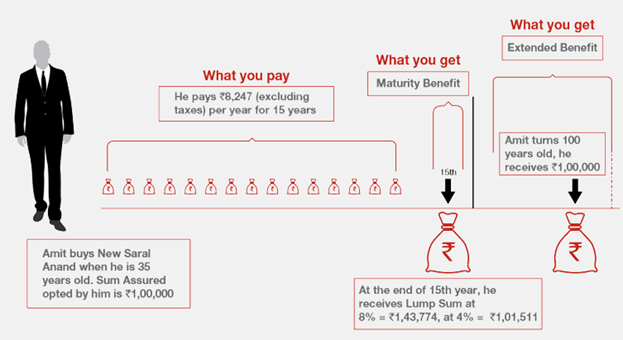

Maturity Benefit

Maturity benefit is payable on the survival of the Life Assured till the end of the policy term. Maturity benefits payable as lump sum payout which is the base Sum Assured plus accrued bonus and Terminal Bonus, (if any) and the policy terminates.

Extended Life Cover Benefit

The life insurance cover will be active till the policyholder attains the age of 100. At the age of 100, the life assured will receive another Lump Sum payment equal to 100% of the policy Sum Assured which is called the Extended Cover Payout. Also, in case of an unfortunate demise after maturity but before the life assured turns 100, the nominee will receive an amount equal to 100% of the Sum Assured.

Bonus

At the end of each financial year, the Company may declare a bonus expressed as a percentage of the Sum Assured and all previous bonuses declared. The bonus of each year is added to the Sum Assured and the next year’s bonus is calculated on the enhanced amount. The Company may declare a discretionary terminal bonus which is payable on death or maturity of the plan.

Loan Benefit

The maximum amount of loan taken is up to 85% of the Surrender Value. The loan can be taken once the policy has acquired Surrender Value.

Surrender Value

The surrender value is equal to the value higher of Guaranteed Surrender Value (GSV) and Special surrender value will be payable as surrender value. The premium must be paid for 3 policy years from inception to avail surrender value.

Tax Benefit

The plan helps in getting tax benefits under section 80C and section 10 (10D) of the Income Tax Act, 1961.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 3 Years | 50 Years |

| Age at Maturity | 18 Years | 70 Years |

| Policy Tenure | 15 Years | 20 Years |

| Premium Paying Term | Same As Policy Term | - |

| Premium Paying Mode | Annually,Semi Annually,Quarterly And Monthly | - |

| Premium Amount | Rs 8,000 P.a | Depends On Max Sum Assured |

| Sum Assured | Rs 1 Lac | No Limit (subject To Underwriting) |

| Freelook Period | 15 Days/ 30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days & 15 Days (for Monthly Mode) | - |

| Plan Type | Offline | - |

Following riders are available with this plan for the payment of an extra rider premium.

Let's understand this benefit with the help of an example:

Life Insured: Amit

Age: 35 years while buying the policy

Sum Assured : Rs. 1,00,000

Policy Term: 15 years

Annual Premium: Rs. 8,247 premium (plus service tax)

Benefits are illustrated below:

Scenario 1: Amit survives the policy term

(Note: The above scenario is depicted at assumed investment returns of 4% and 8%)

Scenario 2: Amit dies in the 2nd policy year

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing