Future Generali Big Income Multiplier plan is a life insurance plan which offers life insurance protection along with the guarantee double return along with the payout.This plan along with offering financial protection offers twice the value of your every rupee saved in terms of premium.It offers a multiplying impact to your savings.

Get QuoteDeath Benefit

The death benefit payable to the nominee in the event of life insured’s death during the policy period is Death sum assured which is higher of :

Death benefit is payable only if the policy is active and premium paying.

Maturity Benefit

Maturity benefit will vary as per the payout option chosen which is Annual or Monthly income.

(I) For Annual Income Payout option:

Total Benefit: Twice the Total Premium paid under the policy.

(II) For Monthly Income Payout option:

Total Benefit: Twice the Total Premium paid under the policy.

Bonus

This plan is a non participating plan and does not attract any bonus amount.

Loan Benefit

No loan is available under this plan.

Surrender Value

You may avail of a loan once the policy has acquired a Surrender Value. The maximum amount of loan that can be availed is up to 85% of the Surrender Value

Tax Benefit

The plan helps in getting tax benefits under section 80C and section 10 (10D) of the Income Tax Act, 1961.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 4 Years | 50 Years |

| Age at Maturity | 18 Years | 64 Years |

| Policy Tenure | 14 Years | 14 Years |

| Premium Paying Term | Limited: 12 Years | - |

| Premium Paying Mode | Annually/ Monthly | - |

| Premium Amount | Rs 18,000 Annually Rs 1,500 Monthly | No Limit |

| Sum Assured | Rs 15.8782 X Annual Premium – For Annual Mode 184.4113 X Monthly Premium – For Monthly Mode | - |

| Freelook Period | 15 Days/ 30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days & 15 Days (for Monthly Mode) | - |

| Plan Type | Offline | - |

Future Generali Accidental Benefit Rider is available with this plan for the payment of an extra rider premium.

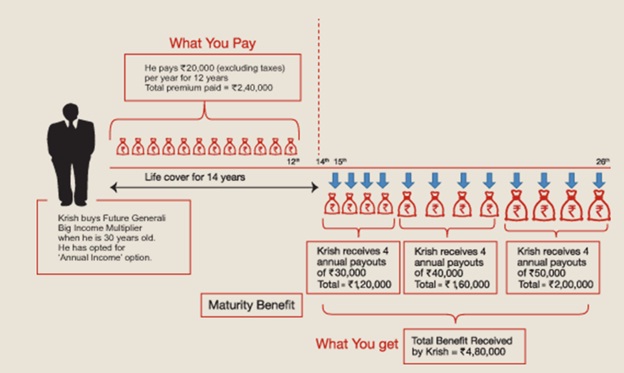

Let's understand this benefit with the help of an example:

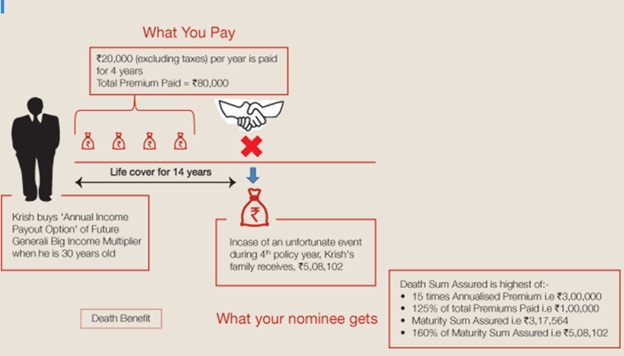

Life Insured: Krish

Age : 30 years old

Plan Details: Future Generali Big Income Multiplier with an ‘Annual Income Payout Option’

Premium: Rs 20,000 as annual premium (excluding taxes, rider premiums, extra premiums and cess)

Premium Payment Term: 12 years

Maturity Benefit:

He will receive Rs. 4,80,000 over a period of 12 years after the end of policy term i.e. 14 years. Let us explain how? Krish will receive 4 annual payouts of Rs 30,000 each year for four years starting from the end of 1st year after the end of policy term. He will receive 4 annual payouts of Rs 40,000 each year for four years starting from the end of 5th year after the end of policy term. He will receive 4 annual payouts of Rs 50,000 each year for four years starting from the end of 9th year after the end of policy term.

Death Benefit:

Krish pays the premium for 4 years and unfortunately passes away during the 4th policy year. In this case, Krish’s nominee will receive the following Death Benefit:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing