Future Generali Assured Education Plan is a non-linked, non-participating insurance plan that is designed to provide payouts at key education milestones for your child. This plan is an ideal launching pad for your child’s bright career and it ensures that your child’s education is never get compromised.

Get QuotesIn the event of death of the life insured during the term of the policy, Guaranteed Death Sum Assured is payable immediately to take care of the family’s needs. 5% of the Sum Assured is also paid immediately and on every death anniversary of the Life Insured till your child turns 17 years. This guaranteed amount can be used to fund your child’s regular school fees. Waiver of all future premiums under the policy.

Death Sum Assured is higher of maturity sum assured, absolute amount payable on death, 10 times the annualized premium, or 105% of the total premiums paid.

Maturity Benefit is also payable as per the option chosen.

Guaranteed payouts that can be used for payment of admission or tuition fees of your child. You have the flexibility to choose between option A, option B or option C, depending on your child’s education milestones. 100% of sum assured is payable as maturity benefit.

This policy does not offer any bonuses, as it is a non-participating insurance plan.

Up to a maximum of 85% of the surrender value can be availed under this policy.

Surrender Value payable is higher of Guaranteed Surrender Value or Special Surrender Value. The policy will acquire a surrender value on payment of at least 2 full policy year’s premium amount.

You can avail tax benefits under section 80C, 80CCC (1), 80D, & 10 (10D) of the Income Tax Act. Tax benefits are applicable, as per the prevailing tax laws.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 21 Years (child: 0 Year) | 50 Years (child: 10 Years) |

| Age at Maturity | 35 Years | 67 Years |

| Policy Tenure | 7 Years | 17 Years |

| Premium Paying Term (PPT) | Equal To Policy Tenure | - |

| Premium Paying Mode | Annually & Monthly | - |

| Premium Amount | Rs 20,000 (annually), Rs 2,000 (monthly) | - |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

Following riders can be opted, upon payment of additional rider premium.

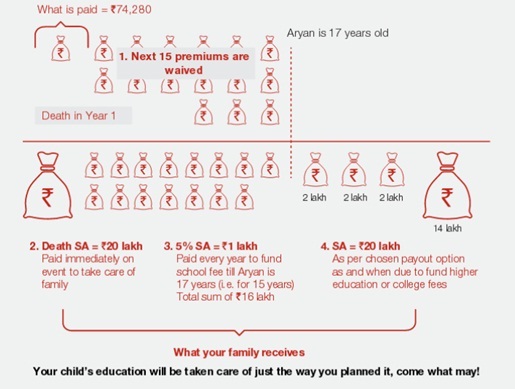

Mr. Rajesh at 30 years of age, opts to buy Future Generali Assured Education Plan with the policy term and premium payment term of 16 years, annual premium amount of Rs 74,280 and sum assured of Rs 20,00,000. He chooses option B for maturity payouts.

Scenario A: Rajesh Survives the Policy Term

Guaranteed payouts on choosing option B is payable that can be used for payment of admission or tuition fees of your child.

Scenario B: Rajesh dies during the Term of the Policy

In the event of death of Rajesh during the term of the policy, Guaranteed Death Sum Assured is payable immediately to take care of the family’s needs. 5% of the Sum Assured is also paid immediately and on every death anniversary of the Life Insured till your child turns 17 years. This guaranteed amount can be used to fund your child’s regular school fees.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing