Exide Life Mera Aashirvad is a Non linked, Non-participating Child Life Insurance Plan that provides guaranteed benefits and help achieve your child’s dreams. This plan pays out money at critical milestones of your child such as child’s higher education, his marriage, starting a business, etc. The guaranteed payouts under this plan ensure you that the child’s future is completely secured.

2 variants can be opted under this plan:

In the event of death of the life insured during the term of the policy, 100% of Sum Assured is paid as a lump sum. All future premiums are waived, upon death of the life insured. The Guaranteed Staggered Payouts already made are not deducted from the death benefit.

On death of the life assured with in the policy term, all the benefits under the plan will continue.

Sum Assured payable on death is at least 10 times of annualized premium or 105% of all the premiums payable.

At the end of the policy term, the maturity benefit payable is sum assured and it depends on the option chosen at the inception of the policy. Under option A, the payout is 65% of the sum assured. Under option B, the payout is 105% of the sum assured. Under this option, the benefit is payable as a single lump sum on the date of maturity along with the guaranteed addition of 5% of Sum Assured.

Guaranteed Staggered Payout

You have the option to receive a part of the sum assured as Staggered Payout, by choosing option A. It is 7.5% of paid-up value factor payable at 1st & 2nd policy anniversary after premium payment term. It is 10% paid-up value factor payable at 3rd & 4th policy anniversary after premium payment term.

Under Option B, Guaranteed Staggered Payout Benefits are not payable.

The Guaranteed additions are payable on maturity only for Option B and it is not applicable if policy acquires reduced paid up value.

No bonus is applicable under this plan.

Loan facility is available, after three full years premiums have been paid.

The amount payable on Surrender is higher of the Special Surrender Value or the Guaranteed Surrender Value, after deduction of loans under the Policy. Surrender Value can be acquired, in case three full years’ premiums have been paid. This policy acquires Guaranteed Surrender Value if at least one full year’s premium is paid.

Premiums paid for this policy is eligible for tax benefits under section 80C, Maturity proceeds can avail tax benefits under section 10 (10D), premium paid towards critical illness rider is eligible for tax benefits under section section 80 D of the Income Tax Act, subject to prevailing tax laws.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 21 Years (0 Year For Child) | 50 Years (15 Years For Child) |

| Age at Maturity | 36 Years | 65 Years |

| Policy Tenure | PPT + 5 Years | - |

| Premium Paying Term (PPT) | 13 To 20 Years (0 Year Child), 12 To 20 Years (1 Year Child), 11 To 20 Years (2 Years Child), 10 To 20 Years (3 To 15 Years Child) | - |

| Premium Paying Mode | Annually & Monthly | - |

| Sum Assured | For PPT (10-14) Years- Rs 350,000 For PPT (15-20) Years- Rs 450,000 | No Limit (subject To Underwriting) |

| Death Benefit | 100% Of Sum Assured | - |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

Following riders can be opted under this plan, on payment of additional rider premium.

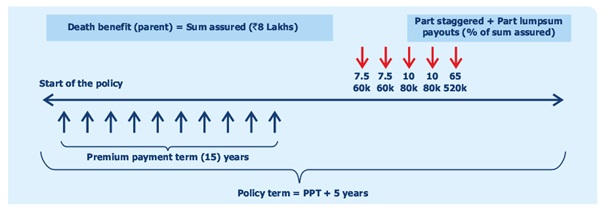

Mr. Raj buys Exide Life Mera Aashirvad with the policy term of 20 years, premium pay term of 15 years and sum assured of Rs 8,00,000. He chooses option A (part staggered and part lump sum).

Scenario A- Payout on Maturity: The guaranteed staggered payout benefits are paid out as 7.5%, 7.5%, 10%, 10% in the first 4 years before the policy maturity date and the balance 65% of the Sum Assured on the policy maturity date.

Scenario B- Payout on Death: In the event of death of the life insured during the term of the policy, 100% of Sum Assured is paid as a lump sum.

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing