Secure Bhavishya Plan is a non-participating unit linked pension plan that helps you to build a retirement corpus, so you can receive a regular income after the retirement. With this plan, you can take advantage of equity participation to boost the retirement corpus. It also provides assurance of ‘capital protection’ to your retirement corpus.

Get QuotesThis policy offers following fund investment options.

This policy also offers an investment strategy, which makes funds flow from riskier to less risky assets, as you approaches the time of vesting. It thus secures your investments from the volatile market situation.

In the event of death of the life insured, the Death Benefit payable is higher of Fund Value or 105% of the cumulative premiums paid (including top-up premiums).

The nominee has the option to use the death benefit through the following ways:

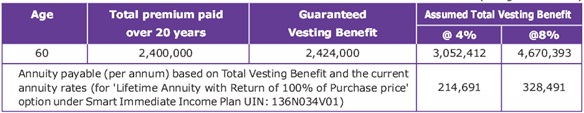

On your vesting date, you will receive the higher of Fund Value or Guaranteed Vesting Benefit. The Guaranteed Vesting Benefit is 101% of total premiums paid.

The vesting benefit can be utilized in the following three ways:

You have the option to take up to 1/3rd of the benefit as tax-free lump sum as per the current income tax regulations.

There is an option to defer the vesting date (up to maximum vesting age), provided the life insured is aged below 55 years.

For single/limited pay, the deferment of vesting is allowed up to maximum vesting age of 80 years. No premiums need to be paid for the extended period. For regular pay, there is an option to extend the accumulation period i.e. premium payment period along with deferment of Vesting Date.

Loyalty Additions are payable, in case of survival of the life insured. It is added to the fund by creating additional units, starting from the 10th policy year and added at the end of every 5 policy years, thereafter.

Loyalty Additions rate is 6.1%/2.5% at the end of 10th policy year/15th policy year and so on after every 5 years, respectively.

Top-up Premium can be paid through the entire policy term, excluding first and last policy year. The minimum amount of top-up premium is Rs 10,000.

You have the option to switch your money from Pension Balanced Fund to Pension Debt Fund. You can exercise this option during last 5 policy years. The minimum switching amount is Rs 10,000.

You can alter the allocation of your renewal premiums to Pension Debt Fund. You can avail premium redirection only once during a policy year. If not availed, there is no option to carry forward it to the next policy year.

No bonus is applicable, as it is a non-participating pension plan.

No policy loan is available under this plan.

Upon surrendering the policy with-in the lock-in period of 5 years, the fund value after deducting surrender charges is transferred to the Pension Discontinued Policy Fund. The Pension Discontinued Policy Fund is credited with a minimum guaranteed interest rate of 4% p.a or as directed by IRDAI. The proceeds are payable upon completion of first 5 policy years.

Upon surrendering the policy after the completion of the lock-in period of 5 years, the fund value is payable immediately.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 25 Years | 70 Years |

| Age at Vesting* | 40 Years | 80 Years |

| Policy Term | 10 Years | 35 Years (regular/limited Pay), 30 Years (single Pay) |

| Premium Paying Term (PPT) | Regular Pay, Limited Pay (5 To 34 Years), Single Pay | - |

| Premium Paying Mode | Annually & Monthly | - |

| Basic Premium | Single Pay- Rs 3,00,000 Regular/Limited Pay- Rs 50,000 (PPT Of 5 To 9 Years), Rs 25,000 (PPT Of 10 Years & Above) | - |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

No rider can be opted under this plan.

Premium Allocation Charge: Premium allocation charge is deducted upfront and the amount is then invested with the fund options. Under Regular/Limited Pay, for annual mode, the Premium Allocation Charge is 8.4%/6.4%/5.4% for 1st policy year/2nd to 3rd policy year/4th to 10th policy year or premium payment term (whichever is less), respectively. For monthly mode, the Premium Allocation Charge is 7.25%/5.0%/5.0% for 1st policy year/2nd to 3rd policy year/4th to 10th policy year or premium payment term (whichever is less), respectively.

For Single Pay, it is 2% of Single Premium and for Top-up Premiums, it is 2% of Top-up premium.

Policy Administration Charge: For Regular/Limited Pay, the policy administration charge is 0.05% of the annualized premium levied on a monthly basis during first 5 policy years. It then increases at the rate of 20% every five years from the 6th policy year. This charge should not exceed Rs 500 per month.

For Single Pay, it is 0.05% of Single Premium (for Single premium less than 3 Lacs) and 0.03% of Single Premium (for Single Premium equal to or greater than 3 Lacs). It is charged on a monthly basis during the first 5 policy years, subject to a maximum of Rs 500 per month.

Mortality Charge: It is levied monthly by cancelling appropriate units under the policy. This charge is applied on the Sum at Risk.

Fund Management Charges: The fund management charge is 1.35% p.a for Pension Growth Fund & Pension Balanced Fund, 1% p.a for Pension Debt Fund, 0.50% p.a for Pension Discontinued Policy Fund.

Investment Guarantee Charge: Investment guarantee charge is 0.25% p.a for Pension Growth Fund and 0.10% p.a for Pension Balanced Fund.

Discontinuance Charge: This charge is levied, in case the policy is discontinued during the first 4 policy years. This charge is levied as applicable under the policy terms & conditions. For more details, please refer the policy brochure.

Switching Charge: The first 6 switches can be availed for free during a policy year and subsequent switches are then levied for Rs 250. This charge can be increased up to a maximum of Rs 500. There is no option to carry forward the unutilized free switches.

Taxes: The service tax and cess is levied for charges applicable under this plan.

This plan offers tax benefits as applicable the Income Tax Act, 1961, subject to prevailing tax laws.

Rahul at 40 years of age, is looking to accumulate a retirement corpus that enables him to receive a guaranteed income after his retirement. He decides to buy Canara HSBC Life Secure Bhavishya Plan with the policy term of 20 years, regular annualized premium of Rs 1,20,000.

Scenario A: Rahul Survives till Vesting

On Rahul’s vesting date, he will receive the higher of Fund Value or Guaranteed Vesting Benefit. Loyalty Additions are also applicable.

Scenario B: Rahul dies within the Policy Term

In the event of death of Rahul, the Death Benefit payable is the higher of Fund Value or 105% of the cumulative premiums paid.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing