BSLI Vision MoneyBack plus plan is the traditional participating plan for attaining a secured form of saving, regular liquidity and a protection for life .The plan offers lump sum payouts during the policy term on regular intervals to meet the financial requirements.

Get QuotesIn case of the unfortunate event of death of the life insured during the policy term, your nominee will get the reduced sum assured on death plus accrued regular bonuses.

During the policy term, every 4th or 5th policy anniversary, as opted by the policyholder, the policyholder is liable to receive the Guaranteed Survival Benefits as a pre-defined percentage of the Reduced Sum Assured. There will be no provision to take the Guaranteed Survival Benefit later under Reduced Paid-up policy.

In the event the life insured survives the policy term, the plan will give back Accrued bonuses till date; plus Terminal bonus (if any) and policy ceases thereafter.

The company will declare simple reversionary bonuses regularly at the end of each financial year and these will be added to your policy on its policy anniversary. The company will also pay a terminal bonus on maturity, surrender or death.

The minimum loan amount amount is Rs 5,000 and the maximum is 85% of your Surrender Value.

The surrender value payable will be greater of the Guaranteed Surrender Value (GSV) and Special Surrender Value (SSV) provided 2 full years’ premiums have been paid.

The plan helps in getting tax benefits under section 80C and section 10 (10D) of the Income Tax Act,1961.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 13 Years | 45 Years |

| Age at Maturity | 23 Years | 70 Years |

| Policy Tenure | 20/24 Years | 25 Years |

| Premium Paying Term | 10 Years | 12 Years |

| Premium Paying Mode | Annually/Semi Annually/Quarterly/monthly | - |

| Sum Assured | 1 Lac | No Limit |

| Freelook Period | 15 Days /30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days | - |

| Plan Type | Offline | - |

The following riders can be availed with this plan:

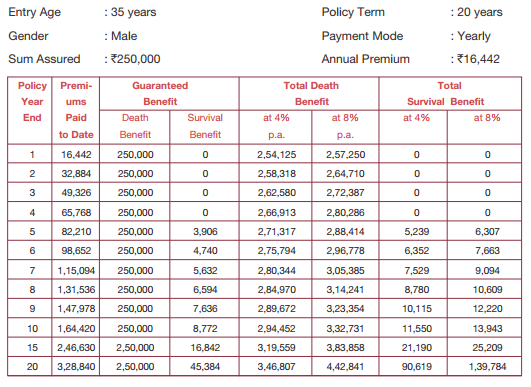

Let us understand the plan with the illustration below:

Service Tax and Education Cess and any other applicable taxes will be added to your premium and levied as per extant tax laws. To explain the benefits – in the 10th policy year the Guaranteed Survival Benefit is `8,772 and non-Guaranteed Survival Benefit (6.25% of the accrued bonus) @ 8% is Rs. 5,171, thus the total Survival Benefit @8% is `13,943. Similarly in the 15th policy year the Guaranteed Survival Benefit is Rs 16,842 and non-Guaranteed Survival Benefit (6.25% of the accrued bonus) @ 8% is Rs. 8,267, thus the total Survival Benefit @8% is Rs. 25,209

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing