The BSLI Income Assured plan is a traditional non-participating savings plan which provides guaranteed income and guaranteed additions along with life cover to offer a comprehensive plan. The plan offers assured income benefits which are payable from the end of the premium paying term till maturity along with the financial protection of your family.

Get QuoteAssured Income Benefit

The policyholder will receive assured income benefit as per the chosen options in the event of the policyholder surviving till the end of the premium-paying Term:

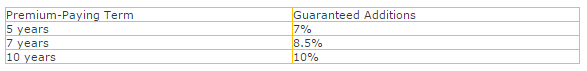

Guaranteed Additions

Guaranteed Additions will be added to the policy at the beginning of each quarter after the completion of the premium-payment term, until the policy maturity date. Guaranteed Additions per annum as a percentage of the sum assured for the various premium paying term are given below:

Death Benefit

In case of the unfortunate event of the death of the life insured during the policy term, the death benefit payable to the nominee is:

Where sum assured on death is maximum of:

Maturity Benefit

On the completion of the policy term, the life insured will receive sum assured on death; plus

Guaranteed Additions accumulated till date of death.In addition, the company will pay the increased receivable Assured Income (if opted for).

Bonus

The plan is not eligible for the bonuses as it is a non-participating life insurance plan.

Loan Benefit

Loan facility is available under this plan. The minimum loan amount is Rs.5,000 and the maximum is 85% of your surrender value.

Surrender Value

In the event of surrender, the Guaranteed Surrender Value shall be payable a percentage of premiums paid (excluding service tax and cess, any applicable rider premiums and underwriting extras, if any). The Guaranteed Surrender Value will vary depending on the year of surrender.

Tax Benefit

The plan offers tax benefits under section 80C and section 10 (10D) of the Income Tax Act, 1961.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 8 Years | 60 Years |

| Age at Maturity | - | 75 Years |

| Policy Tenure | 15 Years | 25 Years |

| Premium Paying Term | 5/7 Years | - |

| Premium Paying Mode | Annually | - |

| Premium Amount | Rs 50,000 | No Limit (Subj To Underwriting) |

| Sum Assured | Rs 1,00,000 | No Limit (Subj To Underwriting) |

| Freelook Period | 15 Days/ 30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days & 15 Days (for Monthly Mode) | - |

| Plan Type | Offline | - |

This plan offers BSLI Waiver of Premium Rider only.

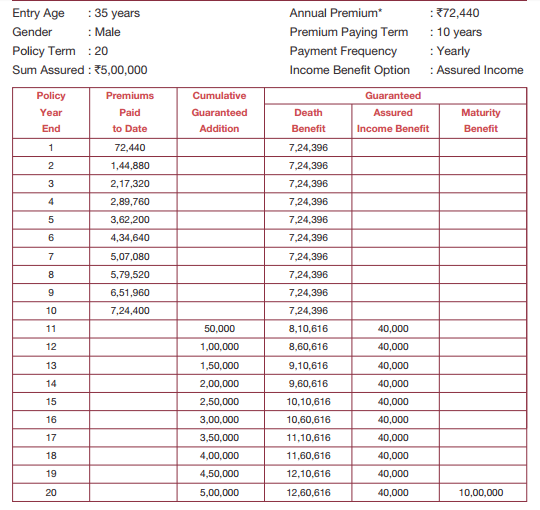

Let us understand the plan with the case study of Rahul:

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing