Life is full of uncertainty and you never know an unforeseen incident can put the financial security of your family at risk. Bajaj Allianz iSecure is a non-linked and non-participating level term insurance plan that provides the financial cover for your family, so they can lead a financially healthy lifestyle even after your demise.

Get Quotes| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 60 Years |

| Age at Maturity | 28 Years | 70 Years |

| Policy Tenure | 10 Years | 30 Years |

| Premium Paying Term | Same As Policy Term Years | - |

| Premium Paying Mode | Monthly, Quarterly, Semi Annually & Annually | - |

| Sum Assured | 2.5 Lacs | No Limit (subject To Underwriting) |

| Maturity Proceeds | Nil | - |

| Riders | Not Available | - |

| Surrender Benefit | Nil | - |

No rider is available with this plan.

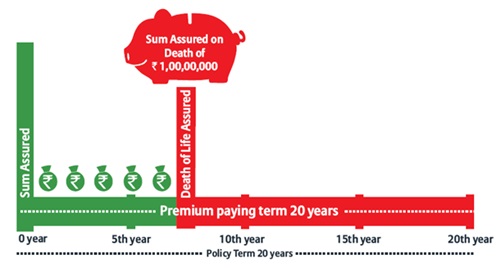

Let us understand the plan with the example of Jai

Life Insured: Jai

Age of life Insured: 30 years

Policy Term: 20 years

Sum Assured: 1,00,00,000

Annual Premium: Rs 10,465

Under this plan, the premium payment qualify for tax benefits as per Section 80C of the Income Tax Act and the policy proceeds are also entitled for tax benefits as per Section 10 (10D) of the Income Tax Act.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing