Financial responsibilities tend to increase as you go ahead in life and thus, ensuring family’s financial protection is quite essential. Bajaj Allianz iSecure More is an increasing cover term insurance plan that enhances financial protection for your family and is helpful to combat inflation during the policy term with increasing life cover.

Get Quotes| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 60 Years |

| Age at Maturity | 28 Years | 70 Years |

| Policy Tenure | 10 Years | 25 Years |

| Premium Paying Term | Same As Policy Term Years | - |

| Premium Paying Mode | Monthly, Quarterly, Semi Annually & Annually | - |

| Sum Assured | 2.5 Lacs | No Limit (subject To Underwriting) |

| Maturity Proceeds | Nil | - |

| Riders | Not Available | - |

| Surrender Value | Nil | - |

No rider is available with this plan.

Bajaj Allianz iSecure More allows you to secure yourself or to cover yourself, along with your spouse. You can customize the plan by choosing between an individual or a joint life cover . Choose your ideal sum assured and your policy term & premium payment frequency under the plan.

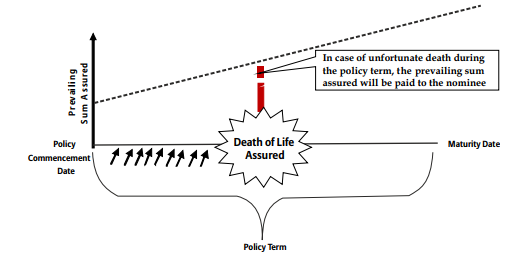

Your life cover under the plan will increase at each policy anniversary by 5% of the original sum assured at the beginning of the policy. This increase of the sum assured will not be more than twice the original sum assured at the policy inception. In case of untimely demise of the life assured, the death benefit payable will be the prevailing sum assured as on date of death.

Under this plan, the premium payment qualify for tax benefits as per Section 80C of the Income Tax Act and the policy proceeds are also entitled for tax benefits as per Section 10 (10D) of the Income Tax Act.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing