Bajaj Allianz Retire Rich is a Unit-linked Deferred Pension Plan that helps you to meet all your retirement dreams. This plan helps maximize your wealth, so you can retire with laughter lines. This ULIP pension plan enables you to accommodate your changing needs post retirement, when you don’t have a regular source of income.

Get QuotesThis policy offers ‘Pension Builder Fund’ that helps you to invest in a suitable mix of debt and equities.

On unfortunate demise of the life insured before the vesting date, the death benefit payable to the nominee is higher of the Fund Value as on the date of intimation of death or the Guaranteed Death Benefit.Guaranteed Death Benefit is 105% of the sum of all premiums and top-up premiums paid till the date of death.

The nominee has the option to utilize the death benefit through the following ways:

The higher of Guaranteed Vesting Benefit or total Fund Value as on the vesting date is payable. Guaranteed Vesting Benefit is 101% of the sum of all premium and top-up premiums paid by you till the date of vesting.

On the vesting date, you have the option to use your vesting benefit through 3 ways.

You need to exercise one of the three options before the date of vesting.

Loyalty Additions added to your Fund Value on the original vesting date of your policy. Loyalty Additions are expressed as a percentage of annualized/single premium. For regular/limited premium, it may vary from 8.5% to 33% of annualized premium. For single premium, it may vary from 3% to 4.5% of single premium.

You can make lump sum investments by way of top-up premiums. The minimum top-up premium is Rs 5,000. It helps to enhance the fund value.

Alteration of premium payment frequency and flexibility to change premium paying term is available, in case of regular or limited premium payment option.

Switching & premium re-direction is not available under this plan.

No bonus is available under this plan.

No loan benefit can be availed under this plan.

Upon surrendering the policy with-in the lock-in period of 5 years, the Fund Value (including top-up fund value) less applicable discontinuance charges is credited to the ‘Discontinued Pension Policy Fund’ and it is refunded upon completion of the lock-in period.

Upon surrendering the policy after the lock-in period of 5 years, the Fund Value (including top-up fund value) as on the date of surrender is payable immediately.

Compulsorily, you need to use the surrender value in one of the following two ways:

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 30 Years | 73 Years |

| Age at Vesting | 37 Years | 80 Years |

| Policy Tenure* | 7 Years | 30 Years |

| Premium Paying Term (PPT) | Single, 5 Years (regular/limited Pay) | Equal To Policy Tenure |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Regular Premium Amount | For Regular/Limited Premium Payment: Rs 50,000 To 15,000 (annually), Rs 37,500 To 11,500 (semi Annually), Rs 25,000 To 8,000 (quarterly), Rs 9,500 To 3,000 (monthly) (It Varies Depending On Premium Payment Term Chosen) For Single Premium Payment: Rs 1 Lac (7 To 10 Years Policy Term) & Rs 50,000 (11 Years & Above) | No Limit |

| Top-up Premium | Rs 5,000 | No Limit |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Online | - |

No rider can be opted under this plan.

Premium Allocation Charges: This charge is deducted from the premium paid. For regular/limited premium payment option, it is 8.5%/5.7% for 1st policy year/2nd to 5th policy year, respectively. For single premium payment option, it is 4% for 1st policy year. The premium allocation charge for top-ups is 2%.

Policy Administration Charge: For Regular/Limited Premium Payment option, charge for the first five years and 1.7% per annum of annualized premium from the 6th policy year capped to Rs 6000. This charge is deducted at each monthly anniversary by cancelling units at the prevailing unit price.

For Single Premium Payment option, 0.8% p.a. of the single premium for the first five years, 0.38% p.a. of the single premium from the 6th policy year, inflating @ 5% p.a on every policy anniversary. The charges are capped to Rs 6000 per year.

Mortality Charges: Mortality Charge is deducted at each monthly anniversary by cancellation of units. It is applied on Sum at Risk based on the age of the life insured.

Fund Management Charges: Fund management charge is 1.25% p.a for Pension Builder Fund and 0.50% p.a for Discontinued Pension Policy Fund. Fund Management Charge up to a maximum of 1.35% per annum of NAV for the Pension Builder Fund and 0.50% p.a. for the Discontinued Pension Policy Fund.

Guarantee Charge: It is 0.25% per annum of the fund value & top-up premium fund value. It is adjusted in the unit price. Guarantee charge up to a maximum of 0.50% per annum of the NAV.

Discontinuance Charge: This charge is levied, in case the policy is discontinued during the first 4 policy years. This charge is levied as applicable under the policy terms & conditions. For more details, please refer the policy brochure.

Miscellaneous Charge: In case of change in premium paying term or alteration of premium frequency, Rs 100 per transaction is levied. Miscellaneous charge up to a maximum of Rs 200 per transaction.

Service Tax: Any service tax/cess on charges will be debited by cancellation of units.

The premium payment under section 80CCC and commutation amount under section 10(10A) are available for deduction under the Income Tax Act, 1961.

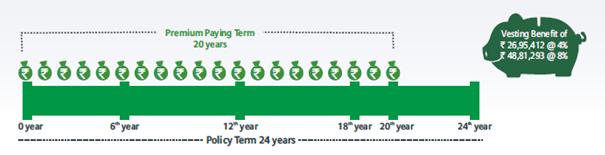

Mr. Subhash aged 35 years, opts for Bajaj Allianz Retire Rich with the policy term of 24 years, premium paying term of 20 years, annual premium of Rs 1,00,000 and the vesting benefit may be Rs 26,95,412 at 4% and Rs 48,81,293 at 8% investment return, respectively.

Scenario A- Vesting Benefit

The higher of Guaranteed Vesting Benefit or total Fund Value as on the vesting date is payable. Vesting benefit may be Rs 26,95,412 at 4% and Rs 48,81,293 at 8% investment return, respectively.

Scenario B- Death Benefit:

On unfortunate demise of Subhash before the vesting date, the death benefit payable to the nominee is higher of the Fund Value as on the date of intimation of death or the Guaranteed Death Benefit. On subhash’s death during the 8th policy year, his nominee may receive Rs 8,40,000 at 4% and Rs 10,00,835 at 8% investment return, respectively.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing