You always want to have an assured income long after you’re retired. Bajaj Allianz Pension Guarantee is a non-linked & non-participating immediate annuity plan that ensures you a regular guaranteed income so, you can live a worry-free life after retirement.

Get QuotesThe immediate annuity options available are:

Option A- Life Annuity

The annuity is paid to the annuitant as long as he/she is alive. On death of the annuitant, any outstanding annuity installment on the date of death is payable to the nominee/legal heir.

Option B- Life annuity with Return of Purchase Price

The annuity is paid to the annuitant as long as he/she is alive. On death of the annuitant, the purchase price and any outstanding annuity installment on the date of death is payable to the nominee/ legal heir.

Option C- Annuity Certain for period 5 years, 10 years, 15 years, 20 years and life there after

The annuity is paid to the annuitant as long as he/she is alive. On demise of the annuitant prior to expiry of the chosen period, annuity is paid to the nominee/legal heir for the remaining chosen period. On the unfortunate demise of the annuitant after the expiry of the chosen certain period, any outstanding annuity installment as on the date of death is payable to the nominee/legal heir.

Option D- Joint Life Last Survivor with 50% of annuity to spouse

The annuitant and his/her spouse are covered under the policy. The annuity is paid to the annuitant as long as he/she is alive. On death of the annuitant, if the spouse is alive, any outstanding annuity installment as on the date of death is payable and 50% of the annuity installment is payable to the spouse, as long as the spouse is alive.

On the death of the spouse if annuitant is alive, there is no change in the annuity payment. On the death of the spouse after the death of the annuitant, any outstanding annuity installment as on the date of death of the spouse is payable to nominee/ legal heir.

Option E- Joint Life Last Survivor with Return of Purchase Price on death of Last Survivor (100% of annuity to spouse)

The annuitant and his/her spouse are covered under the policy. The annuity is paid to the annuitant and/or spouse as long as at least one of them is alive. On the first death, there is no change in the annuity payment. On death of the last survivor, the purchase price plus any outstanding annuity installment as on the date of death of the last survivor will be paid to the nominee/ legal heir.

Option F- Joint Life Last Survivor with 100% of annuity to spouse

The annuitant and his/her spouse are covered under the policy. The annuity is paid to the annuitant or spouse as long as at least one of them is alive. On death of the annuitant, if the spouse is alive, any outstanding annuity installment as on the date of death of the annuitant is payable and 100% of the annuity installment is payable to the spouse, as long as the spouse is alive.

On death of the spouse if annuitant is alive, there is no change in the annuity payment. On death of the spouse after the death of the annuitant, any outstanding annuity installment as on the date of death of the spouse is payable to the nominee/legal heir.

No bonus can be availed under this policy, as it is a non-participating insurance plan.

No loan amount is available under this plan.

You can avail tax benefits under section 80C & 10 (10D) of the Income Tax Act. Tax benefits are applicable, as per the prevailing tax laws.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 37 Years For Option D, E & F: 37 Years For Option A, B & C: 0 Years Under Options D, E & F: 18 Years | 80 Years For Option D, E & F: 80 Years Under Options D, E & F: 100 Years |

| Purchase Price | Rs 25,000 | No Limit |

| Annuity Per Installment | Rs 1,000 | No Limit |

| Annuity Payment Frequency | Annually, Semi Annually, Quarterly & Monthly | - |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Plan Type | Online | - |

No rider can be opted under this plan.

Let’s understand this plan with the help of below illustration:

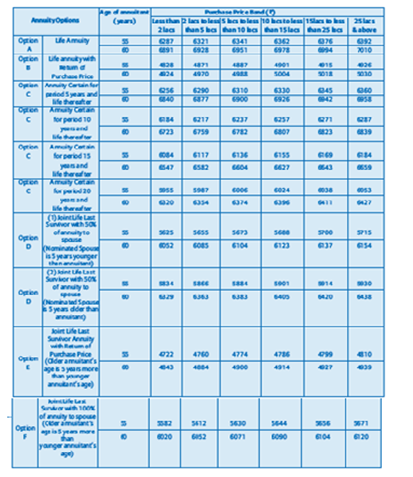

Given below is the sample annuity rate per annum per Rs 1 lac of purchase price for different purchase price bands.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing