Bajaj Allianz Save Assure is a non-linked, non-participating individual limited premium guaranteed return endowment plan that ensures your & your family’s protection. The plan offers guaranteed 115% of the sum assured as maturity/death benefit which is payable under the policy benefits.

Get QuoteDeath Benefit

In the event of death of the life insured during the term of the policy, the sum assured chosen is payable to the nominee, provided all due premiums have been paid in full.

Maturity Benefit

In case of survival of the life insured till maturity of the policy term, 115% of the sum assured chosen is payable, provided all due premiums have been paid.

Death/maturity benefit can be taken in monthly installments for 5 or 10 years from the date of intimation of death/date of maturity.

For 5 years, 1.04 * maturity/death benefit divided by 60

For 10 years, 1.08 * maturity/death benefit divided by 120

Loan Benefit

Loan amount up to 90% of the surrender value can be availed under this policy, provided 3 full policy years’ premiums have been paid.

Surrender Value

Surrender Value becomes applicable on payment of at least 3 full policy years’ premiums. Surrender Value is higher of Guaranteed Surrender Value and Special Surrender Value.

Tax Benefit

Premiums paid under this policy are eligible for tax benefits under section 80C & maturity benefit/death benefit/surrender value can avail tax benefits under section 10 (10D) of the IT Act, 1961.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | Adult: 18 Years, Child: 1 Year | 60 Years |

| Age at Maturity | 18 Years | 75 Years |

| Policy Tenure | 15 Years | 17 Years |

| Premium Paying Term | Policy Tenure Less 5 Years | - |

| Premium Paying Mode | Monthly, Quarterly, Semi Annually & Annually | - |

| Premium Amount | Policy Term 15 Years- Rs 8140 (annually) Policy Term 17 Years- Rs 6620 (annually) | No Limit (subject To Underwriting) |

| Sum Assured | Rs 1 Lac | No Limit (subject To Underwriting) |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Online | - |

Bajaj Allianz Accidental Death Benefit Rider, Bajaj Allianz Accidental Permanent Total/Partial Disability Benefit Rider, Bajaj Allianz Critical Illness Benefit Rider, Bajaj Allianz Family Income Benefit Rider, & Bajaj Allianz Waiver of Premium Benefit Rider are available under this plan.

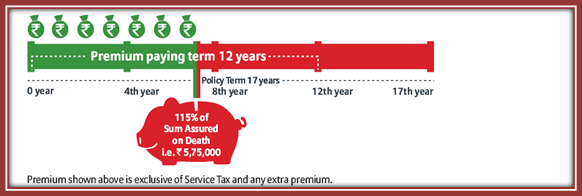

Age of Life Insured: 30 years

Policy Term Chosen: 17 years

Sudesh (life insured) has chosen the sum assured of Rs 5 Lacs on paying the annual premium of Rs 30,065 with premium paying term of 12 years. At policy maturity, he will receive 115% of 5 lacs, i.e., Rs 5.75 Lacs.

In the event of unfortunate demise of Sudesh during the 7th policy year, his nominee is entitled to receive 115% of Rs 5 Lacs which is Rs 5.75 Lacs.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing