Bajaj Allianz Life Income Assure is a non-linked, participating, limited premium payment, monthly income endowment plan. This endowment plan protects your family in case of a mishap and also guarantees a regular monthly income for you & your family. This plan helps you to achieve financial freedom.

It comes with two different variants, including

Death Benefit

If all premiums are paid in full, in the event of the demise of the life insured during the term of the policy, the death benefit payable is higher of sum assured on death plus vested bonus plus terminal bonus or 105% of total premiums paid.

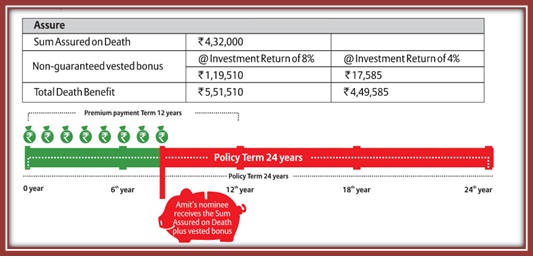

Under Income variant, vested bonus plus terminal bonus is payable immediately on death. Sum assured on death is payable to the nominee as monthly income for 144 equal monthly installments and it begins from the date of death of the life insured. The policy will cease on payment of 144th monthly installment.

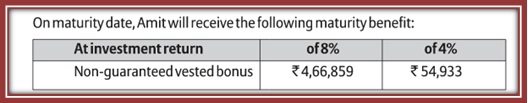

Under Assure variant, the death benefit is payable as a lump sum and the policy will terminate on the death of the life insured.

Maturity Benefit

If the life insured survives at the maturity date of the policy provided policy is in-force, vested bonus plus terminal bonus is payable.

Survival Benefit

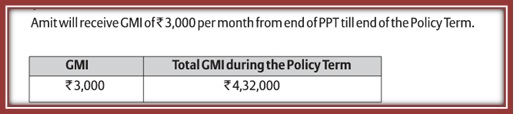

In case the life insured survives at the end of the premium payment term, Guaranteed Monthly Income (GMI) is payable every month for the next 144 months, which starts from the end of the premium payment term. If the life insured dies during the survival benefit payout period, GMI is stopped immediately.

Any amount paid towards GMI during the date of death to the date of intimation is deducted from the death benefit.

Loan Benefit

No loan benefit can be availed under this policy.

Surrender Value

Surrender value is payable on payment of at least 2/3 full policy years’ premiums when premium paying term is less than 10 years/premium paying term is 10 years or more, respectively. Surrender Value is higher of guaranteed surrender value and special surrender value.

Tax Benefit

Premiums paid is eligible for tax benefit under section 80C & Maturity/survival/surrender/death benefit can also avail tax benefit under section 10 (10D) of the Income Tax Act.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 0 Year (Risk Cover Commences Immediately On Issuance Of The Policy And, In The Case Of A Minor, Policy Will Vest On The Life Assured On The Earlier Of Attainment Of Majority, I.e., 18 Years And On Maturity Date.) | 50 Years |

| Age at Maturity | 18 Years | 74 Years |

| Policy Tenure | 17/19/22 Years | 24 Years |

| Premium Paying Term | 5/7/10/12 Years | - |

| Premium Paying Mode | Annually & Monthly | - |

| Premium Amount | Income Variant- Rs 21965 (annually), Rs 1977 (monthly) Assure Variant- Rs 22058 (annually), Rs 1985 (monthly) | As Per The Maximum Sum Assured |

| Sum Assured | 144*Guaranteed Monthly Income Opted | No Limit (subject To Underwriting) |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

Bajaj Allianz Accidental Death Benefit Rider, Bajaj Allianz Accidental Permanent Total/ Partial Disability Benefit Rider, Bajaj Allianz Critical Illness Benefit Rider, Bajaj Allianz Family Income Benefit Rider, Bajaj Allianz Waiver of Premium Benefit Rider are available under this plan.

Age of Life Insured: 30 years

Policy Term Chosen: 20 years with premium paying term of 12 years

Amit (life insured) chooses Guaranteed Monthly Income (GMI) of Rs 3,000 per month and the Sum Assured becomes Rs 4,32,000. The premium amount will be Rs 31,788 per annum (Income variant) and Rs 32,211 per annum (Assure variant).

In the event of death of Amit at the end of 8th policy year, the nominee is entitled to receive the death benefit as depicted below.

Please Note: Premium shown above excludes any extra premium, service tax, cess, & rider premium. The returns are indicated @ 4% and 8% and these rates of return are not guaranteed and are not the lower or upper limits of returns.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing