Aviva Next Innings is a non-linked & non-participating deferred pension plan that helps you build a guaranteed lump sum, so you can enjoy a comfortable lifestyle after the retirement. A lump sum under this plan enables you to get a regular income throughout your post retirement life.

Get QuotesIn case of unfortunate demise of the life insured within the policy term, the death benefit payable to the nominee is the higher of premiums paid plus interest of 6% p.a compounded annually or 105% of the total premiums paid till the date of death.

The nominee has the option to either purchase the annuity at the prevailing annuity rates or to withdraw the entire proceeds.

In case of survival of the life insured till vesting date, the benefit payable is equal to 210% of the premiums paid.

Amount received as a maturity benefit can be used in one of the following ways:

A policyholder can take up to 1/3rd of the benefit as tax-free lump sum as per the prevailing income tax regulations. The rest of the amount shall be used to purchase an annuity at the then prevailing annuity rates.

You will have the option to reinstate the policy with-in 2 years from the date of first unpaid premium by paying all the due premiums plus interest on delayed premiums at the rate of 9% p.a compounded monthly along with the revival fee of Rs 250 plus taxes.

In case, the premium/s is not paid before completion of grace period, no benefit is payable and the policy is lapsed.

You will have the option to revive the paid-up policy with-in 2 years from the date of first unpaid premium by paying all the due premiums plus interest on delayed premiums at the rate of 9% p.a compounded monthly along with the revival fee of Rs 250 plus taxes.

Alterations between semi-annually to annually frequency or vice versa is allowed. An alteration charge of Rs 100 is applicable.

No bonuses are payable, as it is a non-participating pension plan.

No loan is available under this policy.

A single premium policy can be surrendered anytime from 2nd policy year onwards. A limited premium policy can be surrendered anytime after payment of at least 2 policy years’ premiums. The surrender value payable is the higher of Guaranteed Surrender Value or Special Surrender Value.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 42 Years | 60 Years |

| Vesting Age | 55 Years | 78 Years |

| Policy Term | 13/16/18 Years | - |

| Premium Payment Term | Single & Limited Pay Term (5/10 Years) | - |

| Premium Amount | Rs 50,000 Per Annum (limited Pay), Rs 1,50,000 (single Premium) | Rs 5,00,00,000 Per Life |

| Premium Paying Mode | Single, Annually, Semi Annually & Monthly | - |

| Freelook Period | 15 Days From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

No rider can be opted under this plan.

This policy provides tax benefits as per section 80C & 10(10A)(iii) under the Income Tax Act, 1961. The tax benefits are applicable, subject to prevailing tax laws.

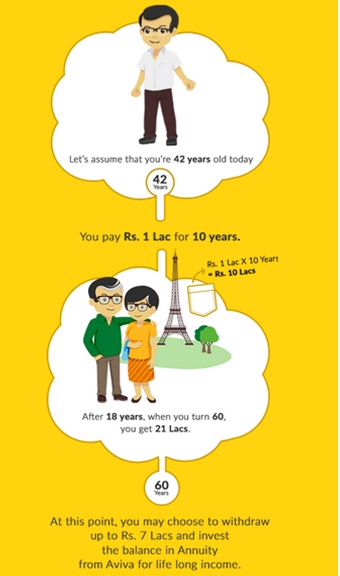

Mr. Rai aged at 42 years wants to accumulate a corpus that can help him to get a regular income after the retirement. He decides to buy ‘Aviva Next Innings’ with the policy term of 18 years, premium payment term of 10 years, and annual premium invested is Rs 1,00,000.

Scenario A: On survival of Mr. Rai

In case of survival of the life insured till vesting date, the benefit payable is equal to 210% of the total premiums paid, excluding extra premium & taxes.

Scenario B: On demise of Mr. Rai

On the unfortunate death of Mr. Rai, the higher of premiums paid plus interest of 6% p.a compounded annually or 105% of the total premiums paid till the date of death, is payable to the nominee.

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing