Aegon Life Rising Star Insurance Plan is a unit linked insurance plan that helps fulfill your children’s needs and aspirations. By systematically managing your investment, this plan leading to a more secure future for your children.

Get QuotesThis policy offers 4 investment funds and you have the option to invest in any one or combination of fund options.

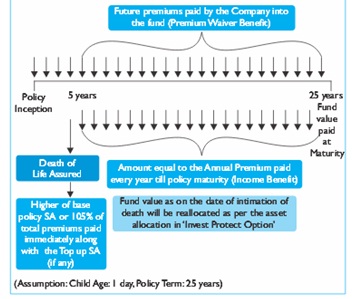

In the event of death of the life assured while the policy is in-force, the following Death Benefit is payable.

This option provides you a flexibility to increase the sum assured during the policy term, subject to underwriting rules. This option cannot be exercised during the revival period.

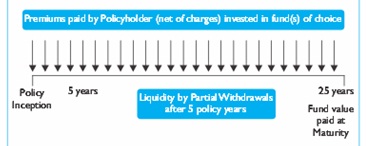

On survival of the life insured till the end of the policy term, the Total Fund Value (including top-up fund value) is payable on the maturity date. You can receive this benefit as a lump sum or structured payout by using ‘Settlement Option’.

On maturity, you can opt to receive your money in installments over a maximum period of 5 years, after the date of maturity. It provides you an option to remain invested in funds beyond the policy maturity date.

You have the option to withdraw the entire fund value during the settlement period. Only fund management charge is levied during this period. You can exercise this option by intimating the company at least 90 days prior to the Date of Maturity.

Upon choosing Invest Protect Option, it helps you gain from your investment plus minimizes the risk to your returns as your policy approaches to maturity. It protects your money by systematically shifting your money from Accelerator Fund to Secure Fund during the last 3 policy years.

When not opted for invest protect option, the policyholder needs to choose the allocation proportions for unit linked funds available under this policy.

At the end of every policy year, it automatically rebalances the allocation of your investments in various funds as per the allocation proportions opted by you. It is free of cost when opted at the policy inception.

A top-up premium is an additional amount of premium over and above the basic premiums. Facility for Top-up Premium is available through the entire policy term, except the last 5 policy years. The minimum amount of top-up premium allowed is Rs 5,000. The total top-up premium should not exceed the total premiums paid. Payment of top-up premium enhances your insurance cover. Top-ups allow you to boost the fund value.

Top up premium increases the sum assured by 1.25/1.10 times the top up amount, if the age at entry is below 45 years/45 years and above, respectively. The policyholder has the option of selecting top-up sum assured up to 10 times the top-up amount. The Top-Up death benefit is at least 105% of the Top-Up premiums paid.

Switching can be done among 4 available fund options to suit your changing investment needs.

Premium Re-direction facility is available to alter future premium allocation and it will apply to your subsequent premiums.

Partial Withdrawal is allowed from 6th policy year onwards (in case of minor lives, the life assured attains 18 years). The maximum partial withdrawal allowed in a policy year is up to 20% of the fund value at the beginning of that policy year. The minimum amount of any partial withdrawal should not be less than Rs 5,000. The minimum fund value required after each withdrawal should be an amount equal to 2 years’ annualized premium.

You have an additional flexibility as Systematic Partial Withdrawal by which company redeem units periodically from your unit account and credit the money to your bank account. You can opt for systematic partial withdrawal frequency as monthly, quarterly or annually for the duration you choose. The minimum installment value of your systematic partial withdrawal should be Rs 2,000. Systematic Partial Withdrawal is available under the ECS facility only.

This plan is not eligible for the bonuses.

No loan benefit can be availed under this plan

Upon surrendering the policy with-in the lock-in period of 5 years, the Fund Value less applicable discontinuance charges is credited to the ‘Discontinuance Policy Fund’ and it is refunded upon completion of the lock-in period. The applicable fund management charge of the Discontinuance Policy Fund is levied. The proceeds after addition of minimum guaranteed interest rate of 4% p.a or as stipulated by IRDAI is payable after the end of the lock-in period.

Upon surrendering the policy after the lock-in period of 5 years, the Fund Value as on the date of surrender is payable immediately and the policy then terminates.

| Factor | Minimum | Maximum |

| Age (as on last birthday)* | 18 Years | 48 Years |

| Age at Maturity | - | 65 Years |

| Policy Tenure | 25 Years Less Age At Entry Of The Child | - |

| Premium Paying Term (PPT) | Equal To Policy Tenure | - |

| Premium Paying Mode | Annually, Semi Annually & Monthly | - |

| Annualized Premium Amount | Rs 20,000 (annually), Rs 30,000 (semi Annually & Monthly) | - |

| Sum Assured on Death | Age At Entry Less Than 45 Years- 10 Times Of Annualized Premium Or 0.5 * Policy Term * Annualized Premium Age At Entry 45 Years & Above- 7 Times Of Annualized Premium Or 0.25 * Policy Term * Annualized Premium | Age At Entry Less Than 45 Years- 18 Times Of Regular Annualized Premium Age At Entry 45 Years & Above- 10 Times Of Regular Annualized Premium |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

No rider can be opted under this plan.

Premium Allocation Charges: The premium allocation charge is 4.40%/3%/2%/1% for the 1st policy year/2nd to 5th policy year/6th to 10th policy year/11th policy year onwards, respectively. Top-up premium allocation charge is 3%.

Policy Administration Charge: The Policy administration charge is Rs 60 per month and it is deducted at the beginning of every policy monthly anniversary by cancelling appropriate units. This charge increases at 3% per annum at the start of every policy year from the second policy year onwards, subject to a maximum of Rs 500 per month.

Mortality Charges: Mortality charge is applicable for providing the risk cover and it is the sum of base mortality charge, premium waiver benefit mortality charge and income benefit mortality charge. It is deducted by cancellation of Units at the prevailing Unit Price at the beginning of each month of your policy.

Fund Management Charges: Fund management charge levied is a percentage of the Fund Value. It is 1.35% p.a. for Accelerator Fund & Stable Fund, 1.10% p.a for Debt Fund, 1% p.a for Secure Fund, 0.50% p.a for Discontinuance Policy Fund. The Fund management charges of all funds except Discontinuance Policy Fund may be revised up to a maximum of 1.35% p.a upon prior approval from IRDAI.

Auto Rebalancing: Rs 200 for addition/removal, when opted after inception of the policy.

Switching Charge: Switching up to 4 times in a policy year is free of charge. Each subsequent switch in the same policy year is charged as higher of Rs 100 or 0.1% of the amount switched, subject to a maximum of Rs 500.

Premium Re-direction: 2 free premium redirections are allowed during a policy year. Rs 200 is levied per additional redirection request.

Partial Withdrawal Charge: 4 free partial withdrawals are allowed during a policy year. The subsequent withdrawals in the same policy year is charged at Rs 200. No charge is levied for systematic partial withdrawal. The switching/premium re-direction/partial withdrawal charges may be revised upon prior approval from IRDAI, but up to a maximum of Rs 500.

Discontinuance Charge: This charge is levied, in case the policy is discontinued during the first 4 policy years. This charge is levied as applicable under the policy terms & conditions. For more details, please refer the policy brochure.

Taxes: The charges mentioned under this plan are subject to applicable tax and cess, as applicable.

Tax benefits can be availed under section 80C & 10 (10D) under the Income Tax Act, subject to change in tax laws.

Mr. Mahesh aged 35 years, is leading a happy life with his wife ananya and a daughter sanya. He wants to build a corpus amount, so his family can achieve their dreams such as sanya’s education, her marriage, etc. He also wants to ensure financial security of the family, in case of a mishap. He thus opts for Aegon Life Rising Star Insurance Plan with the policy term of 25 years, annual premium of Rs 50,000 and sum assured of Rs 10,00,000. He also opts for the Invest Protect Option.

Scenario A- Maturity Benefit: In case of his survival till maturity of the policy, the Total Fund Value (including top-up fund value) is payable on the maturity date. You can receive this benefit as a lump sum or structured payout by using ‘Settlement Option’.

Scenario B- Death Benefit: In the event of his death during the policy term, the nominee will receive the Sum Assured plus premium waiver benefit & Income Benefit. He will also receive the Fund Value at the policy maturity.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing