What is SIP Investment – How does SIP Work?

A Systematic Investment Plan (SIP) is the best for those who want to multiply their wealth efficiently. In simple terms, a SIP refers to a plan in which you invest a fixed amount of money into a mutual fund scheme at fixed intervals, for a specific duration of time. In this type of investment, you have the flexibility to change the value of the installment, stop/start the investment, etc.

Let’s understand the concept of SIP with the help of an illustrative example

Mr. Rakesh wants to invest Rs 30,000 in a mutual fund, but he does not have that much amount ready to invest. He can invest Rs 2,500 per month to invest for the next year. By investing every month, he will be able to fulfill the financial goals. By investing a fixed sum of money over a period of time into a mutual fund will help you to earn high returns on the invested amount.

Table Content

How Does SIP Work?

Under a Systematic Investment Plan, you invest a certain amount of money which is set at a minimum of Rs 500 and you can invest as much as you can to receive high returns over a period of time and fulfill your specific financial goals. In SIPs, your money is invested in a mutual fund scheme to grow your investments. When you invest in it for the long term, you will be able to take advantage of the power of compounding to get high returns on investment.

Key Reasons to Invest in SIP

There are various reasons to go for investing in mutual funds through SIP.

Rupee Cost Averaging

Rupee Cost Averaging refers to an approach when you invest a fixed sum of money at regular intervals. With this approach, you get more mutual fund units when buying at a low price and fewer units will be allotted when buying at a high price.

By investing in a fixed duration, you don’t need to figure out just the right time to invest in a SIP. The Rupee Cost Averaging averages out the cost of your units and thus resulting in less impact of short-term market fluctuation on your investments.

For Instance, Aayush decides to make a SIP investment of Rs 1,000 per month for 12 months. Aarav, another investor makes a one-time investment by buying units for Rs 12,000 at the ongoing NAV.

Let’s look through the tabular representation to understand who is going to end up with a lower cost per unit after 6 months period.

| Month | NAV (Rs) | Monthly Investment Made (Rs) | No. of Units

| Average Cost Per Unit | One Time Investment made in a Mutual Fund (Rs) | No. of Units | Average Cost Per Unit |

| 1st | 15 | 1000 | 67 | Rs 12.75 per unit | 12,000 | 800 | Rs 15 per unit |

| 2nd | 10 | 1000 | 100 | ||||

| 3rd | 12 | 1000 | 83 | ||||

| 4th | 13 | 1000 | 77 | ||||

| 5th | 14 | 1000 | 71 | ||||

| 6th | 12 | 1000 | 83 | ||||

| 7th | 11 | 1000 | 91 | ||||

| 8th | 14 | 1000 | 71 | ||||

| 9th | 13 | 1000 | 77 | ||||

| 10th | 12 | 1000 | 83 | ||||

| 11th | 15 | 1000 | 67 | ||||

| 12th | 14 | 1000 | 71 | ||||

| Total | 12,000 | 941 |

From the above table, you can see that Aayush will enjoy a gain of Rs 2.25 per unit over Aarav. Aayush made a smart move by investing consistently over a period of time that leads to averaging of the market fluctuations and this effect makes SIP an attractive investment option.

Power of Compounding

The Power of Compounding gives you the benefit to earn interest on the returns out of your invested money. You will get the benefit of the power of compounding when you keep investing over a long horizon. With successive investments over the investment term, the entire invested money keeps on growing.

For Instance, If Mr. Aarush started investing Rs 1000 a month on your 40th birthday, in 20 years’ time you would have put aside Rs 2.4 Lacs. If that investment grew by an average of 12% a year (compounded annually), it would be worth Rs 9.68 Lacs at the age of 60.

However, if he started investing 10 years earlier at an age of 30 years, your Rs 1000 each month would add up to Rs 3.6 Lacs over 30 years. Assuming the same average annual growth of 12%, you would have Rs 32.43 Lacs on your 60th birthday.

| Invested Amount | Investment Tenure | Rate of Interest | Total Invested Amount | Total value at Maturity |

| Rs 1,000 | 20 years | 12% | 2.4 Lacs | 9.68 Lacs |

| Rs 1,000 | 30 years | 12% | 3.6 Lacs | 32.43 Lacs |

From the tabular representation, you can see that the total worth of your invested money gets over three times the amount when invested for 30 years rather than you had invested for 20 years!

Risk Management

With SIP investment, you have the option to invest small amounts on a monthly basis and you can stop investing at any time. You can simply withdraw the money from the non-performing mutual fund and invest in a well-performing fund to optimize the returns.

Budgeting

The importance of having proper financial planning is quite enormous. When it comes to investing, you need to follow the strict monthly budgeting that will facilitate you to earn huge amounts by regularly investing a little amount.

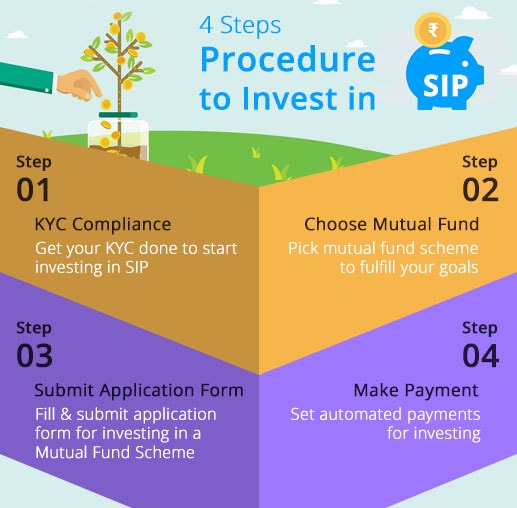

Procedure to Invest in SIP:

A lot of people are seeking to invest in SIPs to generate higher returns, but they don’t have an idea about how to start with. The following are the four simple steps by which you can start investing.

Step 1: Get KYC Compliance

The first step towards investing in SIPs is to get the Know Your Customer (KYC) completed. You need to submit certain documents to ascertain verification of identity and address, Financial Status, and Occupation to any licensed intermediary such as camskra or any Asset Management Company (AMC). For investing in SIPs, you need to become KYC compliant.

Step 2: Choose Mutual Fund

Don’t just pick the funds just as suggested by your broker. The broker is more likely to sell you the high-cost funds. There are various mutual fund schemes and it’s important to choose the best one for you. In order to grow your money with SIP Investment, you may choose equity mutual funds with a growth plan or choose mutual funds as per your risk appetite. It’s also important to choose a portfolio of mutual funds, which can help fulfill your future goals.

Step 3: Submit Application Form

Once you are KYC compliant and have decided the mutual fund scheme you want to invest in, you need to submit the duly-filled combined KIM & application form to begin investing in SIP. In this form, you need to provide personal information, investment details, bank details, etc.

Step 4: Make Payment

Once you are KYC compliant and have decided on the mutual fund scheme you want to invest in, you need to decide on the duration of the SIP. For making payments towards investment, you need to set automated payments with a standing instruction to intermediary/mutual fund company and the money gets auto-debited on the investment date for SIP investment.

Benefits of Systematic Investment Plans:

- Capital Gains: The power of compounding and Rupee-cost averaging are the key mechanisms that help a SIP investment to gain attractive returns when invested for a longer period.

- Flexibility: Although it is advisable to invest in SIP with a long-term perspective, it is not a compulsion. An investor has the flexibility to invest in smaller amounts and can also increase/decrease the investment amount.

- Convenience: For making a SIP investment, you can issue a standing instruction to the bank, so the investment amount can get auto-debited every month.

- No Loading on Entry/Exit: In case, investment in SIP doesn’t work in your favor, you can stop making further investments. You can withdraw the entire amount from your SIP account without incurring a penalty.

- Keeps you Stress-Free: Unlike a mutual fund, in a SIP investment, you don’t need to understand the know-how of the market. There are money market experts who will ensure that your invested money can earn higher returns.

Conclusion:

Systematic Investment Plan (SIP) requires you to invest a fixed amount at regular intervals. By regular investing, you can take advantage of “Rupee-Cost Average” which averages out the cost of purchase of units & the power of compounding helps you to enhance returns on your invested money. If you are seeking to obtain better returns, it is advised to start investing early and keep it for a longer time.

This article is really a good one it helps new internet people, who are wishing in favor of

blogging.

Thanks for posting this informative blog. You have explained very well on how one can invest in SIP because many of us don’t know the right procedure of investing. SIP, Systematic Investment Plan allows investor to deposit fixed amount of money at predefined intervals. When you start investing through it you get many benefits and one is power of compounding which helps you to grow your wealth.