Top 5 ULIP Funds to Invest in 2023

ULIP (Unit Linked Insurance Plan) is a market-linked insurance product that provides a combination of investment and life cover. With an investment option, you have the flexibility to invest with a number of ULIP funds to maximize your investments. With the life cover, the insurance company pays a sum assured to the nominee, in the event of your demise during the policy term. A ULIP plan thus proves as a vital investment instrument towards achieving the goals.

With a ULIP investment, you are set to achieve medium to long-term financial goals. A ULIP policy also provides you a flexibility to switch your money between fund options to adapt to your financial goals and risk appetite.

Investing with a right ULIP plan is the key, so we are here to provide you the details for the top 5 ULIP funds you can invest in 2023.

Table Content

Top 5 ULIPs Funds Performance Growth 2023

Here is the snapshot of the performance growth of the top 5 funds mentioned, in this blog

| S. No | Funds Name | 1 year | 3 years | 5 years |

|---|---|---|---|---|

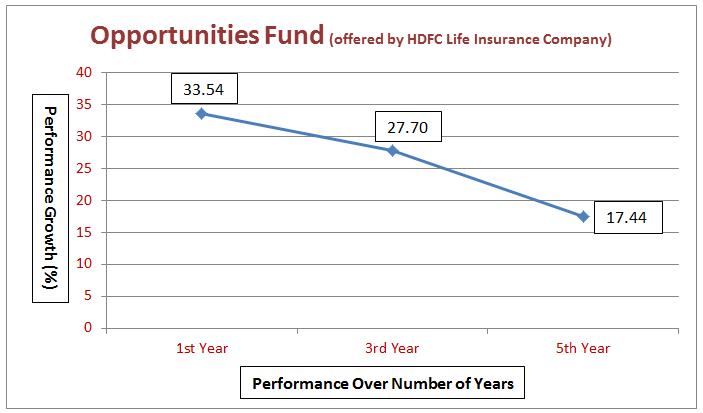

| 1. | HDFC Life- Opportunities Fund | 33.54% | 27.70% | 17.44% |

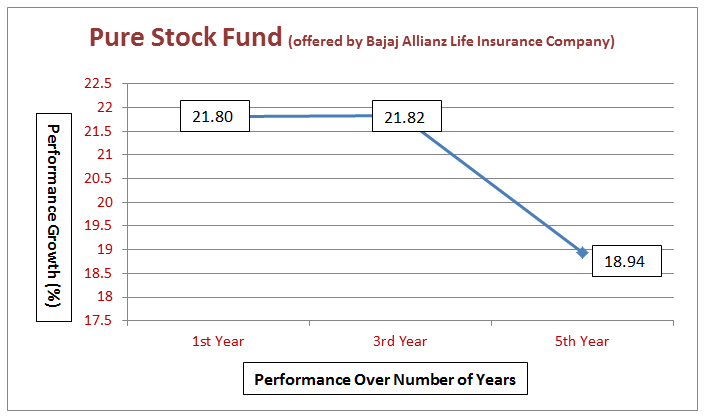

| 2. | Bajaj Allianz Life- Pure Stock Fund | 21.80% | 21.82% | 18.94% |

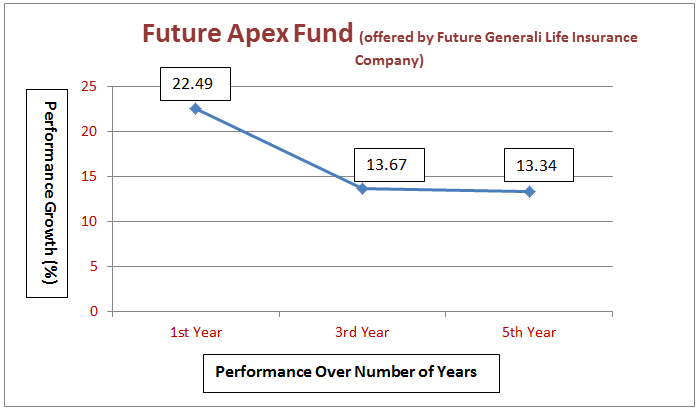

| 3. | Future Generali Life- Future Apex Fund | 22.49% | 13.67% | 13.34% |

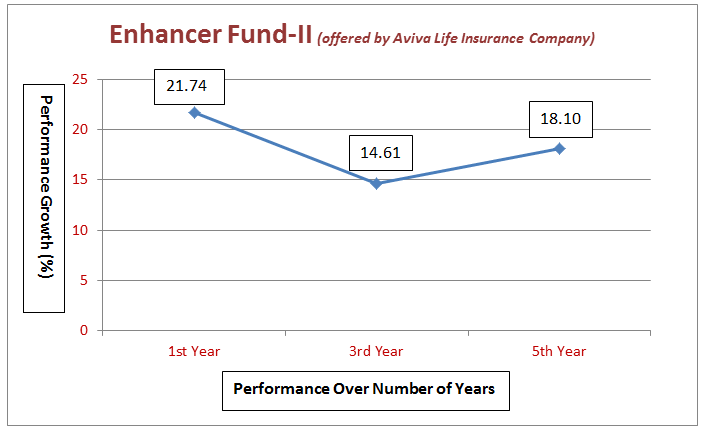

| 4. | Aviva Life- Enhancer Fund-II | 21.74% | 14.61% | 18.10% |

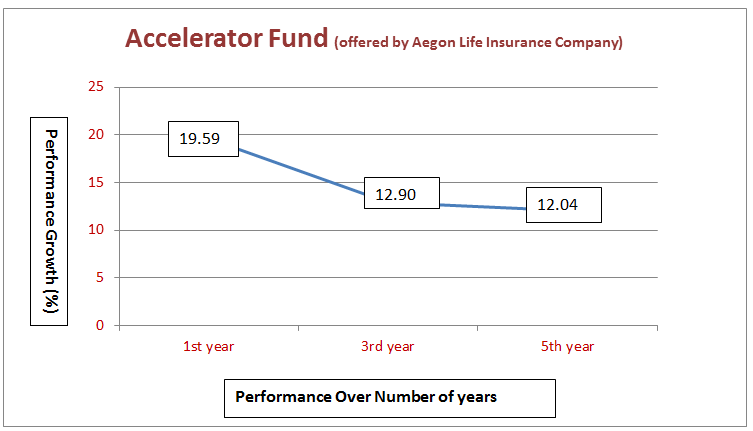

| 5. | Aegon Life- Accelerator Fund | 19.59% | 12.90% | 12.04% |

1) HDFC Life – Opportunities Fund

Opportunities Fund is one of the best performing funds offered by HDFC Life. Last year, this fund provided the absolute returns of 33.54%. So, by investing in this fund helps you to maximize the investments. The Fund Management Charge for this fund is 1.35% p.a of the Fund Value, levied daily.

The portfolio allocation under this fund is Equity: 80% to 100%, Money market instruments, Cash Deposits & Liquid Mutual Fund: 0% to 20%.

If you want to get higher returns with this fund option, you need to choose any of the following HDFC Life ULIP plans.

- HDFC Life Click2Invest Plan

- HDFC SL ProGrowth Maximiser – Single Premium ULIP Plan

- HDFC SL Crest Plan

- HDFC Life ProGrowth Plus Plan

- HDFC Life ProGrowth Super II Plan

- HDFC SL ProGrowth Flexi Plan

- HDFC Life Smart Woman Plan

- HDFC Life Sampoorn Nivesh Plan

These plans allow you to switch between fund options, depending on the risk appetite and financial goals.

2) Bajaj Allianz Life – Pure Stock Fund

Pure Stock Fund from Bajaj Allianz Life has registered the return of 21.80% during the last one year. To obtain high returns, you need to invest with Bajaj Allianz ULIP Plans. The Fund Management Charge for this fund is 1.35% p.a of the Fund Value.

The portfolio allocation under this fund is Equity: not less than 60%, Bank Deposits: 0% to 40%, Money market instruments, Cash, & Mutual Funds: 0% to 40%.

In order to invest in this fund, you can opt for any of the following Bajaj Allianz Life ULIP plans.

- Bajaj Allianz Future Gain

- Bajaj Allianz Fortune Gain

By investing with the ULIP plans from Bajaj Allianz Life, you can take advantage of key features such as flexible allocation of funds, switching and premium redirection, etc.

3) Future Generali Life-Future Apex Fund

If you are looking to buy a ULIP plan, you can consider investing with Future Apex Fund available with Future Generali Life plans. Last year, this fund has provided a return of 22.49%. To obtain these sorts of returns, you can invest with Future Generali Life ULIP plans. The Fund Management Charge for this fund is 1.35% p.a of the Fund Value.

The portfolio allocation under this fund is Equity Instruments: 50% – 90%, Fixed Income Including Cash and Money Market Investments: 10% – 50%.

To invest with this fund option, you can opt for any of the following ULIP plans.

- Future Generali Easy Invest Online Plan

- Future Generali Dhan Vridhi

- Future Generali Wealth Protect Plan

- Future Generali Bima Advantage Plus

- Future Generali Bima Gain

- Future Generali Pramukh Nivesh ULIP

This ULIP plan helps to build your wealth along with the life cover option available.

4) Aviva Life- Enhancer Fund-II

Enhancer Fund-II ensures aggressive, long term capital growth. By choosing this fund with Aviva Life ULIP Plans, you can obtain high ROI along with the benefit of life protection. Enhancer Fund-II from Aviva Life registered the return of 21.74% in the previous year. The Fund Management Charge for this fund is 1.35% p.a of the Fund Value.

The portfolio allocation under this fund is Equity Instruments: 60% – 100%, Money Market Investments: 0% – 40% and Debt Instruments: 0% – 40%.

To invest with this fund option, you can opt for any of the following Aviva Life ULIP plans:

- Aviva iGrowth

- Aviva Affluence

- Aviva Life Bond Advantage

- Aviva Live Smart Plan

Under these ULIP Plans, making partial withdrawals, switching and premium re-direction facility is available.

5) Aegon Life- Accelerator Fund

Accelerator Fund from Aegon Life aims at investing in equities to diversify the portfolio that helps you to generate attractive returns in the long term. This fund also provides you the flexibility to invest in fixed interest assets and money market instruments. The Fund Management Charge for this fund is 1.35% p.a of the Fund Value.

The portfolio allocation under this fund is Equity Instruments: 80% to 100%, Fixed Interest Securities and Money Market Investments: 0% to 20%.

Accelerator Fund provides you the high returns and to invest with this fund option, you can opt for any of the following Aegon Life ULIP plans:

- Aegon Life iInvest Insurance Plan

- Future Protect Insurance Plan

- Future Protect Plus Insurance Plan

- Aegon Life Rising Star Insurance Plan

By investing in these ULIP plans, you can take advantage of investment growth plus insurance protection.

Conclusion

When you are seeking for a ULIPs Investment, it is essential to invest with a ULIP fund that can help you reap higher returns. However, we have listed 5 top ULIP funds to invest in, but it is advisable to search for the top performing funds and allocate the maximum proportion of your investment with fund/s that can help you to create huge wealth, so you can fulfill your investment goals.