Top 10 Health Insurance Companies in India 2023

Top 10 Health Insurance Companies in India 2023

In order to guide customers while buying health insurance. The Insurance Regulatory and Development Authority of India (IRDAI) has been coming out with a list of the top 10 health insurance companies in India every year.

Both General Insurers (private and public) and Specialized Health Insurance companies are authorized to offer health plans to customers, Based on the performances with regard to companies’ those Incurred Claims Ratio (ICR) and their overall financial standing.

Table Content

- Top 10 Health Insurance Companies of India in 2021-22:

- Top Health Insurance Company’s ICR and CSR report.

- 1. HDFC ERGO General Insurance Limited

- 2. Star Health & Allied Insurance Company Limited

- 3. Niva Bupa Health Insurance Company Limited

- 4. SBI General Insurance Company Limited

- 5. Care Health Insurance Company Limited

- 6. ManipalCigna Health Insurance Company Limited

- 7. Bajaj Allianz General Insurance Company Limited

- 8. New India Assurance Company Limited

- 9. Oriental Insurance Company Limited

- 10. National Insurance Company Limited

- Top 10 Health Insurance Companies ICR comparison

- Top Health Insurance Companies in India

- Related posts:

Top 10 Health Insurance Companies of India in 2021-22:

- HDFC ERGO General Insurance Limited

- Star Health & Allied Insurance Company Limited

- Niva Bupa Health Insurance Company Limited

- SBI General Insurance Company Limited

- Care Health Insurance Company Limited

- ManipalCigna Health Insurance Company Limited

- Bajaj Allianz General Insurance Company Limited

- New India Assurance Company Limited

- Oriental Insurance Company Limited

- National Insurance Company Limited

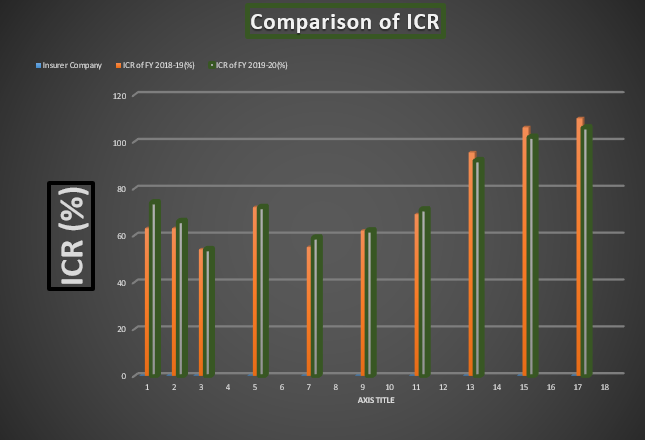

Top Health Insurance Company’s ICR and CSR report.

| Insurer Company | ICR of FY 2018-19(%) | ICR of FY 2019-20(%) | CSR of FY 2019-20(%) |

| HDFC ERGO General Insurance Limited | 63 | 74 | 99 |

| Star Health & Allied Insurance Company Limited | 63 | 66 | 90 |

| Niva Bupa Health Insurance Company Limited | 54 | 54 | 96 |

| SBI General Insurance Company Limited | 72 | 72 | 95 |

| Care Health Insurance Company Limited | 55 | 59 | 95 |

| ManipalCigna Health Insurance Company Limited | 62 | 62 | 90 |

| Bajaj Allianz General Insurance Company Limited | 69 | 71 | 98 |

| New India Assurance Company Limited | 95.39 | 92 | NA |

| Oriental Insurance Company Limited | 106.10 | 102 | 89 |

| National Insurance Company Limited | 109.94 | 106 | NA |

1. HDFC ERGO General Insurance Limited

HDFC ERGO General Insurance Limited is a joint venture of HDFC Ltd and ERGO International AG. It’s one of the companies which comes under the “Top 10 Health Insurance Companies of India”. It has an impressive Incurred Claims Ratio (ICR) of almost 74% for the financial year 2019-20 and 63% for the financial year 2018-19. And it has brought innovations like lifetime renewals and portability benefits of the existing policies. The Claim Settlement Ratio of HDFC Ergo is quite good and the mark is 99% in FY 2019-2020.

2. Star Health & Allied Insurance Company Limited

Star Health & Allied Insurance Company is a joint venture between Oman Health Insurance Company. ETA Ascon Group and a few veterans of the country boast of an Incurred Claims Ratio (ICR) of 66% for FY 2019-20 and 63% for FY 2018-19. The company has an in-house TPA to deal with cashless facilities seamlessly while also coming up with exciting products. Like Diabetes Safe (for diabetic patients) and Star NetPlus (for HIV+ patients). Star Health & Allied Insurance has an impressive Claim Settlement Ratio of 90% for FY 2019-20.

3. Niva Bupa Health Insurance Company Limited

Niva Bupa Health Insurance Company is a joint venture between Max India Limited and Bupa Group brought into existence in 2010. The latest ICR for this healthcare company stands at 54% for FY 2019-20 & 2018-19 too and offers enrollment to its policies for citizens of all age groups. Niva Bupa also holds a good place in terms of the Claim Settlement Ratio with 96% for FY 2019-20.

4. SBI General Insurance Company Limited

SBI General Insurance Co. Ltd comes with a joint venture of the State Bank of India and Insurance Australia Group (IAG). SBI General has a wide presence in over 23,000 branches of State Bank Group. It covers over 110 cities across India along with over 350 locations through satellite resources. It’s one of the companies which comes under “Top Health Insurance Companies of India”.

It has an Incurred Claims Ratio (ICR) of 72% for FY 2019-20 & 2018-19 too. Talking about the Claim Settlement Ratio of SBI is quite better than others, with 95% for FY 2019-20.

5. Care Health Insurance Company Limited

Care Health Insurance Company is a joint venture between Care Enterprises Limited, Union Bank of India, and Corporation Bank that was launched in 2012. However, in a short period of time, it has shown tremendous growth and made a mark in the insurance sector with an Incurred Claims Ratio (ICR) of 59% for FY 2019-2020. And 55% for FY 2018-19.

The Claim Settlement Ratio of Care Health Insurance is quite good and the mark is 95% in FY 2019-2020. It is being promoted by the founders of Fortis Hospitals. It’s one of the companies which comes under “Top Health Insurance Companies of India”.

6. ManipalCigna Health Insurance Company Limited

Manipal Cigna Health Insurance Company is a comparatively new player in the Indian insurance sector. Being launched only in 2014 and has immediately become part of the best health insurance companies in India. Its Incurred Claims Ratio (ICR) for both FY 2019-20 & 2018-19 stands at an impressive figure of 62%. That is no mean feat considering it’s so new to the market. ManipalCigna Health has an impressive Claim Settlement Ratio of 90% for FY 2019-20.

7. Bajaj Allianz General Insurance Company Limited

Bajaj Allianz General Insurance Company is a joint venture between Bajaj Finserv Limited and Allianz SE has some health products up its sleeve. The three major products are Health Guard, Silver Health, and Star Package. Bajaj has the distinction of being the first company to provide captive TPA with certain efficiencies.

Incurred Claims Ratio (ICR) of this company is 71% for FY 2019-20 & 69% for FY 2018-19. Bajaj Allianz also holds a good place in terms of the Claim Settlement Ratio with 98% for FY 2019-20.

8. New India Assurance Company Limited

New India Assurance Company is a fully owned company by the government of India. That has been in operation since 1919 and is most famous for its Mediclaim policy. The most unique feature of this health insurance policy is that it provides a differential rating for major metros in comparison to other locations. The latest Incurred Claims Ratio (ICR) for FY 2019-20 is 92% and FY 2018-19 is 95.39% which might be on the higher side.But it covers any losses or deficiencies from other insurance products.

9. Oriental Insurance Company Limited

Oriental Insurance Company is a public sector general insurance company that offers a number of health insurance products. The best part about this insurer is that it doesn’t require a medical examination of the prospective customers up to the age of 60 years. Whereas other companies push for medical examinations for everyone over 45 years of age. Its Incurred Claims Ratio (ICR) stands at 102% for FY 2019-20 as per IRDAI annual report. And 106.10% as per IRDAI annual report for FY 2018-19. Oriental Insurance also holds a good place in terms of the Claim Settlement Ratio with 89% for FY 2019-20.

10. National Insurance Company Limited

National Insurance Company is a fully government-owned general insurance company that is more than 100 years old and also provides health insurance coverage. Its Incurred Claims Ratio (ICR) is 106% for FY 2019-20 and 109.94% for FY 2018-19. But it covers up its losses with other insurance products in various other categories. The most popular health product offered by the company is Varishtha Mediclaim for senior citizens.

Top 10 Health Insurance Companies ICR comparison

Hope this information was useful for you. Find out about various plans being offered by these General insurance companies in India and buy a health insurance policy for you and your family, now!

Top Health Insurance Companies in India

Health policy is now a basic need of every family. and to be honest, you never want to face the situations,you know India was facing during the second wave of Covid-19, Moreover, We never choose such kind of life, and the reason for the worst situation at that time is government hospitals were never updated till today that they can save a life, If you want to get your treatment in a private and best hospital without spending a single penny then you should opt for a health policy. It’ll provide you with proper coverage and protect your family from uncertainties.

These are the top health insurance company in India that offers you wide coverage and make your life and money precious and valuable. Health policy is a way to get the best treatment, even in the best private hospital across the country, and maybe that’s why people take much interest in health policy.

Note: Latest IRDA Incurred Claims Ratio for FY 2018-19 of General Insurance Companies in India.

we would like to have health insurance plan for my 2 adults + 2 children’s ( family). please suggest which points I need to check prior to buying the policy. do we have any check list for family health insurance plan.

Please guide me if possible.

Mujhe l health insurance karana hai bu by

What about future generali India insurance company?

mediclaim

pls advice the best health insurane plan for family husband age 36, wife age 37 for 10lkh , lives in delhi. Is govt isurance better than any private sector.

star

Is Max Bupa good choice for mediclaim. as have read google reviews many negatives wherein people have complained that post accepting policies they dont approve the claims , they reject it and they harrasse for documents . Pl help me with the advice on this as the mediclaim is back bone for any person and post harrassement will be a nightmare

Please fill the details below and our policy experts will call you to help figure out the correct health insurance policy for your needs Health insurance is the need of the hour! Thankfully, more and more people are waking up to this reality nowadays. As a result, a lot many health insurance policies are being sold every day. The top health insurance companies in India have some very good medical insurance plans on offer. If you are looking to buy health insurance, you will have many options at your disposal. However, to know what your ideal health care coverage should be, you first need to assess your own needs and requirements. Take a look at this article know how you can correctly assess your needs and find the best plan from the best health insurance provider in India.

i have aafiya takaful emarat insurance, may i know in which hospitals is this insurance covered

I, MAKSUD IQBAL 56 AND WIFE ALSO ABOVE 55 NEED HEALTH INSURANCE. WE DONOT HAVE ANY HEALTH ISSUES. ONLY DUE TO SR. PERSON WE LIKE TO START AN INSURANCE. PLEASE ADVISE THE BEST HEALTH INSURANCE POLICY FOR BOTH.

Looking for a health insurance policy for my family 2+2. SI 25L/1CR

I want health insurance , how selection insurance company which parameters can consider during buy policy

kindly suggest me best medcliam plan for my father & mother in max bupa or bajajallianz

max bupa which is best health comapnion Or reassure father age 62 & mother age 59

It is my humble suggestion and experience that CARE HEALTH is one of the worst medical insurance company, They look for money and promise so many things at the time u buy their policy, my experience is they only look for rejection ground while settling the claim, poor website, poor management

Which family health is best public or private I am also diabetes

Royal Sundaram Is One Of The Best Policy Which i Had Seen…..Superb Claim they will provided….

Which is a better insurance company for family floater Comprehensive Health Policy with Super Top up Plan. Start Health insurance or Manipal Signa – Star health gives restoration benefit for same illness where as other insurance company gives restoration benefits for unrelated illness.

Hi Sameer, both options are the better options, but you recognize what’s your demand and what’s your need. After that, you have to decide whether Star Health or Manipal Cigna fulfills your demand.

I always suggest you to take policy in those insurance Companies which deals with all ranges of insurance products ie Fire insurance, Motor Insurance, Marine Insurance, Engineering insurance and Misc Insurance because health port folio is a loss business almost 140% ICR, So how a standalone health insurance Company survives with a loss ICR. So always prefer those Companies which has multiple segment of business because it can compensate with other branches of insurance to mitigate the health insurance claims.

IFFCO TOKIO IS BEST HEALTH INSURANCE COMPANY IN THE MARKET WITH SPECIAL BENEFIT SAME PERSON SAME DISEASE COVER IN THE POLICY PERIOD , RESTORE SUM INSURED BENEFIT UNLIMITED AS PER SUM INSURED UNLIMITED ROOM RENT COVER , CORONA DOSE 10 % DISCOUNT OFFER,NO MEDICAL CHECK UP TO AGE 60

HDFC ERGO IS THE BEST HEALTH INSURANCE POLICY AS PER MY EXPERIENCE.PLEASE CHECK MANY TIMES BEFORE DOING HEALTH INSURANCE.

Dear Expert, Can we take TATA AIG heath insurance considering its reliability and growth in near future.. Please suggest can we consider? if yes which plan can be benificial. T

Thank you so much.

Suggest Health Insurance policy considering following requirements.

1) Policy is required for self(58 yrs) & wife(50yrs).

2) Coverage may be for Rs.10 lakhs should have top up plan.

3) Immediate start of policy after purchase without any tag. Should cover pre-existing diseases.

4) Should cover top speciality Hospitals in India.

5) Bhubaneswar will be the base city after retirement.

6) presently have corporate group health insurance from STAR HEALTH.

Please share your contact number so that sales manager can call you regarding the information

Please share your contact number so that the sales manager can call you regarding the information

Which one is the best policy to compare to all? Your policy approach is good

HI, You can take Care or Niva both are good in affordable segment

Or

contact on 9311238042