What is Staggered Payment Under Your Term Insurance Policy?

Mr.Sharma was very much concerned about financial planning and that’s why he bought a term insurance policy with a regular lump sum payment option at an early phase of his life. He was now in his 50s with a wife and two kids. The term insurance policy of Mr.Sharma was perfect for him as he made a well-informed decision and chose the right amount of sum assured and policy term. Two days ago, Mr.Sharmamet with an accident while going to the office and died on the spot due to severe injuries. Mrs.Sharma received the whole amount of the death benefit at once which made it difficult for her to make any investment or saving decision with such a huge amount of money. The emotional trauma due to the loss of Mr.Sharma was added by the dilemma of making a decision regarding the huge amount of money received as the death benefit and finally, she ended up with a wrong investment in properties due to which she suffered huge financial loss.

Your loved ones can go through the same problem as Mrs.Sharma because the death benefit received is the only hope for a secured future for such families and utilizing it in the most effective way is very much necessary, but most people are not able to manage such huge amount of money and end up making wrong investment and saving option. But there is an option of staggered payment which allows you to receive a portion of the sum assured at once and the rest as monthly income for a particular period of time. So instead of making mistake regarding the payout options in insurance like Mr.Sharma, let us understand the staggered payment option of term insurance through this article so that you can take advantage of your policy.

Table Content

What is Staggered Payment?

This type of payout option allows the nominees to receive the portion of the claim benefit as a lump sum and the remaining amount as installments in the form of a monthly or yearly income for a specified period of time depending upon the plan conditions. It wipes out the hassle for the nominee of investing a huge amount of claim money optimally and helps the nominee to receive the payment as a staggered payment. So even if the initially received corpus will be compromised, the consistent monthly income will help the family to build a secured future. It also helps your family to achieve your financial goals which you earlier chalked out.

For example- Aman bought a term insurance policy of Rs.1 crore with a monthly payout option. After his death, his family will receive Rs.10 lakh on death and Rs.50,000 per month for 15 years.

What are the Different Options Under Staggered Payment?

Under staggered payment, you get the following two options to choose from:-

Monthly Income- In the monthly income payment option, the family receives a portion of the death benefit on death and the rest is paid as a predetermined amount of money on a monthly basis for a particular period of time.

Increasing Monthly Income- This option of staggered payment allows your monthly income to increase annually by 10-20%. Choosing an increasing income option in your term insurance policy helps you to tackle inflation as the value of money is decreasing with time.

Things to keep in mind before going for a Staggered Payment

- If you know that your family cannot make the right financial decision and will face the problem of investment and saving after receiving the huge amount of the death benefit at once then going for a staggered payment is the best option. It will allow your loved ones to receive the death benefits in the form of an income replacement tool.

- If you are taking a term insurance policy as a protection against loans and debts, then there is no need to go for staggered payment as in such situations, you need the sum assured at once, not on a monthly basis. So it’s better to stick to a regular lump sum payment option when you are taking insurance as a protection against loans and debts.

- If you have financial plans which can only be fulfilled with a continuous monthly income like the education of your child, then always go for a staggered payment option under a term plan.

- There are few term plans which offer the flexibility to the nominees to take the death claim as a lump sum at a discounted rate even if the plan benefit opts a staggering payout.

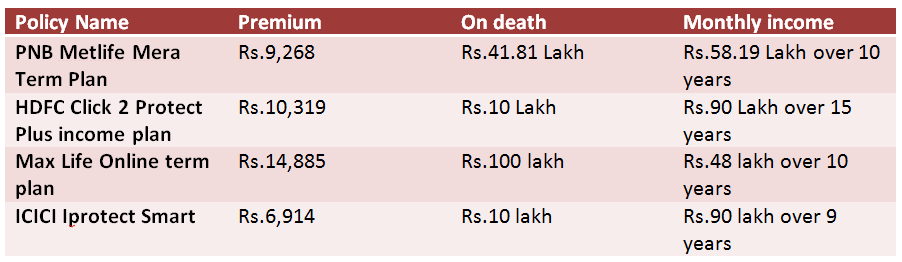

Options Available in the Market

The premium rates have been calculated for a non-smoker, a 25-year-old male with a sum assured of Rs.1 crore and a policy term of 25 years.

To understand the staggered payment option of your policy and take advantage of it because it will allow you to customize your term insurance policy according to your family’s needs and financial goals.