Retirement Benefits Under Government Employees Pension Scheme

The new government employees, who joined on or after 1st January 2004 will be benefited from the government employee pension scheme which was announced on 22nd December 2003. The retirement benefits of this new pension scheme are lucrative and have various aspects of a better life for the retired employee and his or her family members.

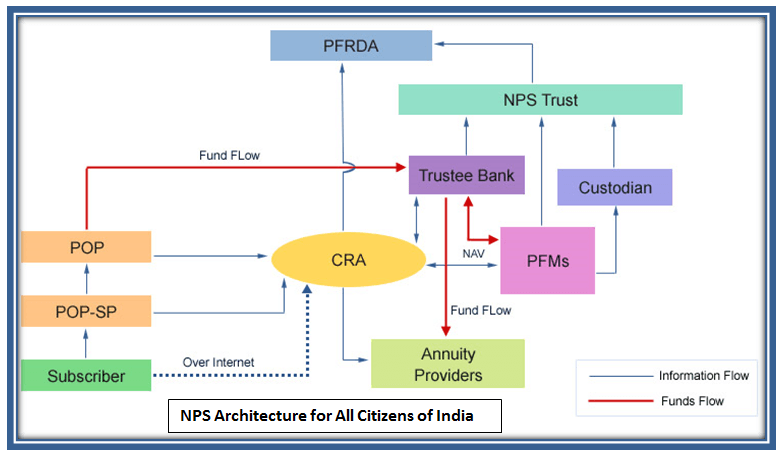

The Government of India introduced National Pension System on 1st January 2004. Pension Fund Regulatory and Development Authority (PFRDA) is the regulatory body, which has appointed NSDL as Central Recordkeeping Agency under National Pension System. Central Recordkeeping Agency (CRA) is critical for the successful operationalization of the National Pension System.

Table Content

- Key functions and Responsibilities of the Central Recordkeeping Agency (CRA)

- What is New Pension Scheme (NPS)?

- There are two types of accounts, namely Tier I & Tier II available to subscribers.

- Key Benefits of New Pension Scheme (NPS)

- Wide Range of Investment Options:

- Choose between Active and Auto Choice:

- Simple Procedure:

- Portable:

- Regulated:

- Tax Benefits

- Steps to Join New Pension Scheme:

- Steps to Open a New Pension Scheme (NPS) Account:

- Process of Opening New Pension Scheme (NPS) Account Online

- 1. Registration Under NPS

- 2. Send the Document to CRA

- 3. Processing of Subsequent Contribution

- Conclusion

- Related posts:

Key functions and Responsibilities of the Central Recordkeeping Agency (CRA)

- Handling administration, recordkeeping, and customer service functions.

- Issuing a Permanent Retirement Account Number (PRAN) to each subscriber, maintaining a database of all PRANs, and recording related transactions.

- The operational interface between PFRDA and other NPS intermediaries such as Pension Fund Managers, Trustee Banks, Annuity Service Providers, etc. CRA monitors member contributions and provides periodic PRAN statements to each subscriber and performs duties & functions as specified by PFRDA from time to time.

What is New Pension Scheme (NPS)?

On May 1st, 2009, the Government of India (GOI) rolled out the NPS for all citizens of India, and for the corporate sector, it was launched in December 2011. The employee/citizen who joins under this pension scheme is known as a ‘Subscriber’. Each subscriber needs to open an account with Central Recordkeeping Agency (CRA) which is identified through a unique Permanent Retirement Account Number (PRAN).

There are two types of accounts, namely Tier I & Tier II available to subscribers.

Tier I account: Subscribers contribute/her savings into a non-withdrawable account.

Tier II account: It is a voluntary savings account, where subscribers have the flexibility to withdraw their savings anytime he wants to. An active Tier I account is a prerequisite for opening a Tier II account.

Under NPS, a government employee makes a contribution along with the matching contribution from the employer towards a pension. The funds are invested in the designated investment schemes through Pension Fund Managers.

Under this new employee pension scheme, retirees can withdraw an amount equal to 60% of total pension wealth in their personal retirement account. The remaining 40% would be invested in different annuities and the schemes can be chosen by the employee himself. The annuity will provide the retiree with the monthly income flow for the rest of his life. If the employee retires before the age of 60 which is the official age of retirement in the government sector, the annuity amount will be equal to 80% so that he can get enough amount of pension in his upcoming years. The family pension is only valid when the government employee dies after retirement from employment.

Key Benefits of New Pension Scheme (NPS)

The new scheme of pensions for government employees is carved out to provide various retirement benefits to the employees. Most importantly the scheme had been revised to maintain the lifestyle and standard of living of the employees even after retirement. With the ever-rising inflation, it is very important for the government to look after the needs of the people. Here are some of the crucial benefits of the new employee pension scheme:

Wide Range of Investment Options:

NPS offers a wide gamut of investment options along with the choice of Pension Fund Manager (PFMs) which helps you plan the growth of your investments and see your money grow. Subscribers have the option to switch from one fund manager to another or from one investment option to another, subject to regulatory restrictions. The returns under this pension scheme are entirely market-related.

Choose between Active and Auto Choice:

A subscriber has the flexibility to choose between auto choice and active choice that helps him/her design her own portfolio towards contribution under the NPS.

Allocation under Active Choice: Under this investment choice, you can invest in four available asset classes i.e., Equity (E), Corporate Debt (C), Government Securities (G), and Investment Fund (A). The Subscriber has an option to choose a fund manager and provide the ratio in which he/she wants to invest funds among the asset classes.

Allocation under Auto Choice: Under this investment choice, funds are invested as per the Life cycle fund matrix. It provides the Moderate Life Cycle Fund, Aggressive Life Cycle Fund, and Conservative Life Cycle, Fund. You need to choose from any of the three funds. If you don’t choose a fund, the fund’s allocation would be as per the moderate life cycle fund.

Simple Procedure:

The process for opening an account with NPS is quite simple and the subscriber is provided with a unique Permanent Retirement Account Number (PRAN) which remains with the subscriber throughout the lifetime. With his/her PRAN, the subscriber can log in to the respective NPS account to access details such as account details, transaction statements, scheme preference changes, update personal details, etc.

Portable:

NPS ensures seamless portability irrespective of change of employment or location. It provides hassle-free arrangements for individual subscribers. NPS is one of the least-cost investment options having only 0.01% as Fund Management Charge.

Regulated:

NPS is regulated by Pension Fund Regulatory and Development Authority (PFRDA), and has transparent investment norms, and regular monitoring of fund managers. It also has efficient grievance management through CRA / PFRDA Website, Email, Postal Mail, or Call Center.

Tax Benefits

For Individuals:- Any individual who is a subscriber under this pension scheme is eligible for tax deduction up to 10 % of gross income under Sec 80 CCD (1) with an overall limit of Rs 1.5 Lacs under Sec 80 CCE.

For Corporate Subscriber:- Subscribers from the corporate sector can avail of additional tax benefits under section 80CCD (2) of the Income Tax Act, where the employer’s NPS contribution of up to 10% of salary (Basic + DA) is eligible for deduction from taxable income.

For all NPS Subscribers:- All NPS subscribers can avail of the additional deduction for investments up to Rs 50,000 (Tier I account) under subsection 80CCD (1B). This is available in addition to the deduction of Rs 1.5 Lacs available under sec 80C of IT Act, 1961.

Note: Tax benefits can be availed only for investments in Tier I account under NPS. A printout of the Transaction Statement can be used as a document to avail of the tax benefit.

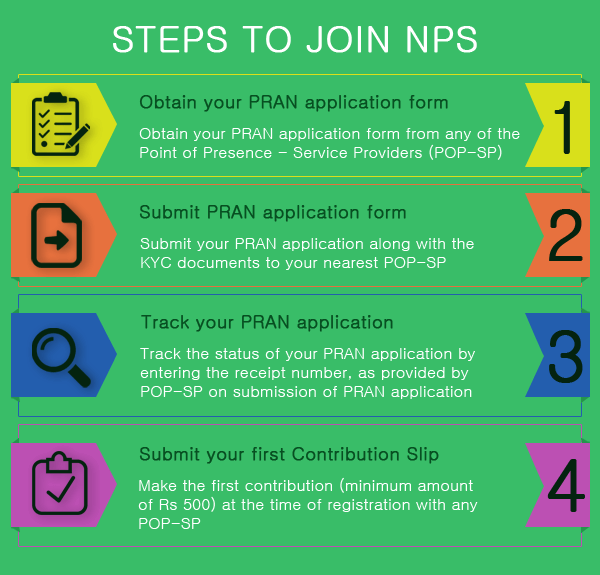

Steps to Join New Pension Scheme:

Steps to Open a New Pension Scheme (NPS) Account:

Obtain Your PRAN Application form: A subscriber between the age group of 18 to 60 years can obtain your PRAN application form from any of the Point of Presence – Service Providers you want to register with. You also have the option to get the PRAN application form from the NSDL website by clicking @ https://www.npscra.nsdl.co.in/subscribers-corner-form.php

You need to ensure that the PRAN application form is properly filled up such as mandatory details, scheme preference details, photograph, signature, etc., and don’t forget to submit KYC documentation for proof of address and proof of identity.

Submit PRAN Application Form: You need to visit your nearest Point of Presence – Service Provider (POP-SP) and submit your PRAN application along with the KYC documents. Your PRAN Kit containing the Welcome Letter, PRAN Card, Scheme Information Booklet, and Subscriber Master Report will be dispatched to your correspondence address by CRA.

Track your PRAN Application: At the time of submitting the PRAN application, POP-SP will give you a receipt number. By entering the receipt number in https://cra-nsdl.com/CRA/pranCardStatusInput.do, you can track the status of your PRAN application.

Submit Your First Contribution Slip: You are required to make the first contribution (minimum amount of Rs 500) at the time of registration with any POP-SP. For making the first contribution, you will have to submit NPS Contribution Instruction Slip (NCIS) mentioning the payment details for your unique PRAN account.

Process of Opening New Pension Scheme (NPS) Account Online

Every individual has the flexibility to open a pension account through eNPS.

1. Registration Under NPS

Option 1 – Registration using Aadhaar

- You must have an Aadhaar number (with a mobile number linked with it).

- Your KYC will be done through Time Password authentication (OTP). OTP will be sent to the mobile number, as registered with your Aadhaar Number.

- Your demographic details and photo will be taken from the Aadhaar database.

- You need to fill up all the mandatory details such as personal details, nominee details, investment options, etc.

- You would need to upload your scanned signature (in *.jpeg/*.jpg format and the file size should be 4kb to 12kb).

- If you want to replace the photo obtained from your Aadhaar, you are requested to upload a scanned photograph.

- You will then be directed to a payment gateway for making the first contribution towards your NPS account.

Option 2 – Registration using PAN (KYC verification by Bank)

- You need to have a Permanent Account Number (PAN).

- You must have a bank account with the impaneled Bank for KYC verification.

- Your KYC verification will be done by the Bank, as selected by you during the registration process under NPS. In case, your KYC is rejected by the selected Bank, you are requested to contact the Bank.

- You need to fill up the mandatory details.

- You will need to upload your scanned photograph and signature in *.jpeg/*.jpg format with a file size of 4kb to 12kb.

- You will then be required to make the payment towards your NPS account.

For NRIs

- He/She should select the Bank Account Status i.e., Non-Repatriable account or Repatriable account.

- Provide the bank account details and need to upload the scanned copy of the passport.

- Select the preferred address for communication. Communication at an overseas address would levy extra charges.

2. Send the Document to CRA

After allotment of a Permanent Retirement Account Number, a subscriber can use one of the following options:

Option 1 – eSign

For Tier I accounts generated through Aadhaar, you need to eSign the document through the below-mentioned steps:

- Select ‘eSign’ option in the eSign/Print & Courier page

- OTP for authentication will be sent to your mobile number, as registered with the Aadhaar. After successful Authentication of Aadhaar, the Registration form is signed.

- As the document is signed, you need not send the form to CRA.

- eSign charge is Rs 5 plus service tax.

Option 2 – Print and Courier

- Select ‘Print & Courier’ option in the eSign/Print & Courier page.

- You need to take a printout of the form, paste your photograph (do not staple or clip) & affix your signature (do not sign across the photograph).

- You should put your sign on the block, as provided for signature.

- You need to send the form within 90 days from the date of allotment of PRAN to CRA, or else your PRAN will be ‘frozen’ temporarily.

3. Processing of Subsequent Contribution

All existing subscribers have the flexibility to contribute to Tier I & Tier II accounts via ‘eNPS’. For making the contribution online, you need to

- Have an active Tier I and/or Tier II account.

- Authenticate your PRAN through the One Time Password sent to your registered mobile number.

- Make payment through your Internet Banking option or Debit/Credit card.

- POP Service Charges are applicable @ 0.05% (minimum of Rs 5 and maximum of Rs 5,000 per transaction) on the contribution amount. This service charge is not levied on subscribers registered in eNPS through Aadhaar.

Conclusion

The retirement benefits of the new pension scheme are way better than the earlier one which provides huge financial security to the employees. From equal contribution by the government to the investment schemes, everything in this Government Employees Pension Scheme is in favor of the employees and or their families. The new one is completely based on the returns that the annuity generates for the retiree per month.

You only need to choose the scheme to invest your funds in and just be ready to enjoy your golden years post-retirement.