Reliance Life Insurance Claim Settlement Ratio

As per IRDAI annual report, the latest claim settlement ratio of Reliance Life Insurance Company is 98.12% for the Financial Year 2019-20. IRDAI report on CSR make things favor in customer because as a customer you always want to go with best option and IRDAI report gives that option. Every year new Insurance become best with their CSR and ICR report, with this customer make their choice.

| Life Insurer | Claims Rejection (FY 2019-20) | Claims Intimated (FY 2018-19) | Total Claims (Claims Pending + Claims Intimated) | CSR% (FY 2018-19) | CSR% (FY 2019-20) |

|---|---|---|---|---|---|

| Reliance Life | 1.86% | 8017 | NA | 97.71% | 98.12% |

- The claim settlement ratio of 98.12% is the indicator of the number of death claims settled by Reliance Life Insurance against the total claims 8017 reported for the FY 2019-20.

- Rs 154 crores has been paid as the claim amount against 8179 claims reported in the FY 2018-19 by Reliance Life Insurance Company.

- The claims have been rejected, resulting in Claim Repudiation of 1.86% for the FY 2019-20.

Table Content

Past 5 years CSR Trends for Reliance Life Insurance Co.

Consistency to maintain a higher claim settlement ratio is considered to be good. Past claims settlement ratio trends will reveal the consistency and inclination of the Reliance Life Insurance Co. towards the settlement of death claims.

Well, consistency is a first thing that everyone want. Insurance company try to be better every year and this consistency will also count. If anyone insurance company best than it try to perform consistently, Reliance Life Insurance Co always try to make their performance better.

Let’s go through the past 5 years’ CSR trend of Reliance Life Insurance Company.

| Financial Year | Claim Settlement Ratio (%) |

|---|---|

| 2015-16 | 93.82% |

| 2016-17 | 94.53% |

| 2017-18 | 95.17% |

| 2018-19 | 97.71% |

| 2019-20 | 98.12% |

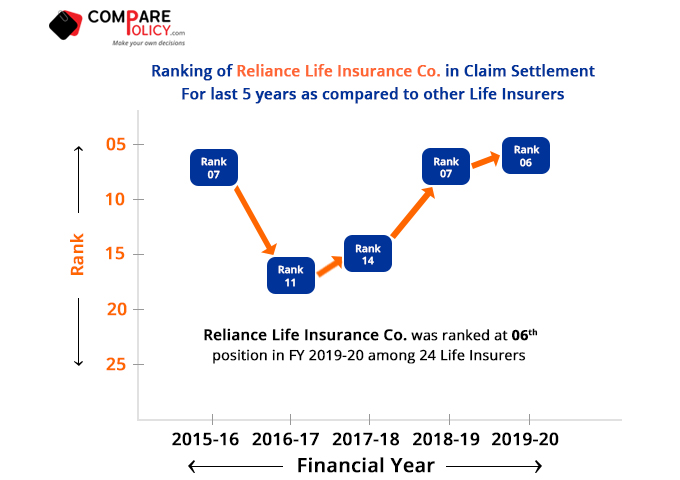

Reliance Life Rank in Claim Settlement among other Life Insurers

The Claim Settlement Ratio (CSR) rank signifies the position where Reliance Life Insurance Company lies, with respect to other life insurers in the industry from the financial year 2015-16 to 2019-20. The claim settlement percentage attained by Reliance Life Insurance Co. is the basis of the rank identified in the respective financial years.

How Claim Settlement Ratio (CSR) is measured?

The Claim Settlement Ratio is expressed as the number of claims settled divided by the total number of claims reported in a given financial year, including the claims outstanding at the beginning of the financial year. The claim settlement ratio is expressed in percentage which is helpful for comparing the claim settlement data by the customer across insurers. The claim settlement ratio is calculated for every financial year.

| Claim Settlement Ratio = Total claims settled / Total claims received where, Total Claims received = (Claims reported in the financial year + claims pending at the start of the year) |

I have a reliance life insurance policy and i have already paid three annual premium of Rs. 50000/- but now i could not pay two annual premium. Can i port to other insurance co. and withdraw the money.