PPF as a Tax Saving Instrument

Public Provident Fund (PPF) is one of the most popular, traditional, and long-term saving instruments in India, introduced by the National Savings Institute in the year 1968. PPF scheme aims to mobilize small savings by offering guaranteed returns on investment along with income tax benefits, PPF as a tax saving, which makes it a lucrative investment option. It is a fifteen-year tenured investment scheme, under which an investor can avail the benefit of compound interest on the invested amount that helps to grow the invested money. It also offers a tax deduction for the money invested and tax exemption for the proceeds received.

Table Content

- Tax Benefits under PPF

- Tax Deduction

- Tax Exemption

- Key Things to Know About PPF Investment

- Eligibility

- Account Opening

- Contributions

- Interest Accrued

- PPF Rate of Interest Over the Last Five Years on graph

- Maturity

- Features of PPF Account

- Capital Protection

- Liquidity

- Premature Closure

- Transfer

- Nomination

- Final Word

- Related posts:

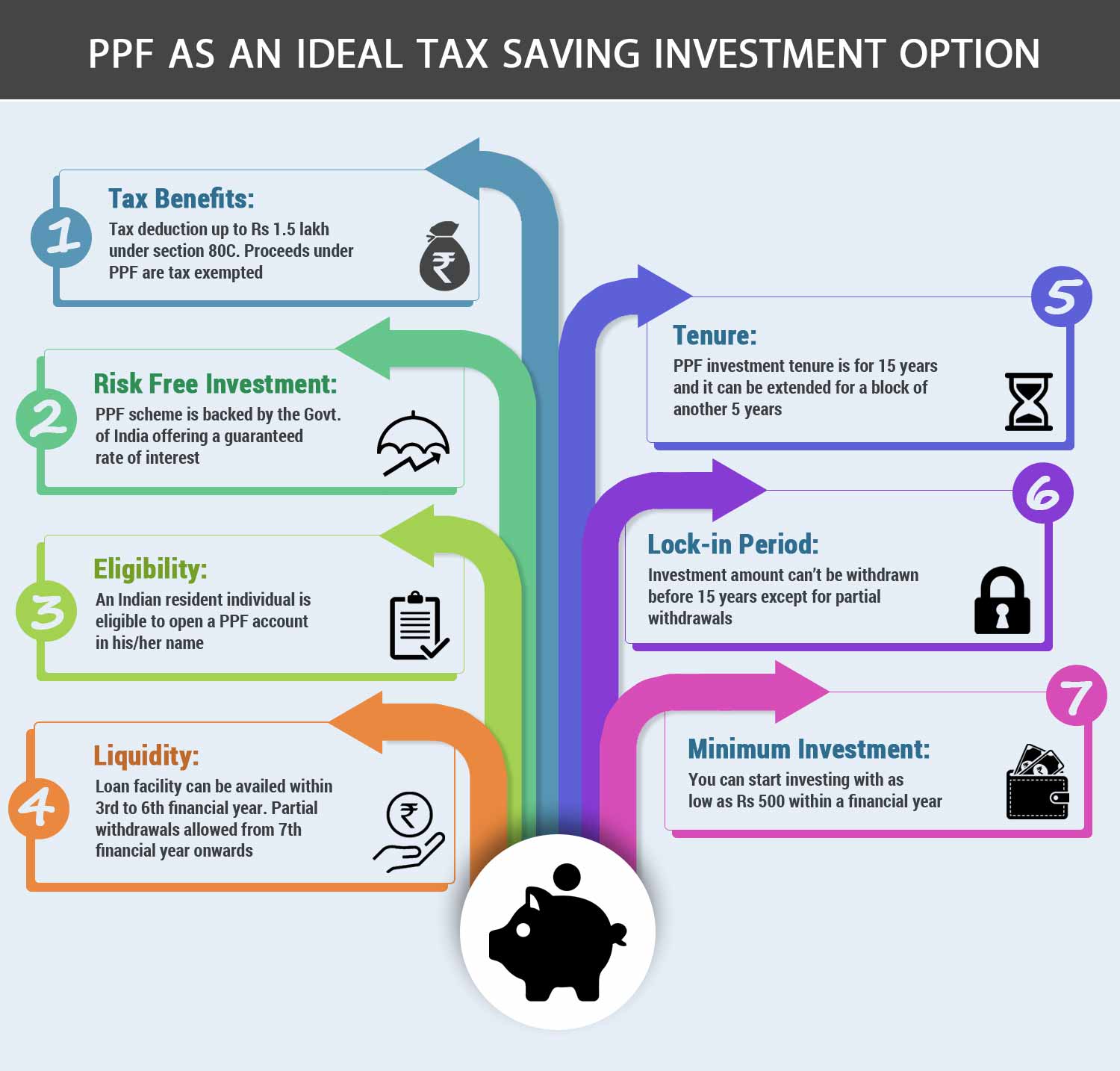

Tax Benefits under PPF

Apart from the key benefits available such as loan, partial withdrawal, and maturity benefit, investing in a PPF account also offers tax benefits.

Tax Deduction

Annual contributions made to a PPF account qualify for tax deduction under section 80C of the Income Tax Act, 1961. The tax deduction towards the money invested is capped up to Rs 1.5 lakhs for a financial year. You can also avail of tax deductions for contributions to PPF accounts of spouses and children. But the tax deduction availed cannot exceed 1.5 Lakhs if contributed to the PPF accounts of spouse and/or children.

Tax Exemption

Interest earned is exempted from income tax and maturity proceeds are also eligible for tax exemption. Any partial withdrawals made before the maturity date is also exempted from tax. Thus, you can avail of tax exemption for all the payouts received under a PPF account.

Key Things to Know About PPF Investment

There are some key aspects that you need to know before investing in the PPF scheme. Let’s go through some facts about the PPF, which will help you to make a well-informed investment decision.

Eligibility

An Indian resident individual is eligible to open a PPF account and start investing, however, opening a joint account is not allowed. A PPF account can be opened for a minor with a guardian (father, mother, or court-appointed guardian). A person is not allowed to open more than one account in his/her name. An account opened for a minor is considered separate. A grandfather or grandmother is not eligible to open an account on behalf of a grandchild, except in the case where a guardian has died.

Hindu Undivided Families, Non-resident individuals, or Body of Individuals are not allowed to invest in PPF. The account will be closed, in case an individual becomes an NRI. The interest paid from the date an individual becomes an NRI till the closure of the account shall be equal to the post office savings account interest rate, i.e., 4% per annum.

Account Opening

You can open a PPF account at all head post offices, other designated post offices, and at designated branches of the leading nationalized banks such as State Bank of India, Central Bank of India, Bank of India, Union Bank of India, Vijaya Bank, Allahabad Bank, Bank of Baroda, etc. Leading private banks such as ICICI Bank, HDFC Bank, Axis Bank, IDBI Bank, etc. have also started the facility to open a PPF account.

When you have decided to open a PPF account, you will need to provide the following documents.

- A duly-filled account opening form

- Two passport size photographs

- Identity proof (at the time of account opening, carry original identity proof for verification purposes)

- Address proof

Following is the list of documents that can be used for identity and address proof for opening a PPF account.

| Documents | Identity Proof | Address Proof |

|---|---|---|

| PAN Card | Yes | No |

| Driving License | Yes | Yes |

| Voter’s Card | Yes | Yes |

| Passport | Yes | Yes |

| Aadhar Card | Yes | Yes |

| Ration Card | No | Yes |

| Bank Account | No | Yes |

It is recommended to choose a nominee and get a witness signature to complete the formalities for opening a PPF account.

Contributions

You need to make a minimum contribution of Rs 500 and up to a maximum of Rs 1.5 lakhs during a financial year is allowed. Any amount deposited over the maximum limit of Rs 1.5 lakhs during a financial year would not accrue any interest. You are allowed to make contributions in a lump sum way or through a maximum of 12 installments during a year. The limit of Rs 1.5 lakhs is applicable on an aggregate basis for all PPF accounts held under your name or on behalf of a minor.

If you don’t make a minimum contribution of Rs 500 during a financial year, your PPF account will become inactive. To revive an account, a penalty of Rs 50 per year is levied along with the minimum contribution of Rs 500 during a year.

Interest Accrued

The rate of interest for the PPF account is announced by The Ministry of Finance, Government of India every quarter. During October to December quarter, the interest rate is 7.8% per annum (compounded annually) during the financial year 2017-18.

As the basis of interest, the calculation is on the lowest balance between the fifth day and the end of the month. In the case of monthly contributions, you are recommended to invest before the 5th of every month (payment to PPF should be received during the first 4 days of the month) to maximize your interest earnings. In the case of lump-sum annual investments, you need to invest money before the 5th day of April in every financial year.

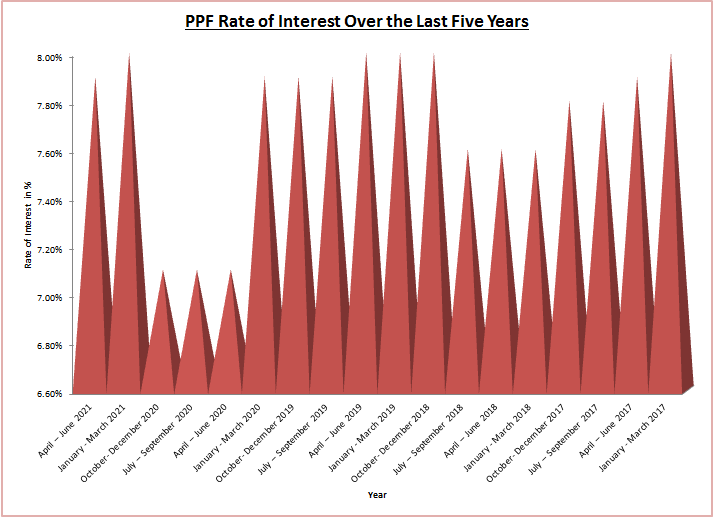

PPF Rate of Interest Over the Last Five Years

| Year | Rate of Interest in % |

| April – June 2021 | 7.9% |

| January – March 2021 | 8% |

| October- December 2020 | 7.1% |

| July – September 2020 | 7.1% |

| April – June 2020 | 7.1% |

| January – March 2020 | 7.9% |

| October- December 2019 | 7.9% |

| July – September 2019 | 7.9% |

| April – June 2019 | 8% |

| January – March 2019 | 8% |

| October- December 2018 | 8% |

| July – September 2018 | 7.6% |

| April – June 2018 | 7.6% |

| January – March 2018 | 7.6% |

| October- December 2017 | 7.8% |

| July – September 2017 | 7.8% |

| April – June 2017 | 7.9% |

| January – March 2017 | 8% |

PPF Rate of Interest Over the Last Five Years on graph

Maturity

PPF has a lock-in period of 15 years and upon completion of this period, you are entitled to withdraw the entire proceeds at maturity. You also have the flexibility to extend the maturity date for another 5 years and so on.

- Extend the PPF account with no ContributionIf you don’t take any action during one year from the maturity date of the PPF account, your account is extended for another 5 years with no contributions required. Under this option, any amount can be withdrawn from the PPF account, but you are allowed to make only one withdrawal in a financial year. The balance amount keeps earning interest.

- Extend the PPF account with a contribution if you want to choose this option, you need to submit form H in the bank or post office where you are having a PPF account, within one year from the date of maturity. Upon exercising this option, you can withdraw up to a maximum of 60% of the amount (at the beginning of the extended period) in your PPF account during the entire 5 year period. A single withdrawal is allowed in a financial year.

As per PPF scheme rules, the date of maturity is calculated from the end of the financial year during which you started investing in PPF, irrespective of the month or date the account was opened.

| Suppose, you made the first PPF contribution on June 15, 2017. The 15-year lock-in period will be calculated from March 31, 2018 and the year of maturity will be April 1, 2033. |

Features of PPF Account

Investing in a PPF account provides you with some key features such as capital protection, liquidity, premature closure, transfer, and nomination facility. Let’s discuss all these features to have an accurate understanding of what it has to offer.

Capital Protection

The PPF scheme is backed by the Government of India, making it a risk-free investment. It ensures that the capital amount invested is completely protected and your investment amount will grow with the help of the guaranteed rate of interest. The interest rate is aligned with government security (G-Sec) rates of the same maturity, with a spread of 0.25%.

The money invested in the PPF account is completely safe and it cannot be seized by a court order. No authority can even order to take over your account.

Liquidity

Although PPF has a lock-in period of 15 years, loans and partial withdrawals are allowed, depending on the PPF balance and age of the account. The loan facility is available between the 3rd to 6th financial year. The rate of interest levied on the loan amount is more than 2% of the interest earned on PPF investment. The principal repaid is credited to your PPF account and the interesting part goes to the government.

A subscriber cannot get a fresh loan until the earlier loan has been completely paid off along with the interest amount levied. Partial withdrawal is permissible from the 7th financial year onwards. You have the flexibility to withdraw an amount up to 50% of the balance in the account at the end of the 4th year or the immediately preceding year, whichever is lower. In case, you discontinue the account, you are not eligible to avail of loans and withdrawals till the revival of the account. After reviving the account and making a minimum contribution, you will also become entitled to receive interest at the prevailing rate.

Premature Closure

Premature closure is not allowed before the maturity date (i.e., 15 years) however, this facility can be availed only in case of certain conditions. You become eligible for premature closure of the PPF account upon completion of 5 years and it is entitled only for medical treatment of family members and higher education of the account holder. Premature closure levies an interest rate penalty of 1%.

Transfer

You have the option to transfer his/her PPF account from bank to post office or vice versa. Moreover, you also have the flexibility to transfer your PPF account from one bank/post office branch to another. The facility to transfer your PPF account is available free of charge.

Nomination

You have the option to nominate one or more persons in a PPF account. The shares of nominees need to be specified by the subscriber. You can nominate a minor in your account, however, no nomination is permitted in an account opened for the minor. If the account holder or subscriber has not nominated anyone against the account and suddenly something unfortunate happens to him/her, the balance amount will be paid to the legal heir. It is, however, recommended to make the nomination while opening a PPF account.

Final Word

PPF is one of the well-known traditional long-term investment avenues, backed by the Government of India. If you are looking to accumulate a risk-free corpus with a decent rate of return and tax benefits, investing in PPF is the best option. With guaranteed returns, a PPF account facilitates you to accumulate a lump sum amount at maturity that can be utilized to fulfill various long-term financial goals. You only need to make the regular contributions into a PPF account to make the most of it.

Investing in a PPF account also offers a tax deduction for annual investments up to Rs 1.5 lakh under section 80C of the Income Tax Act, 1961. You can also avail of tax exemption for all the payouts you receive under a PPF account. Invest in a PPF account, grow your money safely, save tax and attain peace of mind!