Max Life Insurance Claim Settlement Ratio

As per IRDAI annual report, the latest claim settlement ratio of Max Life Insurance Company is 99.22% for the Financial Year 2018-19a and FY 2019-20 too.

| Life Insurer | Claims Rejection (FY 2019-20) | Claims Intimated (FY 2018-19) | Total Claims (Claims Pending + Claims Intimated) | CSR% (FY 2018-19) | CSR% (FY 2019-20) |

|---|---|---|---|---|---|

| Max Life | 0.78% | 15463 | NA | 99.22% | 99.22% |

- The claim settlement ratio of 98.74% is the indicator of the number of death claims settled by Max Life Insurance against the total claims 15087 reported for the FY 2018-19.

- Rs 452 crores has been paid as the claim amount against 14897 claims reported in FY 2018-19 by Max Life Insurance Company.

- 187 claims have been rejected, resulting in Claim Repudiation of 1.24% for the FY 2018-19.

Table Content

Past 5 years CSR Trends for Max Life Insurance Co.

Consistency to maintain a higher claim settlement ratio is considered to be good. Past claims settlement ratio trends will reveal the consistency and inclination of the Max Life Insurance Co. towards the settlement of death claims.

I think if we talk about consistency then no one can be better than Max Life Insurance Co., last two FY CSR report is the same and if you are the best insurance company then you always try to be the best and the CSR report of last two year says it all.

Let’s go through the past 5 years’ CSR trend of Max Life Insurance Company.

| Financial Year | Claim Settlement Ratio (%) |

|---|---|

| 2015-16 | 96.95% |

| 2016-17 | 97.81% |

| 2017-18 | 98.26% |

| 2018-19 | 99.22% |

| 2019-20 | 99.22% |

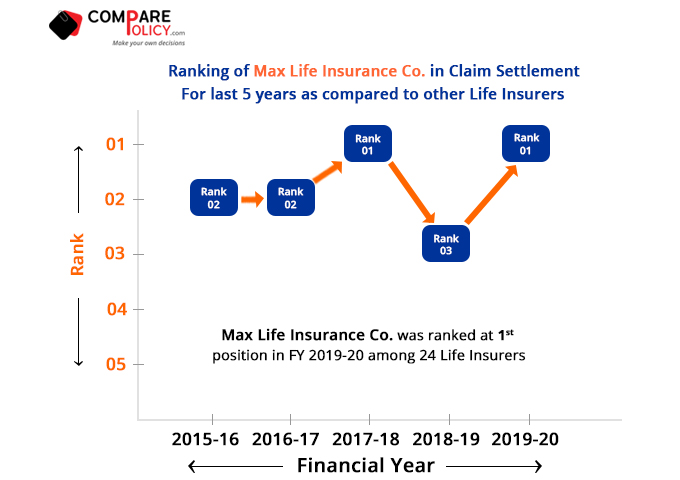

Max Life Rank in Claim Settlement among other Life Insurers

The Claim Settlement Ratio (CSR) rank signifies the position where Max Life Insurance Company lies, with respect to other life insurers in the industry from the financial year 2015-16 to 2019-20. The claim settlement percentage attained by Max Life Insurance Co. is the basis of the rank identified in the respective financial years.

Being the best company you never try anything new as usual, but you always demand to be the best and serve your customer as you serve. You always want to keep the same performance you did in past, these commitments make a difference and with this commitment, you became the best option.

How Claim Settlement Ratio (CSR) is measured?

The Claim Settlement Ratio is expressed as the number of claims settled divided by the total number of claims reported in a given financial year, including the claims outstanding at the beginning of the financial year. The claim settlement ratio is expressed in percentage which is helpful for comparing the claim settlement data by the customer across insurers. The claim settlement ratio is calculated for every financial year.

| Claim Settlement Ratio = Total claims settled / Total claims received where Total Claims received = (Claims reported in the financial year + claims pending at the start of the year) |

DOB 10-01-1965 with diabetic need 50 lakhs term plan till my 70 years. which is the best company.MY LIC Policy expiring in 2024.

hi, i would like to invest in Max life flexi wealth plus scheme. Am planning to invest 1lac yearly for 7 years, targeting my kids education needs after 12years and this policy covers insurance as well.

Pls advise your suggestion, thanks

Why claim is rejected.under which situation

Hi Mam..can you help with best Term Insurance Plan and of which company