Know about Pre and Post Hospitalization Cover in Your Health Policy

Most people opine that a health policy provides coverage only for those medical expenses that one incurs during his/her stay at the hospital. However, contrary to the common belief, insurers also cover the expenses incurred prior to getting hospitalized as well as after getting discharged from the hospital. These are commonly termed pre and post-hospitalization benefits respectively.

To gain a better understanding of this concept, let us take an example:

Mr. Anoop, aged 40, an engineer by profession, was experiencing heaviness and pain in his chest for quite some time. He consults his family physician, who after carrying out a physical examination and making a note of his symptoms, asks him to get a few diagnostic tests done, which include an ECG, an Echocardiogram, and several others.

Ram returns to the physician with the reports, who then suggests conducting an Angiogram to find out if the coronary arteries are diseased. After having the test done, Ram again goes back to the practitioner, who sees the test results, and confirms that he is suffering from Coronary Artery Disease, for which he would have to undergo hospitalization. For explanation purposes, let us consider that it takes 30 days to carry out this whole procedure of visiting the doctor’s clinic and completing the tests. On the 31st day, Ram is admitted to the hospital, where the cardiac surgeon performs a Coronary Artery Bypass Surgery on him. After a few days, Ram is discharged from the hospital. At the time of discharge, the surgeon prescribes some medicines along with investigation tests to monitor the recovery progress. He also asks him to come back for regular checkups.

Now, if Ram has a health insurance policy, he can make a claim of not only the expenses incurred during hospitalization, but he can also claim the payments he made towards the doctor’s fee and investigations he underwent during those 30 days prior to getting admitted to the hospital. Further, he will also be reimbursed the amounts he paid on his medicines, diagnostic tests, and follow-up visits during a period of 30/60 days, post his date of discharge from the hospital.

Let us now have a look at what is covered and what is not covered under each of the heads:

Table Content

- Pre-Hospitalization Covers

- What is Covered?

- What is Not Covered?

- Post Hospitalization Covers

- What is Covered?

- What is Not Covered?

- What is the Time Limit for The Coverage?

- How to file the claim for Pre & Post-Hospitalisation

- These are the papers, you need to file a claim for your expenses.

- Key Features

- Related posts:

Pre-Hospitalization Covers

What is Covered?

- To avail of the benefits under this head, it is mandatory that the person undergoes a hospitalization. Hospitalization implies when a person undergoes treatment in a hospital as an in-patient.

- The insurance company will pay for only those expenditures that directly pertain to the ailment/ disease for which the person was hospitalized.

- Admissible expenditures include diagnostic charges (X-Ray, Blood Tests, Urine Tests, and more), doctor’s consulting fees, and medicine costs incurred 30 days before getting admitted to the hospital.

What is Not Covered?

Any routine medication that is not related to the ailment, for which the person was hospitalized, is excluded from the purview of pre-hospitalization benefits.

Post Hospitalization Covers

What is Covered?

- To receive the claim under this head, it is mandatory that the person has undergone hospitalization.

- All expenditures relevant to the ailment/ disease/injury for which the person was hospitalized, are payable by the health insurance provider.

- Admissible expenditures include investigation tests (X-Ray, blood tests, Urine Tests, and more), doctor’s consulting fee, and medicine costs incurred up to 30/60 days from the date of discharge.

What is Not Covered?

- Any other routine medication that the person has been taking or needs to take, which is not related to the disease for which he/she was hospitalized, is not covered under the scope of this head.

- Any expenses made towards alternative therapies, including the likes of naturopathy, acupressure, or acupuncture do not fall within the ambit of this benefit.

What is the Time Limit for The Coverage?

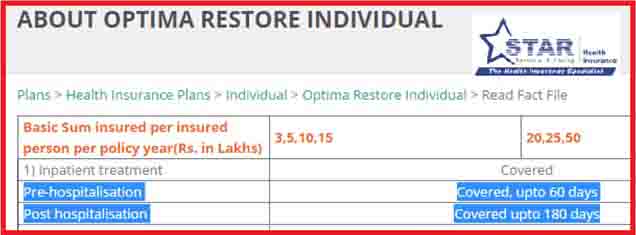

Usually, most health plans offer 30 days timeline before hospitalization for Pre-hospitalization benefits and 60 days timeline post-discharge for post-hospitalization benefits subject to the plan-specific terms and conditions.

But there are few health plans like OPTIMA RESTORE INDIVIDUAL from Star Health Insurance Co. that offers 180 days of post-hospitalization benefit. It is imperative to check on the timeline of coverage as well.

Below is the snapshot.

The policyholder can claim the admissible expenses from the insurer by submitting the original bills & receipts, together with the copies of the discharge summary and doctor’s certificate.

How to file the claim for Pre & Post-Hospitalisation

Look, first of all, most insurance companies provide cashless treatment under their network hospitals. But, some why you couldn’t make it, in such situation you have to file a claim for your hospital expenses and you need certain papers for filing the claim. If you can then you should avoid this way, cause within 24 hours of being admitted to any hospital, you can claim directly, and sooner you will get benefits of coverage on that hospital.

These are the papers, you need to file a claim for your expenses.

- Hospitals Bill

- Medical Certificate

- Prescriptions

- Discharge Summary

- Medicine and Drug Bills

Key Features

Wide range of coverage – Mostly health insurance policies offered you more, a wide range of coverage in health insurance policy gives a strategic policy to make your life secure. Like – Free health checkups, critical illness & organ donor expenses as per need.

Additional coverage for treatment – Services like pre-hospitalization & post-hospitalization are the additional coverage with health insurance policies and become your health liability partner.

Easy Claim Procedure – Look, we all know that getting treatment in private hospitals is way expensive and not everyone can afford this, so if you have insured yourself then you can file the claim and it’s easy to get the amount that you spend during treatment.

It is important to note here that these expenses are reimbursed, only when the ailment being treated is itself eligible for the claim. To avail of the maximum benefit, it is always advisable to check the inclusions and exclusions of the Health insurance policy under the heads PRE & POST HOSPITALIZATION.