Do You Know About Health Insurance Portability?

Raghav, a 26 year old sales manager came to know about health insurance policy from his colleague Dheeraj. After understanding the benefits of a health insurance policy, Raghav was very much impressed and was eager to buy a health insurance policy as soon as possible. Just on the next day, Raghav researched about health insurance policies and after analyzing the different options, he chose the best policy for himself. But after 4 months, Raghav realized his mistake as he came to know that the company which he has chosen isn’t up to the mark and doesn’t even fulfill the basic expectations. Raghav thought that he will have to stick to this policy forever until Dheeraj told him about the portability of health insurance policy which allowed Raghav to switch to a different insurer without even losing the benefits of his previous policy.

This is not only the case of Raghav, many people are not satisfied with their current health insurance policy and because of the lack of awareness, they think that they don’t have any other option than sticking to the unfruitful health insurance policy. But with the option of portability such dilemma can be overcome.

So let us understand the various aspects of portability of health insurance policy.

Table Content

- What is Health Insurance Portability?

- What is the process of Porting your Health insurance policy?

- When you should port to a different Health Insurance provider?

- What are the documents required for porting?

- What are the advantages and disadvantages of porting health insurance policy?

- Key points to keep in mind before porting

- Related posts:

What is Health Insurance Portability?

Health insurance portability allows you to switch your current insurer to a new insurer or from one plan to another plan, without losing the benefits attached to your health policy like accumulated no claim bonus and waiting period clauses for pre existing diseases. Health insurance companies try to provide the maximum benefit to their customer so that they will stay with the company, but there are many circumstances when you will find your policy’s offerings to be insufficient. In such situation you can use the portability option and switch to your desired insurer or plan. This option of portability also ensures that the insurer doesn’t take the customers for granted.

What is the process of Porting your Health insurance policy?

- First of all you need to find a better insurer than your current one and request for portability to your new insurer before 45 days of the expiry of your current policy. In return of your request, your new insurer will give you a proposal and a portability form which will give you details of the available products with the new insurer.

- Then you need to choose a product and fill the proposal form completely with the correct details and submit it to the new insurer.

- The insurer will acknowledge your form within 3 days and will contact your previous insurer or use the IRDAI website to know your claim history, medical record, continuity of premium payment, etc.

- As per the regulations, your new insurer will have to give the decision of accepting or rejecting your request of portability within 15 working days, otherwise the new insurer will have to accept your request in any condition.

- After accepting your request, the new insurer will send you the proposed terms and condition of your new policy and if you are satisfied with it, you need to pay the premium immediately to bring the policy in effect.

When you should port to a different Health Insurance provider?

- Poor Service- If your current health insurer is not able to provide you the promised service, then there is no point of holding on to them. A good insurer should be able to provide a good service before and after buying the insurance.

- Slow claim settlement- Slow claim settlement is one of the biggest hurdles in a health insurance policy and if your current health provider has the same issue then it’s better to switch.

- Hidden rules- Hidden clauses can act as a bad surprise for you in case of emergency and that’s why transparency of policy details is very much necessary. So shifting to a new insurer with no hidden clauses is always beneficial.

- Additional cover- If your current health insurance provider is not providing you enough cover, then moving to a new insurer which gives you additional cover is always an ideal decision.

- Better offer- It might be possible that you are paying high amount of premium for a cover which is available at a cheaper price with a different insurer. In such cases, switching to a new insurer is always cost-effective and efficient.

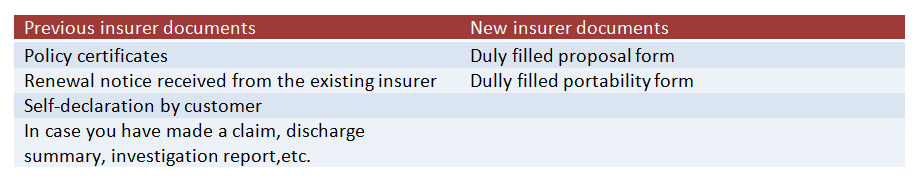

What are the documents required for porting?

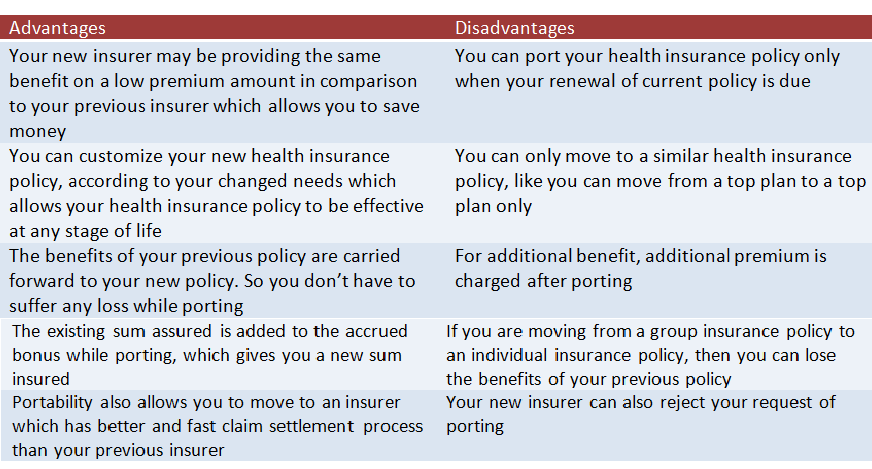

What are the advantages and disadvantages of porting health insurance policy?

Key points to keep in mind before porting

- There is no charge for porting, you only need to pay the premium amount of your new policy

- You can port from one plan to another plan in the same company

- Always ensure that the policy is renewed without a break

- Apart from the waiting period credit, all other terms of your new insurance policy are the discretion of the new insurance company.

So don’t stick to your current health insurance company if you are not satisfied with it. Use the option of portability and switch to a new insurer which can provide you better offers and service.