ICICI Prudential Life Insurance Claim Settlement Ratio

As per IRDAI annual report, the latest claim settlement ratio of ICICI Prudential Life Insurance Company is 97.84% for the Financial Year 2019-20. IRDA report gives a better view to the customer for making a wise decision or choosing a good product in terms of insurance. We all know that having insurance is an assurance of protection of your precious life and family too.

| Life Insurer | Claims Rejection (FY 2019-20) | Claims Intimated (FY 2018-19) | Total Claims (Claims Pending + Claims Intimated) | CSR% (FY 2018-19) | CSR% (FY 2019-20) |

|---|---|---|---|---|---|

| ICICI Prudential Life | 1.34% | 11460 | NA | 98.58% | 97.84% |

- The claim settlement ratio of 97.84% is the indicator of the number of death claims settled by ICICI Prudential Life Insurance against the total claims 11460 reported for FY 2019-20.

- Rs 1117 crores has been paid as the claim amount against 11460 claims reported in FY 2019-20 by ICICI Prudential Life Insurance Company.

- 164 claims have been rejected, resulting in Claim Repudiation of 1.34% for the FY 2019-20.

Table Content

Past 5 years CSR Trends for ICICI Prudential Life Insurance Co.

Consistency to maintain a higher claim settlement ratio over the years is considered to be good. Past claims settlement ratio trends will reveal the consistency and inclination of the ICICI Prudential Life Insurance Co. towards the settlement of death claims.

Well, it’s a challenge for every insurance company to maintain its position in terms of CSR every year. But they always try to give all to their customer and make things easy for them.

Let’s go through the past 5 years’ CSR trend of ICICI Prudential Life Insurance Company.

| Financial Year | Claim Settlement Ratio (%) |

|---|---|

| 2015-16 | 96.20% |

| 2016-17 | 96.68% |

| 2017-18 | 97.88% |

| 2018-19 | 98.58% |

| 2019-20 | 97.84% |

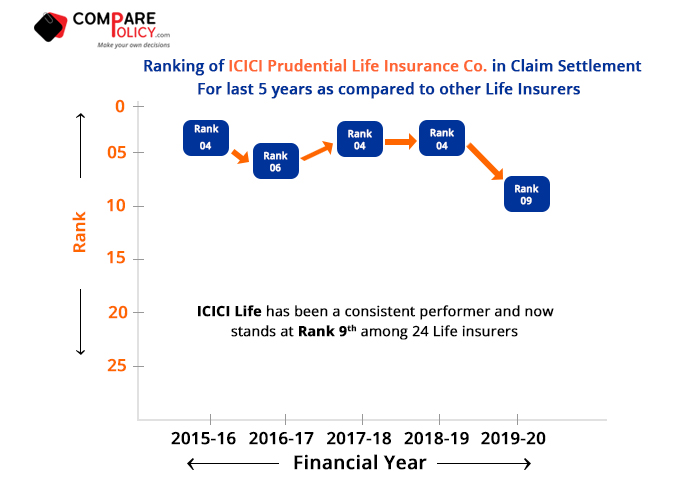

ICICI Prudential Life Rank in Claim Settlement among other Life Insurers

The Claim Settlement Ratio (CSR) rank signifies the position where ICICI Prudential Life Insurance Company lies, with respect to other life insurers in the industry from the financial year 2015-16 to 2019-20. The claim settlement percentage attained by ICICI Prudential Life Insurance Co. is the basis of the rank identified in the respective financial years.

As we told you earlier that maintaining the same position every year is quite difficult for companies but they always try to come better than ever and this commitment makes them the best in insurance service. The customer always wants more and whenever they take a look at the CSR of companies, it should feel like certain companies are staying committed to their goal.

How Claim Settlement Ratio (CSR) is measured?

The Claim Settlement Ratio is expressed as the number of claims settled divided by the total number of claims reported in a given financial year, including the claims outstanding at the beginning of the financial year. The claim settlement ratio is expressed in percentage which is helpful for comparing the claim settlement data by the customer across insurers. The claim settlement ratio is calculated for every financial year.

| Claim Settlement Ratio = Total claims settled / Total claims received where, Total Claims received = (Claims reported in the financial year + claims pending at the start of the year) |

Will wrong nationality in proposal form can reject the policy if it’s within 3years.

Hi

I have taken term policy for

Wife age 54- 50lacs + accidental coverage

2 son 25yrrs- 2cr + accidental coverage

Is it worth continuing?

Does claim settlement happens?

I read about terms like

Claim amount ratio, claim settlement ratio, rejection ratio.

Under what circumstances claim gets rejected??

Pls suggest

Hi

I have taken term policy for

Wife age 54- 50lacs + accidental coverage

2 son 25yrrs- 2cr + accidental coverage

Is it worth continuing?

Does claim settlement happens?

I read about terms like

Claim amount ratio, claim settlement ratio, rejection ratio.

Under what circumstances claim gets rejected??

Pls suggest

Hi ..can I opt for icici pru ismart policy ..its premium is quit ok and comes with option of limited pay with multiple riders