HDFC Life Insurance Claim Settlement Ratio

As per IRDAI annual report, the latest claim settlement ratio of HDFC Life Insurance Company is 99.07% for the Financial Year 2019-20. IRDA CSR report gives a different view to make a certain and good decision, HDFC Life Insurance Company did better last FY 2019-20 and hold the position of 2nd continuously 2nd year.

| Life Insurer | Claims Rejection (FY 2019-20) | Claims Intimated (FY 2018-19) | Total Claims (Claims Pending + Claims Intimated) | CSR% (FY 2018-19) | CSR% (FY 2019-20) |

|---|---|---|---|---|---|

| HDFC Life | 0.43% | 12626 | NA | 99.04% | 99.07% |

- The claim settlement ratio of 99.07% is the indicator of the number of death claims settled by HDFC Life Insurance against the total claims 12626 reported for the FY 2019-20.

- Rs 577 crores has been paid as the claim amount against 12822 claims reported in the FY 2018-19 by HDFC Life Insurance Company.

- The claims have been rejected, resulting in Claim Repudiation of 0.43% for the FY 2019-20.

Table Content

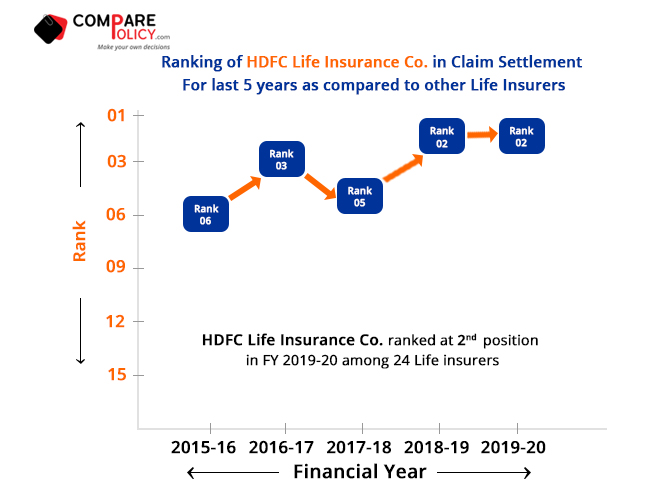

Past 5 years CSR Trends for HDFC Life Insurance Co.

It signifies the position where HDFC Life Insurance Co. lies, with respect to other life insurers in the industry from the financial year 2015-16 to 2019-20. This rank is based on the claim settlement percentage attained by HDFC Life Insurance Co. in the respective financial years.

Let’s go through the past 5 years’ CSR trend of HDFC Life Insurance Company.

| Financial Year | Claim Settlement Ratio (%) |

|---|---|

| 2015-16 | 95.02% |

| 2016-17 | 96.62% |

| 2017-18 | 97.80% |

| 2018-19 | 99.04% |

| 2019-20 | 99.07% |

HDFC Life Rank in Claim Settlement among other Life Insurers

Consistency to maintain a higher claim settlement ratio over the years is considered to be good. Past claims settlement ratio trends will reveal the consistency and inclination of the HDFC Life Insurance Co. towards the settlement of death claims.

If we talking about consistency than, we must add HDFC Life Insurance Company as a consistent performer insurance company cause last two FY HDFC Life Insurance company hold the second position and these performance are must add as consistent.

How Claim Settlement Ratio (CSR) is measured?

The Claim Settlement Ratio is expressed as the number of claims settled divided by the total number of claims reported in a given financial year, including the claims outstanding at the beginning of the financial year. The claim settlement ratio is expressed in percentage which is helpful for comparing the claim settlement data by the customer across insurers. The claim settlement ratio is calculated for every financial year.

| Claim Settlement Ratio = Total claims settled / Total claims received where, Total Claims received = (Claims reported in the financial year + claims pending at the start of the year) |

Sir, i have 3D life option plan of hdfc life. But i came to know that it has low claims settlement ratio(by benefit amount)… Max life has more.. Should i change… It has been 1 yr into hdfc life.

I HAVE POLICY PURCHASE 14 MARH-2005 AMD MATURITY DATE IS 14.03.20 AND CRITICAL CLAIM ARISE DT-9.01.20 HDFC LIFE CO. IS REJECTED MY CLAIM AND NOT GIVEN US REJECTION LETTER TILL DATE WHAT I CAN DO IT

my policy name is unit link young star with critticall illness rider

Love this