Equity Linked Saving Scheme (ELSS) as a Tax Saving Investment Option

The Government encourages people to save and invest their earned income in various portfolios and investment avenues. Along with savings, many such investment options offer tax benefits which could reduce your taxable income due to tax deductions available under various investment schemes. Many of us feel happy to see the rate of return on our invested amount, but it makes more sense if we could see the rate of return in comparison with the rate of inflation. Investment returns must be robust enough to surpass the rate of inflation to allow the investor to build wealth.

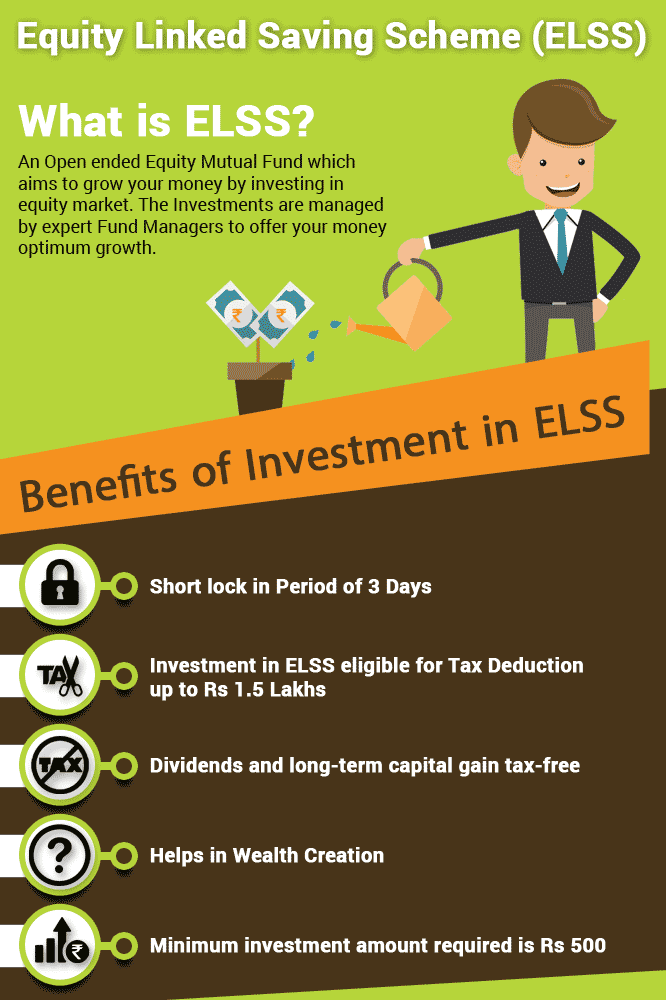

One such investment scheme is Equity Linked Saving Scheme (ELSS).

Table Content

- What is ELSS?

- Are ELSS and Mutual Funds One and the Same Thing?

- Types of ELSS:

- Open-End ELSS:

- Closed-End ELSS:

- Tax Benefits under ELSS Mutual Funds:

- Tax Benefits on Investment:

- Tax Free Dividends & Returns:

- Other Benefits of ELSS:

- Comparison of ELSS to other Tax Saving Options:

- Who can invest in ELSS?

- Things to Analyse Before You Invest in ELSS:

- Link it to your Financial Goal:

- Understanding the Fund Category:

- Track Fund Performance:

- Build an investment cycle:

- Concluding Words:

- Related posts:

What is ELSS?

Equity-linked Saving Scheme is a diversified mutual fund that invests your money chiefly in the equity market and related schemes. Investment in ELSS tax saver fund can be done as a lump sum or through Systematic Investment Plan (SIP) as per the individual’s preference. Expert fund managers take care of your investment amount and the investments are subject to market-linked returns. ELSS offers the shortest lock-in period of 3 years, which suggests that the investor has to stay with this scheme for at least 3 consecutive years. ELSS stands out from other investments as it offers greater returns along with tax benefits.

Are ELSS and Mutual Funds One and the Same Thing?

As discussed, ELSS is one of the types of Mutual Funds and the mechanics work in the same pattern where the investor’s money is invested as per the fund opted based on the risk appetite. Various points make ELSS different from other forms of Mutual Funds:

- ELSS allows investment majorly in equity-related funds only

- Other Mutual Funds are more liquid in nature

- ELSS has a minimum lock in period of 3 years

- ELSS is the only mutual fund, which allows tax rebate under Section 80 C

Types of ELSS:

Open-End ELSS:

The investors can invest in an ELSS at any given time as per their preference under this scheme. The redemptions can be made once the lock-in period of three years ends at any time of the investor’s choice.

Closed-End ELSS:

Close-ended ELSS only takes investment during the NFO (New Funds Offer) period and it is closed for investments after that. Here also, the investors can liquidate their investment in the closed-end fund after completion of the minimum 3-year lock-in period at only specific periods of time as declared by the fund from time to time.

Tax Benefits under ELSS Mutual Funds:

Tax Benefits on Investment:

Investment done towards ELSS allows a tax rebate up to the maximum limit of 1.5 Lakhs under Section 80 C of the Income Tax Act, 1961. However, investors can claim the tax benefits for the financial year in which they have invested in the ELSS.

Tax Free Dividends & Returns:

ELSS returns and dividends, unlike other investment avenues like FD and PPF, are tax free and not treated as yet another income to be taxed.

Other Benefits of ELSS:

- SIP availability under ELSS allows an investor to invest in installments under the systematic investment plan regime. SIP helps the investor to avail the benefit of “Rupee cost average” which allows to reduce the incidence of market volatility on investments.

- Minimum invested amount required is Rs 500 under the ELSS which could go up to Rs 1.5 Lakhs to avail the tax benefits.

- Lock in period for ELSS is the shortest among other investment options which is only 3 years from the inception. This helps prevent outflows and investor panic during a bear run leading to increased chances of capital appreciation.

- Greater returns make ELSS a lucrative investment option. Being an equity linked scheme, it offers higher returns on investment, but also accompanied with the market fluctuations.The long-term average annual returns range is way more than other tax saving investment options.

Comparison of ELSS to other Tax Saving Options:

| Saving Scheme | Lock-in Period | Taxability of Returns | Taxability of Dividends | SIP availability |

|---|---|---|---|---|

| ELSS | 3 years | Tax free | Tax free | Yes |

| PPF | 15 years | Tax free | No Dividends | No |

| NSC | 6 years | Taxable | No Dividends | No |

| FD | 5 years | Taxable | No Dividends | No |

Who can invest in ELSS?

Individuals and HUF’s are eligible to invest in ELSS mutual fund schemes. NRIs can also invest in such mutual fund, however some AMC’s doesn’t allow NRI’s from Canada/USA to invest in India because of the tedious and cumbersome taxation policies in USA/Canada. ELSS is most suited for the following strata of people:

- Youngsters who have just started earning

- Investor with an investment horizon of at least 10 years

- Investors who have high risk apetite to seek high returns

- Investors who are looking for wealth creation and tax savings both with a single investment option

- Senior citizens with taxable income and an investment horizon of more than 5 years

Things to Analyse Before You Invest in ELSS:

Link it to your Financial Goal:

Having a financial goal in place is important and linking it to your ELSS investment makes it more prudent. However, experts believe that staying invested for a longer duration will fetch you greater returns as compared to being invested for a minimum lock in period.It is important to note that minimum lock in period should not be confused with an ideal tenure for investment.

Understanding the Fund Category:

Asset Management companies segregate their ELSS tax saving mutual fund scheme on the basis of large cap, mid cap/small cap. Based on this bifurcation their risk and returns vary.so it becomes imperative to assess your risk taking capacity and then decide accordingly for the fund category.

Track Fund Performance:

It is important to do a good research before you invest in the type of fund and the asset management company. Studying the past returns, variation trends,market fluctuations,etc. all together is important to understand the consistency of the fund.You may seek advise of financial advisors as well in case this is your maiden attempt to jump into equity linked investment.

Build an investment cycle:

You can create an investment-free cycle after the third year of your investments if you wish to continue even after lock-in period. The money after the lock in period can be redeemed and further invested in the fourth year.Such investment cycle will allow you get the tax benefit again in the fourth year as investors can claim the tax benefits for the financial year in which they have invested in the ELSS. The process can be continued with the same redeemed amount or with the enhanced investment amount as per the investor’s investment budget.

Concluding Words:

Investment in non guaranteed equity linked investment must be done with a longer time horizon of more than 7 to 10 years. Investing in equity related schemes need patience and longer investment period to attain the optimum benefits. ELSS has offered greater returns in the past which makes it a stand out investment option to beat inflation for wealth creation. Tax deduction for the investment amount and tax free returns and dividents make it a lucrative investment option for investors having higher risk bearing capabilities.

True Information Sir